Housebuilder target price halved

7th July 2016 14:34

by Lee Wild from interactive investor

Share on

Following the release of minutes from its latest meeting overnight, the Federal Reserve is in no rush to raise borrowing costs. Over here, the next move will be lower, perhaps as early as this month, but an August cut is odds-on. This is all great news for risk assets like equities, and investors are scrambling for bombed-out domestic plays like housebuilders and banks Thursday.

, and are up between 4% and 6%. However, they've still lost 35-40% of their value since EU referendum day on 23 June, and yesterday I explained why investors were unwilling to buy what look on paper like cheap shares.

Of course, the UK must build more homes, and the housebuilders have plenty of land bought at decent prices. Balance sheets are much stronger than they were during the devastating crash in 2007-08, too. But it's the uncertainty around a possible recession, job losses and further fallout from the Brexit vote that's a big deterrent.

Today, after Halifax data showed house price growth slowing, Jonathan Hopper, managing director of buying agents Garrington Property Finders, said:

"The Brexit result means all bets are off, and the market's psychology has fundamentally shifted. While it's too early to know how much prices have fallen, sellers are already behaving as if a fall is coming. Many of those who have to sell are starting to offer discounts, often big ones.

"In the space of a fortnight the property market has reversed its polarity from a seller's to a buyer's market."

It remains too early to tell what the full impact of the referendum vote will beWe'll find out more when the builders begin publishing results at the end of this month. In the meantime, analysts at Barclays have put together a 49-page research note detailing their take on the sector.

Recent events, especially around Brexit, force a downgrade from 'positive' to 'neutral' and cut in price targets of as much as 47%. However, analyst Jon Bell does remain "cautiously optimistic".

"At this stage, it remains too early to tell what the full impact of the referendum vote will be," he says, and that when it comes to dividends, "more time is required to assess the longer term impact on trading patterns."

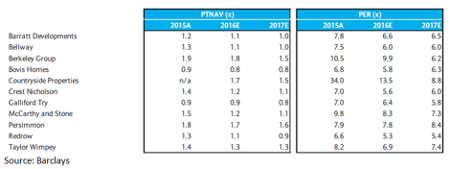

Bell's forecasts are based on flat house prices in 2017 in the UK at large, with an implied 5-10% fall in London, down from forecasts for 3% growth previously.

Biggest casualty of Barclays' review is ,which Bell downgrades from 'equalweight' to 'underweight' with target slashed by 47% from 1,562p to just 830p. Bell worries that non-residential construction will face pressure as the economy slows, preferring instead pure house-building plays, particularly at this stage of the cycle. That justifies a price/earnings ratio of just 5.8 times based on 2017 earnings estimates.

A hard sell

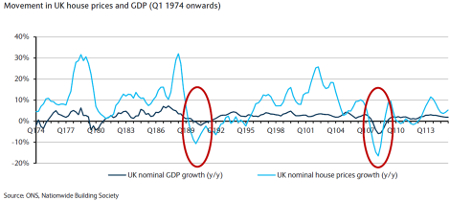

But while Bell admits his claim that "it's different this time" is often a hard sell, he believes there are a number of reasons why 2016/17 is not the same as 2008.

For starters, margins on new land acquisitions have been materially higher in the current cycle. Affordability is also less stretched than it was, at least for the UK at large, and the government's Help to Buy scheme is a boost.

And housebuilders carry little or, in some cases, no debt this time - whereas in 2008, most housebuilders were borrowed up to the eyeballs. Both interest and mortgage rates are also at record lows, and heading lower.

The broker also likes , which it reckons even now is a £22 stock. It's a "high-quality operator with a strong track record," says Barclays. Even in the 2008 downturn it kept paying a dividend.

Elsewhere, and - both rated 'overweight' - are now trading below 2017 estimated book value. Targets drop to 434p and 364p, respectively.

Targets were cut dramatically at Barratt Developments ('overweight') and ('underweight') by 43% to 484p and 41% to 616p, respectively. The rest are down by around a third, although Barclays still thinks Taylor Wimpey is worth 146p.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.