Goldman Sachs' post-Brexit share tips

12th July 2016 14:59

by Harriet Mann from interactive investor

Share on

Theresa May is set to take her place as the UK's new Prime Minister tomorrow, generating a wave of optimism in the City. There are pockets of value across the market, but investors should wait a little while longer before they add these to their portfolio, investment bank Goldman Sachs has warned.

Going over the implications of the Brexit vote with a fine-tooth comb, Goldman reduced its UK economic growth forecasts for 2017 by 1.8 percentage points to 0.2% year-on-year. Eurozone GDP is tipped to decline by 0.3 percentage points to 1.2%.

This slowdown is likely to ripple into earnings, and Goldman has downgraded its small/mid-cap earnings guidance by 1.5%/7.7%/7.5% for the next three years, pulling price targets down 9.2%.

But it's not all bad news. Rebounding on news of Theresa May's victory in the race to be PM, cutting short an otherwise lengthy election process - the FTSE 100 has risen 1.3% since Friday's close and the mid-cap FTSE 250 3.8%, although it's still 2.8% below its pre-referendum high.

Still too early

"Not yet the time to buy the FTSE 250 and UK domestic stocks," says Goldman, citing political uncertainty and weaker growth in the UK. "These stocks will continue to underperform for some months."

Further deterioration in consumer confidence is bad news for the FTSE 250 where around half revenue is generated in the UK. For the FTSE 100 it's just 20%. "However, given the weakness already seen and the current discount of UK-exposed stocks to the market [Goldman's portfolio strategists] do not recommend a short position either," writes the investment bank.

In fact, there are pockets of value ripe for the picking if investors look for stable growers like , , , , and .

With dollar strength affecting global markets, US exposure will be good for portfolios too, with , , , , , , and flagged by Goldman analysts.

Investors should be looking to add a defensive cushion to their portfolio, with Goldman upgrading its exposure to Food & Beverages to 'overweight' and adding a long on Tobacco. It's already 'overweight' Telecoms and Healthcare. In contrast, Travel & Leisure, Industrial and Basic Resources are rated 'underweight'.

Five buys

The Goldman team has just added , CTT, ISS, and London real estate giant to its buy list, kicking , , , , , Temenosand and Tele2 to the sell list.

While , and are perfect for investors searching for yield against a lower for longer interest rate backdrop, Acerinox is good for US exposure, argues Goldman. Derwent's limited City exposure and smaller offices should underpin a recovery from post-referendum weakness.

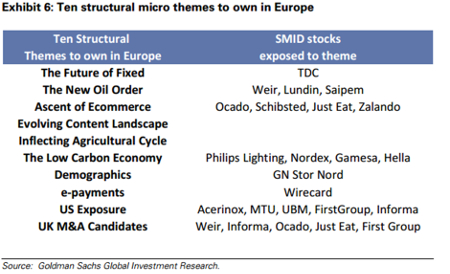

Investors should also keep an eye out for structural themes that could disrupt profit pools and create opportunities for small-cap stocks. Oil pumps and seals supplier , and could benefit from the New Oil Order; the ascent of e-commerce should help food delivery firm , fast food hub , Shibsted and ; and the Low Carbon Economy is optimum for , , and Hella.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.