Carney delivers rate shock

14th July 2016 13:09

by Lee Wild from interactive investor

Share on

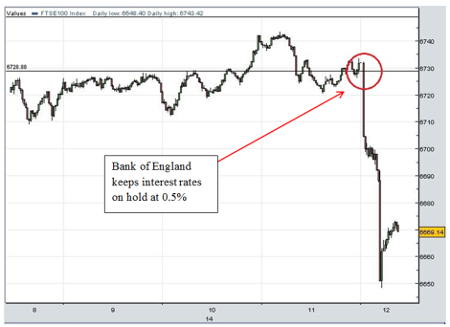

Bang! Another blow for forecasters! After screwing up the EU referendum outcome and the last general election, they've ended up with egg on their face again after Bank of England governor Mark Carney's shock interest rate decision.

Predicting the first cut in borrowing costs for over seven years, the market has had to reprice assets after Carney and his Monetary Policy Committee (MPC) kept rates at 0.5% and decided against launching any further quantitative easing (QE).

As I wrote at breakfast time this morning:

It's one of the biggest days since Brexit, but the first interest rate cut since 2009 is not the cast-iron certainty is was a few days ago.

One can understand why Mark Carney is so keen to give confidence a boost, but he's done that already with his own Big Bazooka story and both markets and the economy show no sign of imminent collapse. Using up our last ammunition shooting at shadows is not consistent with a Bank of England governor urging us to be "prudent".

With a new prime minister and chancellor of the exchequer only hours into the job, and a lack of quality data, Carney might be forgiven for holding off this time. Next month he'll be armed with the numbers that make up the Bank's quarterly Inflation Report.

Equity markets are having none of it though, and are busily pricing in a 25 basis-point cut in rates to a record low 0.25%, extending the blue chip rally since 24 June to an incredible 950 points.

I'm sure Theresa May and Philip Hammond will appreciate the Bank's decision - a mini feel-good factor - ahead of the inevitable hard yards to come. Her whirlwind victory and cabinet reshuffle had already acted as a buffer for sterling, and the pound has just surged to a two-week high versus the dollar post-MPC.

Carney had promised within a week of the referendum that "some" monetary policy easing would probably be required "over the summer", and that a "host of other measures and policies" would be considered in the coming weeks.

But only one member of the MPC - Gertjan Vlieghe, an economist and newest member of the committee - voted for a cut this time. Eight didn't. They will in August though, armed with more data and a commitment to take "whatever action is needed to support growth and to return inflation to the target over an appropriate horizon".

"In the absence of a further worsening in the trade-off between supporting growth and returning inflation to target on a sustainable basis, most members of the Committee expect monetary policy to be loosened in August," explained the BoE in its noon release.

"The precise size and nature of any stimulatory measures will be determined during the August forecast and Inflation Report round." New growth and inflation targets will be published as part of the BoE's Inflation Report on 4 August.

Carney last month urged us all to be "prudent", and this decision is consistent with that message. This is all about the economy, and Carney has proved himself in the past to be a man you can trust to do the right thing. He's done it here again.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.