Share of the week: Successful take-off

15th July 2016 16:49

by Lee Wild from interactive investor

Share on

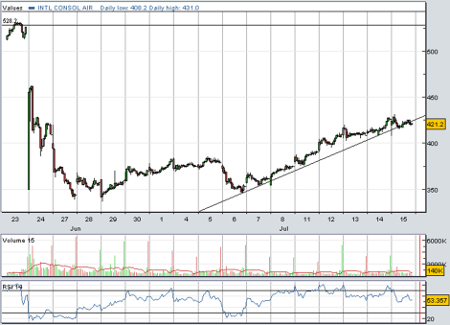

After rocketing for three years, rising fourfold since 2012, shares in British Airways-owner traded largely sideways for 18 months. They then plunged over 20% amid post-Brexit turbulence, down from 528p on 23 June to their lowest since autumn 2014.

Within hours of the Brexit result, IAG said it didn't think leaving the European Union (EU) would do any long-term damage, although it admitted that business had been weaker than expected in June, in the run-up to the referendum.

"Following the outcome of the referendum, and given current market volatility, while IAG continues to expect a significant increase in operating profit this year, it no longer expects to generate an absolute operating profit increase similar to 2015," said the carrier.

We heard earlier this month that revenue passenger kilometres rose by 13.6% in June, or up 3.5% on a pro-forma basis. Premium traffic was up just 0.1%.

However, in Farnborough Air Show week and with half-year results in a fortnight's time, IAG shares rose as much as 15% from 375p to a best of 431p, their highest since mid-morning on Brexit day.

Admittedly, UBS analyst Jarrod Castle has tempered his enthusiasm, reining in his price target dramatically from 800p to 475p, but that still leaves 13% upside and Castle says 'buy'.

"IAG is the best-of-breed European flag carrier, in our view, with management in the past displaying an ability to drive out costs from the organisation," he writes. "Should the team deliver on the medium-term targets provided at the 2015 Capital Markets Day, we would not be surprised to see the shares receive a permanent re-rating."

There are, of course, regulatory issues to clear up if Britain does leave the EU - IAG has four operating companies, three of which are based outside the UK. But, more immediately, UBS downgrades both capacity and yield estimates for this year and next, which results in a cut to earnings per share (EPS) forecasts of 15% to €0.973 and 35% to €0.829 respectively.

But the current share price may be factoring in far too much bad news, argues Castle, not just in the near-term but also over the next three years or more. While mid-cycle valuation multiples might not be appropriate until visibility improves, the shares appear oversold given IAG's operational flexibility and a top notch management team.

Instead, using peak earnings multiples of 4.4 times enterprise value/cash profit gives the 475p target price.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.