Stockwatch: This share just got exciting

22nd July 2016 12:08

by Edmond Jackson from interactive investor

Share on

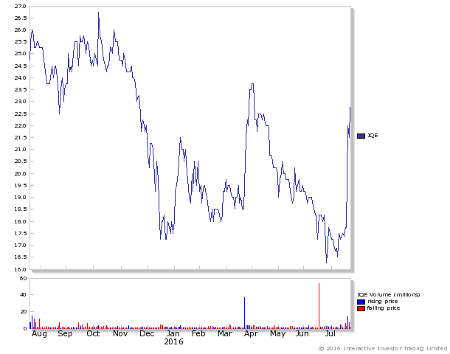

Does a bullish first-half update and 40%-plus jump in AIM-listed semiconductor wafer manufacturer mark a genuine breakout? In response to news of 15% revenue growth, IQE has risen from 16.5p to 24.5p (currently about 23p to buy), although that's well within in its one-year trading range of 16.5p to 27.5p (see chart below).

A "penny stock" status does not necessarily reflect on the firm's calibre - see its established financial record - more a cumulative 672 million shares issued after a 20-year history on AIM. In traders' jargon, it's one that's been around the block a few times: hopes ebb and flow. Yet IQE's downtrend from about 24p to 16.5p since 2015 prelims is now shown to be at odds with the underlying trend.

Wireless recovery affirms growth profile

Sentiment was hit after the 2015 prelims last March were a mixed story that didn't altogether convey growth. While photonics sales surged 28% to £16.0 million (good, if relatively easy from a quite low base) the dominant wireless side saw an 11% reduction in sales to £79.5 million, such that overall revenues edged up only 2% to £114.0 million.

In fairness, management did say it expected "a return to growth in wireless and accelerating growth in photonics, increasing contributions from power and solar, and continuing leverage of our powerful Intellectual Property position through licensing, new product development and introductions."

The underlying story gives precedent for a higher ratingWith a good start to 2016, the company was trading in line with expectations and brokers' upgraded forecasts, but traders took their cue from mixed progress. That the downtrend has lasted three months shows markets are not necessarily efficient, more susceptible to trends.

The latest trading statement affirms 15% like-for-like revenue growth in the first half of 2016 as wireless and infra-red have stabilised to achieve a slight increase in revenues, and photonics has continued its rapid growth.

The stock rebound is amply justified by the low earnings valuation, expectations over £20 million pre-tax profit implying a price/earnings (PE) multiple of 7-8 times with IQE currently 23p to buy. Company REFS shows the annual average historic PE having declined from 17.4x and 22.6 in 2012/13, each year to 11.1, 8.4 and 8.9 - so there is precedent for a higher rating, given the underlying story sounds plenty progressive.

Scope to capitalise on 'internet of things'

With the photonics side evolving, management anticipates sustainable growth in years ahead "as Vertical Cavity Lasers and Indium Phosphide Lasers are increasingly adopted for a wide range of end-market applications - including consumer products, fibre optic communications, data centres and industrial processes."

Softbank's £24bn deal for ARM is a stark comparison with IQE's modest ratingIt's easy to feel blinded by science, but the numbers and declared prospects follow various industry studies, how photonics can be a vital enabler for "the internet of things" (IoT). Affirming IQE's strategic priorities, a 2011 study set out the long-term context for photonics as a key enabling technology in the IoT, and a 2014 feature the wide applications both consumer and industrial.

There's an aspect of being swept along by the white heat of science, but the IQE story now reflects investment value - not mainly speculation.

There's a parallel in the way Japan's SoftBank is making a huge long-term bet with its acquisition of to position itself for IoT. Time will tell whether it's paying over 40 times forecast earnings will be value-accretive, but it's a stark comparison with how modestly IQE is rated - proclaiming, as it does, to be a global leader in its own fields. Moreover, it is just a £155 million business, a lot easier to swallow than ARM at nearly £24 billion, hence if IQE multiplies in value then it will become a similar strategic target.

A tidier, cleaner financial profile

The five-year table shows a frustration in 2013 and 2014, in that headline profit was substantially lower than normalised profit, a differential that can deter investors. The problem was exceptional charges such as deferred consideration payments, investment impairment and group restructuring. Once a company looks like making a habit of this, an element of investors simply wait for a cleaner act.

IQE's 2015 year saw a £5.2 million exceptional boost from disposals and a £1.8 million positive adjustment instead of a £10.9 million cost in 2014. Furthermore, net debt reduced from £31.3 million to £23.2 million, helped by a 15% rise in operational cash flow to £22.6 million. Deferred considerations will end this September.

Claims on IQE's earnings valuation vary, but the price makes it pointless to quibbleWith 61% of 2015 revenues US-derived and only 8% UK, the stock is also a useful hedge for sterling-based investors, should pressure persist in light of Brexit uncertainties and the current account deficit. Meanwhile, IQE management dismisses any effect from the UK exiting the EU.

Mind how earnings definitions - hence earnings per share (EPS) growth and PEs - can vary. Company REFS' approach asserts 2015 normalised EPS of 2.2p versus IQE's accounts showing adjusted basic of 2.7p and adjusted diluted of 2.6p, while brokers' forecasts vary from 2.7p to 3.0p this year and up to 3.4p in 2017.

So, expect to see a range of claims as to the earnings valuation, although it's so low-priced anyway it seems pointless to quibble. Asserting a "margin of safety" doesn't altogether square with fast-moving technology, but this may be as near as it's possible to get.

IQE's dilemma is this having "been around the block", i.e. after 20 years it's valued around £150 million, while ARM has attracted a suitor with £24 billion. Yet the business is now showing good overall progress in a sector capable of bucking the wider stagnant economy, so it looks worth exploiting this cautious sentiment to accumulate.

For more information see the website.

| IQE - financial summary | Consensus estimates | ||||||

|---|---|---|---|---|---|---|---|

| year ended 31 Dec | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| Turnover (£ million) | 75.3 | 88.0 | 127 | 112 | 114 | ||

| IFRS3 pre-tax profit (£m) | 6.9 | 6.1 | 5.2 | 5.2 | 19.4 | ||

| Normalised pre-tax profit (£m) | 6.8 | 6.7 | 11.8 | 21.6 | 14.3 | 19.6 | 22.4 |

| Operating margin (%) | 9.7 | 8.3 | 10.5 | 20.6 | 13.8 | ||

| IFRS3 earnings/share (p) | 1.5 | 1.1 | 0.9 | 0.2 | 2.9 | ||

| Normalised earnings/share (p) | 1.5 | 1.2 | 1.9 | 2.7 | 2.2 | 2.8 | 3.1 |

| Earnings per share growth (%) | 6.4 | -20.7 | 57.1 | 42.8 | -19.1 | 30.8 | 10.8 |

| Price/earnings multiple (x) | 8.2 | 6.3 | 5.7 | ||||

| Cash flow/share (p) | 2.0 | 0.8 | 1.6 | 2.3 | 2.9 | ||

| Capex/share (p) | 3.7 | 2.8 | 1.6 | 1.5 | 1.5 | ||

| Net tangible assets per share (p) | 7.6 | 6.1 | 5.4 | 5.6 | 8.7 | ||

| Source: Company REFS | |||||||

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.