16 safe haven funds for stormy markets

3rd August 2016 09:00

by Kyle Caldwell from interactive investor

Share on

It has been a turbulent first half of the year for financial markets, and yet more storm clouds are on the horizon for the coming months.

Stockmarkets will be twisting and turning whenever data emerges on how the British public's decision to leave the European Union has impacted the economy; but other headwinds, such as November's US presidential election, China's slowing economy and the prospect of a broader eurozone crisis, will also weigh on investor sentiment.

There are plenty of other risks including political uncertainty, with four big European elections taking place over the next 18 months.

Safe-haven staples

Another fear is that over the past couple of years share prices have been artificially inflated by quantitative easing, rather than as a result of an improvement in company fundamentals, and therefore at some point stockmarkets will correct.

At uncertain times, assets that protect your capital are highly sought-after. Here we size up the various options available to help readers navigate the tougher times ahead.

There are certain investments that over the years have proven their value when it comes to protecting portfolios from volatile markets. Gold is viewed as the standout safe haven, and typically forms a small part of a more conservatively positioned multi-asset portfolio.

The simplest way to invest in gold is through a low-cost physical gold-backed ETP

For example, Andrew Cole, who runs the , has a 5% position in the yellow metal. According to Cole, it is important for investors to "hedge their bets".

"The last thing I want to do is lose money, which is why it is important to have a segment of the portfolio in assets that are genuinely uncorrelated to equity markets and act as an insurance policy," he says.

Over the past couple of months gold demand has spiked, due to growing concerns over global growth and the uncertainty a Brexit vote would bring for Britain's economy.

The precious metal at the time of writing on 7 July was trading at a two-year high, just below $1,380 (it is now, 27 July, at around $1,325).

Gold does not have a yield, nor does it generate cash flow or profit. Instead its price simply reflects what the next person is prepared to pay for it, so it tends to be volatile.

Silver, which hugely outperformed gold during 2008-11 when markets were scrambling for havens, is another asset with defensive qualities - but less so than gold owing to its more cyclical characteristics, with 50% of demand coming from industrial uses.

The simplest way to gain exposure to these metals is through a low-cost physical gold-backed exchange traded product.

Government bonds

Government bonds are another defensive option, as are some currencies. For both asset classes the US is seen as the ultimate haven. US Treasuries, which are priced in dollars, are considered relatively good value versus other countries.

Cole holds a small position in 30-year Treasury bonds, which yield 2.2%.

"Compared to the likes of Japan and Switzerland, where yields are negative so investors have to pay to park their money, US government bonds are the most attractive, particularly given that I am not fearful an inflation shock will be appearing anytime soon," he comments.

Another option for bond investors to consider is the , which has an ongoing charge figure of just 0.15%.

Given the fact that interest rates are unlikely to be going up any time soon, plus the prospect of more quantitative easing, the yields on UK government bonds should fall, so in turn the price of the bonds will rise.

Under the radar

There are other, more under-the-radar, havens, including infrastructure.

Companies involved with long-term projects such as toll roads, rail networks or electricity grids are viewed as worth holding in uncertain times, due to the fact that the contacts tend to be very long term and usually include clauses to adjust for inflation.

Ben Willis, head of research at wealth manager Whitechurch Securities, has been boosting exposure to infrastructure across his clients' portfolios.

Aircraft leasing is an alternative safe-haven play, although it is riskier than infrastructure as airlines can default on leases.

Willis says: "Generally speaking, infrastructure equities are a relatively defensive non-cyclical area, with high barriers to entry, strong pricing power and sustainable growth. In addition, the equities throw off relatively robust yields of around 5%."

Willis likes VT UK Infrastructure Income, which invests in a diverse range of assets from hospitals and schools through to ports and airports. But his core position is .

Another alternative under-the-radar safe-haven play is aircraft leasing. While not directly exposed to the movements of equity markers, this alternative investment is viewed as riskier than infrastructure given that there is a chance of an airline defaulting on the leases.

Nick Edwardson, an investment specialist on the , holds , a closed-ended fund.

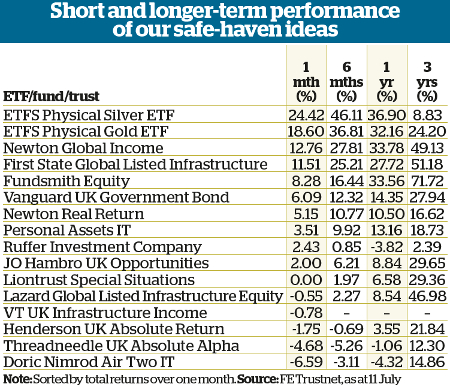

As our table above shows, the fund has not covered itself in glory in terms of protecting investors' capital over the past month, but nevertheless Edwardson says the high yield on offer should comfort investors.

"The planes are leased to Emirates Airline on a 12-year term, and one thing to bear in mind is that over this period the residual value of the aircraft may fall; but with a yield of 6% to 7% I feel compensated for the risk I am taking," said Edwardson.

Quality defensives

One of the early winners post-Brexit has been the group of UK-based businesses that derive the majority of their earnings overseas.

Their exports have been made more competitive by weaker sterling, thus boosting earnings. Businesses that have thrived include tobacco company and pharmaceutical firm .

'Weak sterling and European uncertainty will put pressure on pockets of value in developed markets.'

In times of low growth, quality businesses that, as well as operating globally, are armed with intangible assets - for example, big brands or a unique product or service - are tipped to shine.

The likes of consumer goods giant and , the world's biggest drinks company, fit the bill.

Fund managers with defensive investment styles tap into businesses which provide high barriers to competitors.

In the global fund arena Willis tips , managed by City veteran Terry Smith, as well as .

"Our view is that the weakness of sterling and an uncertain outlook for Europe mean that "value" areas in developed markets will come under pressure," he says.

Preservation funds

There is a small number of funds, perhaps around half-a-dozen or so, that invest in an extremely cautious manner.

These funds invest on the principle that they would sooner keep £1 rather than risk losing it to try and win £2. The trade-off, however, is that in rising markets these funds will lag both the stockmarket and many of their sector rivals.

There are, however, a couple of absolute return funds that are worthy of the wealth preservation tag, including and .

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.