How long can the hunt for yield continue?

18th August 2016 09:30

by Harriet Mann from interactive investor

Share on

Resigned to the fact we live in the era of low interest rates, equity markets have surged as income investors hunt for yield. But is the latest rally really a consequence of the most recent cut in borrowing costs, or is global economic momentum to blame? With dark clouds forming, investors should be tweaking their portfolios, argues one expert.

Locked in an inverse relationship, bond prices rise when interest rates are cut. As higher bond prices cause their yields to fall, those investors looking for income are forced into equities, which drives valuations higher.

Certainly, global risk assets have rallied since the uncertainty unleashed by the Brexit vote late June: European equities are up 12% and cyclicals have outperformed defensives by 11%. Compared to global markets, emerging market (EM) equities are at a one-year high and EM currencies are up 5% compared to the US dollar.

Disappointing sales and credit data from China and the US suggest global momentum is weakening

This rally is underpinned by stronger global economic momentum, not falling bond yields, says Deutsche Bank.

Not only have US real bond yields risen by 15 basis points over the last six weeks, but the correlation between equities and global macro events have risen to a decade-high over the last 12 months. Its relationship with real bond yields is also way below levels seen in 2013/14.

"Global equities have moved higher in line with improving global macro surprises, which hit a two-year high last week, allowing global earnings revisions to turn positive for the first time since 2012," explained Deutsche analyst Sebastian Raedler, adding that 70% of the rally was underpinned by stronger economic momentum.

Disappointing data on US retail sales and productivity measures and softening credit data from China suggesting global economic momentum could be weakening once more, however. So, what should investors do about it?

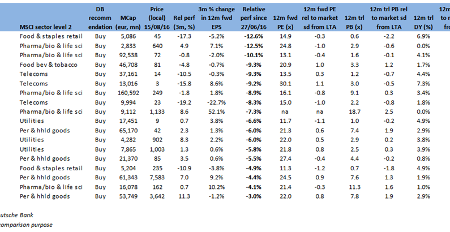

"We maintain our cautious stance on European equities (Stoxx 600 year-end at 325, 5% downside from current levels) and remain overweight defensives versus cyclicals. We think the rally in the miners will fade as metal prices soften on the back of weaker China momentum. We remain overweight pharma and cautious on financials (as weak growth caps the upside for bond yields)."

The broker has 'buy' recommendations on pharmaceutical group , household goods colossus and the utilities pair of and .

Supermarket also makes the list, whereas , , , , and are rated 'hold'.

is in the sin bin, with a 'sell' sign hung on the door.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.