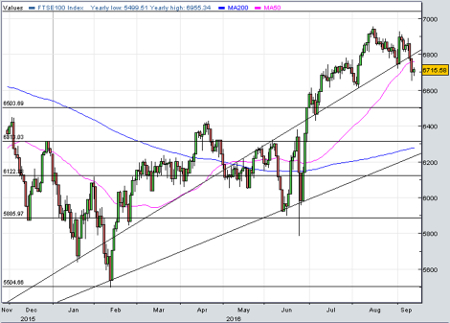

FTSE 100 can make 7,000 in 2016

13th September 2016 13:41

by Lee Wild from interactive investor

Share on

Triple-digit losses across global stockmarkets yesterday were a rude wake-up call, signalling that all is not well. Strong summer gains were underpinned by massive central bank stimulus and the belief that US interest rates would not rise in September. Jitters were inevitable if the mood changed. It did.

Thankfully, Federal Reserve governor and reliable dove Lael Brainard soothed the market after London closed. "In today's new normal, the costs to the economy of greater-than-expected strength in demand are likely to be lower than the costs of significant unexpected weakness," she said, warning that headwinds from abroad "should matter to US policymakers".

We won't hear any more from Fed members until the policy meeting decision on 21 September, but Goldman Sachs thinks that Brainard would have given the markets a steer if rates really were going up. It's why the broker has cut the likelihood to 25% from 40%.

However, with a week to go until the Fed vote, traders have other things on their mind. UK inflation rose less than expected in August despite the plunging pound. Headline CPI at 0.6% year-on-year compared with consensus estimates of 0.7% and the Bank of England's own forecast of 0.8%. The pound sank to $1.3250.

And in Germany, an anticipated improvement in the widely-watched ZEW economic sentiment survey hasn't happened. In September, consumers in Europe's largest economy were no more optimistic than the month before, while the current situations index fell more than expected.

And investors here are none the wiser. After a great response to Brainard, the FTSE 100 quickly gave back 45 points to trade lower. At lunchtime, the market looks pretty clueless.

is still reeling after yesterday's warning on its pension deficit and possible currency driven margin hit at Primark. Banks and housebuilders are also on the back foot again, and very few of the risers look convincing.

"Scepticism is probably the best reflection of investor sentiment at the moment, with many calling into question the post-Brexit move higher in markets," says Dennis Jose, European equity analyst at Barclays, explaining that a maturing profits cycle in the US, a sharp slowdown in China and the economic impact of Brexit are a concern.

Valuations are a big worry for many right now, but, while Jose acknowledges that "risks to the cycle have increased", he argues that valuations are only in line with historical norms and still well below the highs seen prior to major bear markets. In fact, the cyclically adjusted price/earnings (PE) ratio, or CAPE, remains at levels that have not seen negative stockmarket returns on a five-year view.

It's part of the reason why Jose upgrades his 2016 year-end target for the FTSE 100 from 6,200 to 7,000.

"Even if the Fed hikes rates in September, risking a further short-term correction in markets, excess money growth remains supportive of further PE multiple expansion," he writes. "Ultimately, if the global economy maintains its post-crisis resilience, valuations could revert higher, in our view.

"Unlike 2000 and 2007, cyclicals appear deeply discounted and the premium for high-quality defensive stocks is high."

Favouring "value" over "quality", Barclays repeats its 'overweight' stance on a number of UK stocks, including , , , , , , , and .

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.