How FTSE 100 just hit 10-day high

19th September 2016 13:26

by Lee Wild from interactive investor

Share on

Finally, after weeks of endless speculation and column inches, the US Federal Reserve begins its two-day monetary policy meeting tomorrow. With a rate rise now incredibly unlikely, the dollar is down Monday, which means miners must be up. They are, and have helped the FTSE 100 kick-start the week with triple-digit gains.

Unconvincing data, a split among Fed policymakers, and a presidential election in November now make December the odds-on favourite for a next increase in US borrowing costs. True, rates are unlikely to rise elsewhere any time soon, but it does at least rein in the dollar.

In response, , , , and are pick of the bunch, up 3-5%. And that's despite a downgrade at Haitong Securities.

Analyst Andrew Keen has just downgraded BHP, Glencore and from 'buy' to 'neutral'. Stocks have outperformed over the summer and miners now face a period of falling commodity prices, he says.

"Bulk commodity prices have held up surprisingly well, however we see more moderate demand conditions in China going into the fourth quarter accompanied by stronger supply growth in iron ore and coal," warns Keen. "The non-Brexit related strength in the sector worked well, but that catalyst appears to have played out, and we see relatively few company specific catalysts though to year end.

"We believe the best way to play the mining sector at present is to opportunistically buy on dips and not get too carried away with short-term revivals in China."

Keen also revises price targets for the big players. BHP slips to 960p, Glencore to 190p, and Antofagasta to 470p. Rio Tinto remains his only 'buy' now, with a target price of 2,790p implying 19% upside from here.

Meanwhile, a sharp uptick in oil prices has given and a new lease of life after struggling this past month. Brent crude was up as much as 2% Monday after Venezuela hinted at a deal on output between OPEC and non-OPEC producers. Fighting in Libya also lessens the threat of oil there flooding the market.

In fact, the upbeat mood stretches across all sectors, leaving just four blue chips in the red - travel giant TUI (TT), pharma firm , outsourcer and , which is in the process of being taken over.

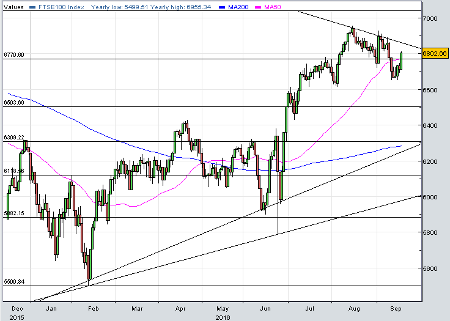

It's why the FTSE 100 is up as much as 103 points, or 1.5% Monday, and back above 6,800 for the first time since September 9th.

Earlier today, chartist and regular Interactive Investor contributor Alistair Strang suggested a break above 6,790 could open the way for a move above 6,900. That would provide a platform for a fresh assault on a 15-month high above 6,955.

Of course, while a rate rise is highly unlikely in the US this week, many in the market do expect further stimulus in Japan. The central bank there reveals the outcome of its latest meeting as Brits tuck into their cornflakes Wednesday morning. But there's potential here for a shock.

"To say I've no idea what they are going to do is an understatement," admits Deutsche Bank strategist Jim Reid "Last week's press speculation hasn't helped as it’s suggested a split in the committee.

"Overall our economists expect them to keep powder dry at this meeting. Indeed they maintain their view that the BoJ is unlikely to cut rates further (or deepen NIRP [negative interest rate policy]) and will do little more than indicate its intent to base its policy implementation on the yield curve."

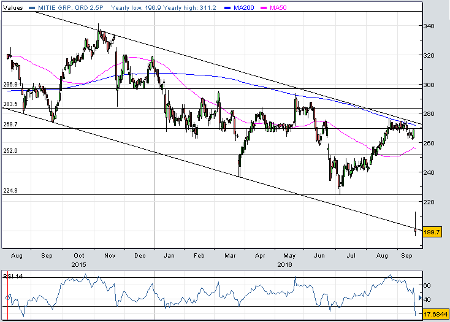

And there are warning signs for bullish investors inclined to get carried away. Check out Mitie, the mid-cap outsourcer which just warned that operating profit in the year to March 2017 will be way below expectations.

Blaming "lower UK growth rates, changes to labour legislation and further public sector budget constraints, and uncertainty both pre and post the EU referendum" has sent the share price to its lowest since April 2011. It's a long way back from here given these issues are unlikely to be short-term setbacks.

A quick glance at AIM reveals casualties there, too, among them IT firm (contract delays), smoke alarms outfit (weak sales in Europe), and the old Quindell business (Slater and Gordon lawsuit).

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.