Insider: Proven winner buys big

7th October 2016 10:36

by Lee Wild from interactive investor

Share on

Ooh aah Zoopla

Investors who bought shares in property website have done well. Priced at 220p when the company floated in 2014, they hit a record high at 349p last week. They're currently worth a little less, but are still a buy, reckons one reliable non-exec.

Robin Klein, also a serial entrepreneur, venture capitalist and angel investor in high-growth internet businesses, has just splashed out over £100,000 on 30,750 Zoopla shares at 325.77p.

If history is anything to go by, he's a man to follow. Klein's biography boasts of early investments in star companies like LastMinute.com, Agent Provocateur, Lovefilm, Wonga, Mind Candy (Moshi Monsters), Tweetdeck and others.

He and Zoopla founder Alex Chesterman have also just backed Bricklane.com, a company offering the UK's first online property ISA.

Klein's purchase follows last month's mega-sale by chief executive Chesterman. The entrepreneur, who set up the company in 2007 and also founded Lovefilm, trousered £13.8 million from the sale of 4.25 million shares at 325p.

He still owns over 8.5 million shares, currently worth £28.4 million, and has agreed not to sell any more until at least June next year, the third anniversary of Zoopla's IPO.

Chesterman's sale came just weeks after he told shareholders that cash profit in 2016 should be at the top end of market expectations of £69-£76 million.

With the property services division - Zoopla and PrimeLocation - trading in line with expectations, outperformance was driven by the uSwitch comparison business, which benefited from competitive supplier offers and supportive regulatory environment across the home services switching market.

Gangs of buyers

Elsewhere, directors went hunting in packs this week.

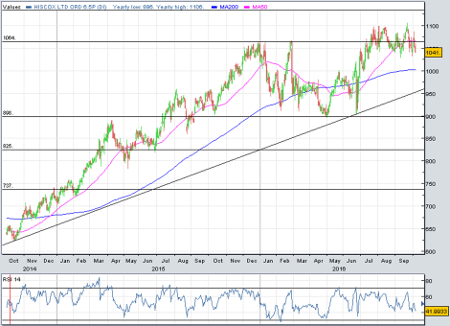

At insurer , a trio of non-execs invested over £77,000 between them. Ernst Jansen, Anne MacDonald and Colin Keogh bought almost 7,500 shares at 1,041p a pop.

First-half results reported over the summer smashed expectations, with profits helped by a slug of foreign exchange gains. Analysts rushed to raise full-year forecasts both for 2016 and 2017, but, while Hiscox deserves a premium rating, Joanna Parsons at Stockdale Securities thinks 1,060p is a fair price for the shares, only marginally higher than where they are now.

"Investors should not underestimate the trading pressures, with lower yields likely and no sign yet of a harder market (we may be close to reaching a floor but could stay here for a while)," she wrote. "We continue to view Hiscox as a core holding but multiples/yield suggest it's at fair value."

And, while full-year results at failed to impress this week, an army of top brass backed the pub chain with their own cash.

Chief executive Mark McQuater, finance boss Chris Chambers, chairman Keith Edelman and five other directors spent over £344,000 on 222,118 shares at 155p. McQuater bought half of them.

Hours earlier they'd reported better than expected like-for-like sales growth of 2.3% for the year to 30 June, well ahead of the industry average. Margins improved, too, and adjusted pre-tax profit rose 11% to £9.2 million, giving adjusted earnings per share (EPS) of 14.6p. Unfortunately, sales growth of 1.8% for the first 12 weeks of the new financial year was disappointing.

Revolution shares have struggled to trade much higher than 200p, the offer price at IPO in March 2015. At 156p currently, they trade on less than 10 times broker finnCap's EPS forecast of 16.1p for 2017.

That's cheap, especially for an earnings compound annual growth rate of 11% over the next three years. Valuing the shares in line with multiples enjoyed by peers and gives a share price of 232p, according to finnCap.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.