Unilever weakens amid brawl with Tesco

13th October 2016 13:29

by Harriet Mann from interactive investor

Share on

Tensions between suppliers and retailers have been thrust into the spotlight this week as Ben & Jerry's and Marmite supplier fights over prices.

Despite the very public bust-up, Unilever has had a decent third quarter and is on track to deliver sector-leading growth, plus improvements in both margin and cash flow this year. However, investors are unsure and fear the Tesco spat could be just the start.

Sterling's recent collapse has increased costs at Unilever, but Tesco is refusing to accept a reported 10% hike in prices. Deliveries have stopped, and supplies of household favourites like Surf washing powder and Pot Noodle are running low. One would imagine there'll be some kind of resolution, but the longer it lasts, the harder it hits Unilever.

It's why the share price sank a further 3% Thursday, despite chief executive Paul Polman claiming the king of household products should outperform the market. It now sits 5% below Tuesday's all-time high at 3,808p.

Third-quarter turnover rose 3.2% on an underlying basis to €13.4 billion (£12.1 billion), although it fell 0.1% if you add back in a big foreign exchange loss – Unilever makes a lot of money in sterling but reports results in euros. Although weak consumer demand has weighed on performance, especially in Latin America, underlying sales still grew 5.6% in emerging economies against flat in developed markets.

"Soft and volatile" markets have sharpened the mind, we're told, and Unilever is making big changes. Polman says "actions" will "keep us on track for another year of volume growth ahead of our markets, steady improvement in core operating margin and strong cash flow".

Strong competition pulled back Personal Care sales growth in the third quarter, with a 3.1% increase taking turnover to €5.2 million. Up 1.7% to €2.9 billion, the Food business maintained its return to growth thanks to popularity of emerging market cooking products and high-margin product innovations in Health Care underpinned a 3.9% turnover increase to €2.5 billion. Demand for Ben and Jerry's ice cream in the summer months helped boost refreshment revenue by 4.5% to €2.8 billion.

Investors will receive a 28.9p interim dividend in December, but the company has ring-fenced €565 million in case it is required to pay indirect taxes from legal proceedings in Brazil.

Despite the drop in price Thursday, Unilever shares still trade on 22 times forward earnings, falling to 20 times on Barclays' forecasts for 2017. And that's a multiple investors have been comfortable paying for Unilever for some years.

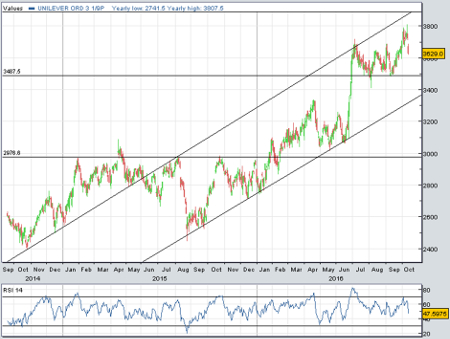

Its share price had rallied by a quarter to all-time highs in the four months since the referendum, with the shares bouncing off the underlying trend line of its bullish trading channel as the weak pound made big overseas earners flavour of the month.

"Unilever is a story of margin self-help backed by scale and an ability to withstand the threats posed by weakening barriers to entry in Food/HPC," Barclays analyst Simon Hales said in a preview note Wednesday.

"We believe the group's more diversified brand portfolio, especially in Personal Care, and unique routes-to-market in Asia, leave it better placed than most peers to fight off incursions in its categories from new entrants."

A tougher comparative period and weaker emerging market volumes mean second half sales growth will likely be slower in the second half, Hales warns, although he points out that savings of "at least" €1 billion are pencilled in by 2018, and margins could improve more than expected.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.