Insider: Chair hopes to clean up

14th October 2016 10:25

by Lee Wild from interactive investor

Share on

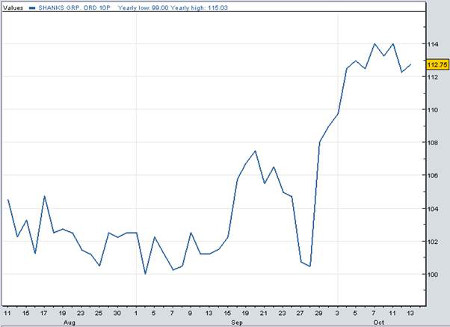

Shanks cleans up with Van Gansewinkel

"Where there's muck, there's brass," they say in some parts, and waste management firm certainly turns over plenty of cash. Last year it generated £615 million of revenue and made an underlying pre-tax profit of £21 million, excluding a lorry-load of one off costs.

And in May, the company confirmed press speculation that it was thinking about buying Dutch waste collection and recycling business Van Gansewinkel (VGG). A deal worth €440 million (£396.6 million) was announced in July, and last month both sides agreed on €482 million.

Shanks funded the acquisition through a £45 million share placing at 100p and three-for-eight rights issue at 58p to raise a further £96 million.

Ahead of completion, most likely in December, chairman Colin Matthews has just bought 100,000 Shanks shares at 114.5p each. They've risen from just 69p in February and 80p as recently as May, and, despite weaker waster volumes and margins driven by a slowdown in the Dutch construction sector, there's clearly potential here.

Broker Credit Suisse called the VGG deal "transformational", and construction volumes are on the up. There'll be big cost savings, too. A weak pound is not ideal, given much of Shanks' borrowings are in euros, but management expect the merger to be "significantly" earnings enhancing in the financial year ending March 2019.

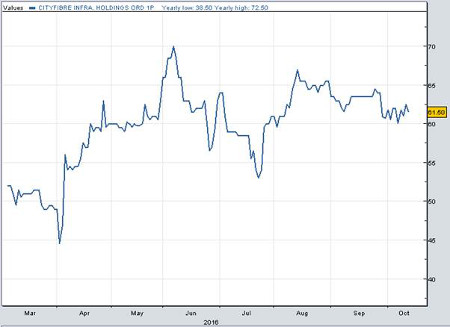

CityFibre brothers sell

floated on AIM in January 2014, raising £16.5 million by selling shares at 60p each. Nearly three volatile years later, founding brothers Greg and Gary Mesch have sold 1.2 million shares at the same price.

The Mesch brothers came to AIM with big reputations. Gary set up Versatel Telecom in Holland in 1995. Greg stumped up the cash and helped develop the business plan. Ten years later the company was sold to Tele2 of Sweden and Apax for over €2 billion.

And revenue is growing fast at CityFibre, doubling to £6.6 million in the half-year to 30 June, it's just that costs are, too. Buying assets from KCOM helped double admin costs to almost £10 million in the six months. Strip that out and they still rose 29% to £5.3 million.

Last month's results failed to capture the City's imagination. John Karidis at Haitong Securities worries about the firm's high cost of debt. "We think the conversation continues to focus too much on revenue and EBITDA," he said, "and too little on capex and net debt".

There are also concerns about industry regulator Ofcom, which wants "large-scale deployment of new ultrafast networks" in the next decade, which could increase competition for CityFibre.

Still, even after selling a stake worth around £750,000 - Gary sold 1.08 million shares and Greg 210,000 - the Mesch's continue to own 1.17 million (Gary) and 572,803 (Greg) currently worth almost £1.1 million.

Director of strategy & public affairs Mark Collins also sold 210,000 shares for £126,000, keeping 162,987 worth £98,000. All three own around 10 million share options between them.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.