This company is in an arms race it could win

14th October 2016 11:54

by Richard Beddard from interactive investor

Share on

My personal highlight of a recent trip to the World Executive Search Conference at the Tower of London wasn't the guided tour of the Crown Jewels afterwards. It was the answer to a question aimed at Jason Starr, chief executive of , the firm that runs the conference.

Dillistone develops recruitment software for executive search firms, and Starr had taken time out to address investors invited to the event to learn about the company, and the industry.

The questioner asked about Dillistone's office. Was it palatial? Adorned with expensive artworks, perhaps? I knew the answer. A colleague who had visited Dillistone HQ described the office as even worse than his own. Starr explained how the firm has moved around the perimeter of the City in search of the cheapest rents. Then he offered to take the questioner back to the office in his private helicopter.

I'd gone to find out why profit contracted in the year to December 2015 and what Dillistone had done to its FileFinder software to achieve a dramatic increase in orders, perhaps indicating a recovery. Between January and August it had received more new business orders than it had in the whole of 2015.

Starr was disarmingly frank. In hindsight, version 10 of FileFinder was rushed out. The company released inadequate software and lost face as well as custom. Although Dillistone thinks FileFinder has the largest international installed base of software, it may well have ceded top spot in the sales chart to rival Invenias in 2015. In FileFinder Anywhere, the latest iteration of the software, Dillistone has the only browser based executive search software, and Starr thinks it may be top-seller again.

Arms race

But this is only the latest development in what looks like an arms race. Dillistone has its nose ahead because browser solutions are low-maintenance. They do not require installation, but how long before competitors develop their products? Dillistone and Invenias do not have the market to themselves. Bond International sells an executive search product, Bond Adapt, and Cluen is a US competitor. There are many small software houses that produce recruitment software.

The cost of developing new software has eaten into both the amount and 'quality' of Dillistone's profit. In a practice that has become commonplace, Dillistone treats costs of developing new software as investment, like an engineering company would treat equipping a new factory. Instead of deducting the salaries of the software developers straight from profit when it pays them, it amortises - or spreads - the cost over five years.

File Finder Anywhere is only the latest development in what looks to be an arms race

Since Dillistone doesn't earn all the revenue from its investment straight away, the idea is to match costs to revenues and produce a more realistic measure that recognises the ongoing benefit of the software.

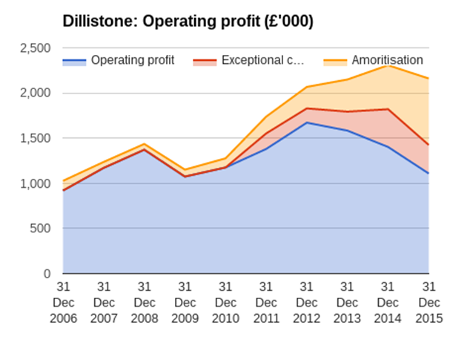

Amortisation makes the profit figure somewhat arbitrary, dependent on the judgement of how long to amortise costs. In the chart below, I've separated the amortisation of internally generated intangible assets, mostly software, (orange) from acquired intangible assets, mostly customer relationships (red). These costs, among others, are deducted from revenue, to give operating profit (blue).

If a company's salesmen recruit new clients, the costs are expensed immediately. It's not allowed to treat them as an investment. However, when a company takes over another business, effectively buying new customer relationships, it's required to recognise them as an asset and amortise it. Since from the time of the acquisition the costs of maintaining and developing these customer relationships is expensed, it is being charged twice when it also amortises the cost of acquiring them when it buys another company.

For that reason, I treat the amortisation of acquired intangible assets as an exceptional cost and add it back to operating profit.

Growing operating capital

This is a long-winded way of saying if I were to choose one operating profit calculation it would be the red line, after the amortisation of internally generated intangible assets but before the amortisation of acquired intangibles. The orange area shows the growing real, at least in accounting terms, cost of developing new software.

Dillistone's operating capital has grown faster than profit in recent years. Partly because of the botched launch of FileFinder 10, the numerator of the return on capital calculation has decreased, while, because the investment in new software has been recognised as an asset on the balance sheet, the denominator, operating capital, has increased. The result is a fall in profitability.

The pace of development is unlikely to ease much as Dillistone tries to avoid being leapfrogged by competitors

I asked Dillistone whether the increase in development expenditure is peaking, perhaps the results of a Herculean effort to clean up bugs in the FileFinder 10 software and develop FileFinder Anywhere. Now the software's popular with new clients again, perhaps the company will take a breather from development.

The pace of development is unlikely to ease much. Dillistone must innovate to avoid being leapfrogged by competitors. It also has a lot more software to keep up to date because of acquisitions in its relatively new Voyager Division, which sells software for temporary and permanent recruiters.

If the benefits of innovation are transitory, we must look elsewhere for more durable sources of advantage. It might come from Dillistone's relatively large installed base, which means in certain markets more people use its software than any of its rivals'. Dillistone thinks Voyager is the UK market leader, although it has a much less impressive international footprint than FileFinder.

Advantage of scale

The advantage of scale comes in three parts...

It's costly to switch systems so Dillistone's installed base is somewhat entrenched. Data must be converted to operate with a new database, which can take from three to nine months. Most of Dillistone's FileFinder customers are small businesses who are more likely to stop using the software because they've ceased trading or been taken over than because they've found a fancier software package.

I can see how the machine could work. I can also see how it goes wrong

Software needs to be updated regularly, not just to keep pace with competitors, but also to keep pace with regulatory developments for example. Many of Dillistone's competitors are even smaller and lack the resources to bring new software versions to the market quickly.

Finally, Dillistone has more customers, which makes it easier to put on events like the World Executive Search Conference and raise its profile among potential new customers.

But I'm mindful of the reason why we've been invited here. Dillistone is very accommodating to investors because we stump up the cash to make the acquisitions that give it the scale to compete effectively. Over the last ten years, the share count has increased 22%.

I can see how the machine could work. Dillistone raises money for acquisitions, its installed base grows, it becomes more competitive. I can also see how it goes wrong. We put in more money, the business becomes more complex, costs increase as it supports more and more products targeting perhaps smaller opportunities, management is spread too thin, there are more mistakes...

Open about risks

Other companies are investing too. In an arms race only one country wins and the others go bust trying (or there's a big war, but let's not take the analogy too far!).

Dillistone is open about the risks. The executives talk about them, and they are documented in the annual report. That in itself is a rare and attractive thing.

I could invest. The Decision Engine, my way of comparing shares, scores it 7/10, which ranks it about twentieth of all the companies I follow. For such a small business, it's complicated, and the arms war scenario is worrying, but Dillistone has been profitable and if 2015 was a temporary lull, the shares might not be expensive. A share price of 93p values the enterprise at £19 million, about 16 times adjusted profit in that year. The earnings yield is 6%.

After we toured the Crown Jewels, I hiked around the Tower walls and left by a drawbridge. By coincidence, Jason Starr was a few steps ahead of me. He'd swapped his shoes for a pair of trainers and was disappearing into a crowd of tourists and commuters.

There was no helicopter in sight.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.