A new Dogs of the Footsie strategy

14th October 2016 14:43

by Lee Wild from interactive investor

Share on

There are plenty of investment strategies based on buying unloved shares in the hope that the market has got it wrong. One of the best-known is our sister magazine Money Observer's Dogs of the Footsie, which picks the highest-yielding blue chips in the belief that the shares are undervalued. Our new portfolio of losers takes a different approach, but shares the same objective.

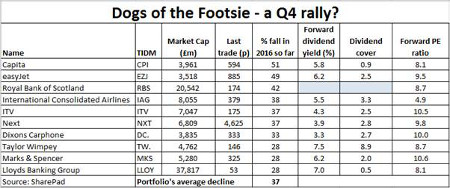

Despite the FTSE 100's miraculous recovery from its post-referendum plunge, plenty of our largest companies have grown considerably smaller since. According to SharePad, a popular investment data service, 10 of them are still down 20% or more. In 2016, so far, 19 are down at least a fifth.

All are now cheap on the standard price/earnings (PE) valuation multiple and seven out of 10 offer an above-average dividend yield - that's because the shares have tanked and the market has doubts about the company's ability to maintain shareholder returns.

True, there are serious concerns including valuations, Brexit, US elections, and central bank monetary policy, but the fourth quarter is historically the strongest period for equities. Will investors hunting for bargains in an otherwise expensive market spot these cheap blue chips?

Outsourcer heads the list of fallen giants. It's lost over half its value, a slug of it in the past few weeks following an ugly profits warning. At 580-600p, the shares are at multi-year lows and a crucial technical support level. Might we see a bounce?

It's been no fun at either. Two profit warnings since the EU referendum have sunk the shares to their weakest in almost four years, and a record-breaking 2015 is a distant memory. This month the budget carrier warned of a big FX hit and further yield pressure, triggering massive downgrades to profit forecasts for 2017.

Taxpayer-owned needs no introduction. A victim of the financial crisis, it's struggling to sell assets and is unlikely to pay dividends for years. It also faces a colossal fine from the US Department of Justice (DOJ), much like Deutsche Bank which is currently haggling over a $14 billion charge for selling toxic mortgage securities.

British Airways owner has done little better than easyJet. Down 38% in 2016, Brexit has already had an impact on business volumes and the weak pound could deter travel out of the UK. All eyes will be on a Capital Markets Day next month. IAG could gain altitude if it repeats existing targets and achieves promised cost cuts.

is one pound, or about 36% cheaper than it was at the start of the year. Media firms are struggling with the slump in advertising revenue, with the broadcaster tipped to report net ad revenue down 10-11% in October. It's already warned of a 5-10% drop in September.

A decision by boss Adam Crozier and FD Ian Griffiths to sell 500,000 ITV shares each at around 200p is hardly encouraging, but many analysts still think the shares are worth 250p or more. Non-executive director Anna Manz and chairman Peter Bazalgette have also just spent £50,000 and £22,000 on shares, respectively.

That's the top five dogs. We've included the other five in the table. Don't get me wrong, this is no fool-proof investment strategy, just a bit of fun hinged firmly on repetition of the typical seasonal uplift in equity markets during the fourth quarter.

It also assumes that investors will decide to snap up cheaper stocks in an otherwise richly valued blue chip index.

We'll track them until the end of the year and compare their performance against both the FTSE 100 and the FTSE All-Share index.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.