Weak pound 'supercharges' UK dividends

17th October 2016 13:33

by Lee Wild from interactive investor

Share on

A plunge in the value of the pound since the EU referendum was a huge boon for income seekers during the third quarter. It'll give payouts another boost in the final three months of the year, too. But all is not as it seems, and latest data from Capita paints a rather "disappointing" picture.

Above $1.49 just prior to the Brexit vote, sterling now trades at less than $1.22, not far off recent 31-year lows. It's been a huge benefit to companies which convert money made overseas back into pounds and pence. It's also had a massive impact on dividends declared in foreign currencies.

In fact, sterling weakness provided a £2.5 billion windfall for UK investors in the three months to September, £1 billion more than Capita had pencilled in.

UK dividends rose by a better-than-expected 1.6% in the third quarterWith around two-fifths of UK dividends declared in dollars and euros, big payouts from heavyweights like - the biggest dividend payer in the world accounts for over £1 in every £8 paid by UK-listed companies - and moved the needle.

This third quarter enjoyed the largest exchange rate effect in any three-month period since the financial crisis, when sterling crashed from over $2 to $1.38 in 2009.

Capita's Justin Cooper currently estimates another currency windfall of almost £1.7 billion in the fourth quarter, taking the total for 2016 to over £5.6 billion.

UK dividends rose by a better-than-expected 1.6% in the third quarter to £24.9 billion. And that's despite £2.2 billion of cuts, mainly in the resources sector. Strip out special dividends, which also exceeded expectations, and the total was up 2.6% to £23.9 billion.

Forced to rethink full-year forecasts £2.2 billion higher, Capita now pencils in a 6.6% increase in annual dividends to £84.7 billion. Underlying dividends, excluding special one-off payouts, are tipped to grow by 2.7% to £78.6 billion.

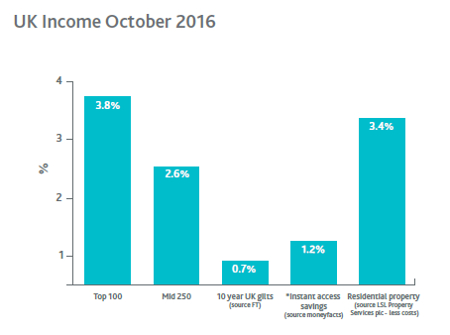

For yield, there's no better place than equities, where the UK offers 3.6% and the FTSE 100 3.8% "The exchange rate remains the main source of uncertainty over dividends in the fourth quarter and into next year," says Capita. "If it continues to fall, 2016 will exceed even our newly revised forecast."

This looks great on the surface, but dig deeper and there are concerns. "In truth, the picture is rather disappointing," admits Capita.

Exclude the currency bonus and also the negative impact of high-profile cuts by , and the miners, dividends actually fell by 0.1% in the third quarter.

However, there is better news among the mid-caps, which outperformed blue-chips for a second year. Stronger profit growth underpinned a 4.9% increase in dividend payments during the last quarter compared with just 0.9% for the top 100.

Exchange rate gains looks set to support UK PLC dividends well into 2017"These have included weak commodity and oil prices, difficulties in the banking sector, and price wars in the grocery industry," explains Capita.

"Mid-cap profits have outperformed, and that is enabling them to grow their dividends consistently faster."

Of course, markets have wobbled recently after hitting a record high last week, but income seekers face a difficult choice. If you're after yield, there's still no better place than equities, where the UK offers a prospective yield of 3.6%. It's 3.8% for the FTSE 100.

"While exchange rate gains looks set to support UK PLC dividends well into 2017, investors will need a sustained improvement in company profitability in order for the true value of pay-outs to regain solid upward momentum," warns Cooper.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.