'Safe' stocks in danger; buy value

25th October 2016 14:03

by Lee Wild from interactive investor

Share on

Low volatility equity strategies have been popular for a number of years now. Investors have piled into smart-beta exchange-traded funds (ETFs) based on the strategy, and even active European fund managers have gone 'overweight' so-called low-vol and 'underweight' value stocks. It's been a successful trade, but the good times may be nearing an end, warns one expert.

After a multi-year rally, low volatility stocks have already struggled in recent months, and Dennis Jose, an equity analyst at Barclays, believes that the recent underperformance "has further to run".

"With valuations at historical extremes, and positioning still overweight, a turn in inflation could prompt a further rotation from low-vol stocks into value stocks," he says.

Low-vol stocks are typically those high-dividend low-growth stocks best equipped to ride out jumpy markets. These bond-proxies have been incredibly popular recently as record-low interest rates means "there is no alternative" (TINA) for investors seeking income.

But Jose argues that the sector's outperformance has been driven not by "earnings stability or a hidden structural alpha", but by valuations moving from being "very cheap to being very expensive", a point illustrated by .

BAT, the poster child of the low-vol strategy, traded on a price/earnings (PE) ratio of around 5 in September 2000, versus a wider market on 24 times. was on just 10 times earnings. Now, it's 18 and 22 times, respectively, against the market on 15 times.

And Barclays thinks that valuation matters for these stocks, despite their earnings visibility, stable business characteristics and lower risk profiles. Back-testing the idea proves it. "Today's extremes in valuation have historically seen low-vol stocks significantly underperform," writes Jose.

Remember, too, that low-volatility funds are driven very much by bond yields. Speculation around higher interest rates could trigger an exodus from fixed-income markets, driving yields higher. That makes the payouts offered by low-vol plays less competitive.

There's inflation risk, too, argues Jose:

"The recent rally in low-vol stocks appears to be pricing in a further deceleration in global inflation to negative. The deflationary outlook being priced in by low-vol stocks runs counter to economists projections for developed market inflation to pick up to 1.9% in 2017.

"With global inflation set to accelerate, we believe the high valuations on low-vol stocks render them susceptible to further underperformance.

"Moreover, the heavy inflows into ETFs based on low-vol strategies, as well as the high exposure of active funds to the low-vol factor suggest to us that the pace of the unwind in these stocks could be quite severe."

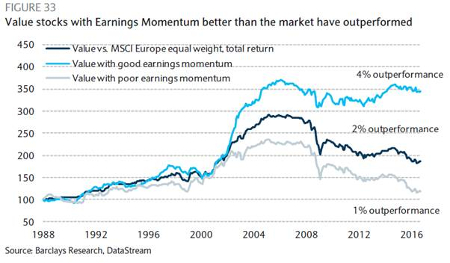

With value stocks near the cheapest they have ever been in two decades relative to low-vol, the broker thinks the recent rotation into value has further to run. Barclays mixes value with earnings momentum to identify its top picks to play the theme.

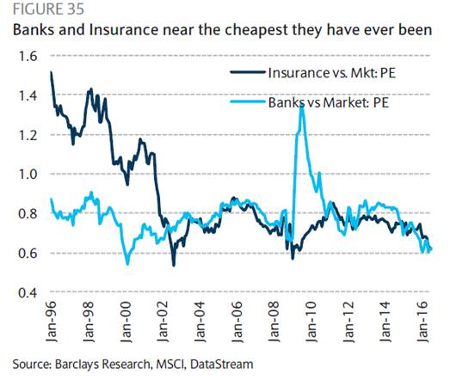

For the first time this year, Barclays has quite a few banks stocks featuring heavily within its selection of value stocks. Along with autos and Insurance stocks, the three sectors continue to trade near PE lows despite positive earnings per share revisions.

Here are Barclays' top buys among value stocks with earnings momentum better than the market:

, , , , , , , and .

Trim holdings in these expensive low-volatility plays:

, BAT, , Reckitt Benckiser, , , , , , and .

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.