Where investors should seek sanctuary from inflation

4th November 2016 12:21

by Anthony Cross from ii contributor

Share on

A key tenet of our investment process is the importance of barriers to competition. We have moulded our approach around the identification of characteristics which we believe allow companies to sustain profits in the face of competitive threats.

Another way of thinking about barriers to competition is in the form of pricing power; the ability to maintain prices and profit margins in a crowded and competitive marketplace.

Pricing power not only insulates a company from competition, it also allows it to cope better with inflation. In simple terms, a company can pass on some or all cost inflation rather than having to absorb it through a reduction in profit margins. In more jargonistic terms, we would say that the company's demand is relatively price inelastic.

Effects of inflation coming through

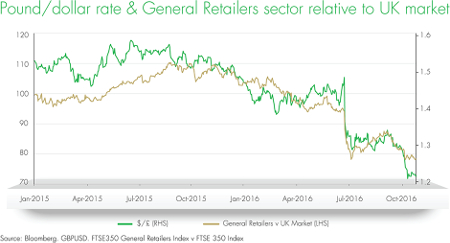

This is an attribute which should be particularly highly valued by investors given the current UK economic backdrop. The UK is facing a combination of "cost-push" inflationary pressures due to the recovery in oil prices and the weakness of the pound (which is leading to imported inflation).

Neither of these trends are new and the majority of action in energy and currency markets actually happened back in the second quarter of this year.

But we know that inflation feeds through in a lagged manner - a substantial chunk of economic theory is built upon the assumption of sticky prices in the short term - and we are now starting to see the widely anticipated effects.

We already see stockmarket fault lines between companies with pricing power and those withoutYesterday's inflation report from the Bank of England shows its central inflation expectation (for the consumer price index - CPI) peaking at 2.7% in the fourth quarter of 2017, which compares with the 2% forecast it made back in August.

Meanwhile the National Institute of Economic and Social Research yesterday published forecasts which included a prediction of around 4% CPI by the second half of 2017.

So where should investors seek sanctuary from these inflationary trends? We believe the answer lies in pricing power, and we are already starting to see stockmarket fault lines developing between those companies that have it and those that don't.

Pricing power is key

One of the clearest and simplest ways a company can possess substantial pricing power is through the value of a brand.

The brief absence of Marmite from shelves in October brought to public attention the battle between consumer goods companies (in this case ) and retailers over who would foot the bill of increased ingredient import costs.

While this match up looks to be a score draw, with Tesco restocking Unilever products but not yet implementing the price increase Unilever has demanded, has relented to the pressure, raising the price of Marmite by 12.5% and hiking the prices of over 90 other Unilever products.

Unilever (whose other brands include Dove, Lynx, and Ben & Jerry's) is a stock we hold in our funds.

Retailers in general are not in a strong position to cope with imported inflationTogether with other consumer goods and beverages holdings like (Smirnoff, Guinness and Johnnie Walker) and (Nurofen, Strepsils and Dettol), we believe it has a significant amount of value associated with its brands.

These brands play no small part in conferring these stocks with pricing power and economic advantage.

It is easy to contrast this with stocks which have little pricing power. Although Tesco's huge market position seems to have given it some leverage in its Unilever negotiations, retailers in general are not in a strong position to cope with imported inflation, particularly if they are selling commoditised products or other non-premium goods.

For example, disposable-fashion retailer Primark (via its parent group ) has already been forced to warn its investors that current exchange rates will result in an increase in input prices, which it will be unable to pass onto consumers (unlike those buying Marmite in Morrisons), thus hurting its gross margin.

Regular readers may have seen my contribution (below) to our Halloween offering - "Liontrust fund managers' scariest charts". The data I supplied clearly shows that the UK's FTSE General Retailers sector has already weakened to reflect the increased cost of importing goods.

With inflationary forces still feeding through to the UK economy, I fear this relationship could prove to be a scary one for investors well beyond Halloween.

Anthony Cross runs various funds for Liontrust, including Liontrust UK Smaller Companies, one of Money Observer's Rated Funds.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.