How experts think US election result will move equities

8th November 2016 11:05

by Lee Wild from interactive investor

Share on

Click here to read more of our expert news, analysis and videos surrounding the 2016 presidential election at Interactive Investor's US Election Hub.

In less than 24 hours, there's a pretty good chance we'll know who'll lead America for the next four years. Polls start to close at midnight UK time, and TV stations could call the result as early as 4am. But with European markets due to open just a few hours later, how will they respond?

Barclays' global equity strategist Keith Parker reckons a Trump win could lead to a sell-off for the S&P 500 to 2,000, down 9% from the record high, while a Clinton presidency could trigger a "moderate rally", up to 2,150-2,175, or just 1-2%.

"Near-term, do not expect new highs, as the Italian referendum and December FOMC [interest rate decision] remain overhangs," warns Parker. "Our year-end S&P 500 target is still 2,200. Prospects for a progressive agenda (higher taxes, regulation, etc), which would be negative for equities, would be greatly reduced with a Republican controlled House."

Equities and the economy are all about confidence, which would be fragile [under Trump]Expect a big boost for emerging market equities if Hillary gets it, as anti-trade measures are priced out, while Europe and Japan should also outperform the US, he says.

"After a notable divergence in performance as Trump's odds have risen, we would rotate out of materials and into tech and select industrials/transports. Stay long financials and 'underweight' most bond proxies as rates reset higher initially.

"However, without recession concerns, the necessary pre-condition for a correction is absent," adds Parker.

"Equities and the economy are all about confidence, which would be fragile. A 'V'-shaped recovery is less likely, and the path for equities should be driven by Trump, GOP leadership, the Fed and data - and whether they engender confidence, or not.

"If growth stays solid, we see a recovery into year-end to ~2,100, but with asymmetric downside risks."

Winners and losers

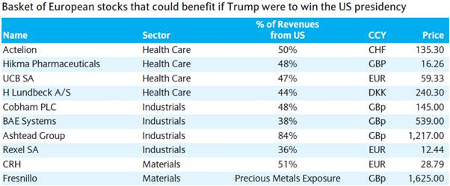

Parker's colleagues in the UK issued a follow-up note Tuesday morning, spelling out the potential winners in a Trump presidency.

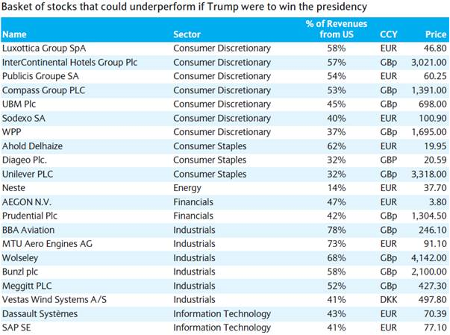

And the losers…

The team at JP Morgan has been busy, too, penning an equity strategy note that stretches to a thumping 174 pages. The election results will have a binary impact on the market, we're told.

"We believe that if Trump wins, markets are likely to fall further - one should not use the Brexit template, where stocks bounced quickly," writes the broker.

"Clinton victory remains the more likely outcome, though, and if this scenario comes through, equities are likely to have a relief bounce. They should at least unwind the past week's fall, with S&P 500 moving back towards 2,150. This means Europe/emerging markets should move up 3-4%."

Politics will remain fractured

However, even a Clinton win does trigger a knee-jerk bounce, US politics will likely remain fractured and equities are unlikely to break out on the upside.

Certainly, emerging markets will do well if Clinton gets in. However, it won't be long before focus shifts onto a likely December Fed hike and the dollar's resumption of its "upmove".

"UK was the beneficiary of improving emerging market exposure, of falling gilt yields, and the pound was a hedge against politics, as 72% of sales are derived abroad," says JP Morgan.

"We believe that one should be cutting UK exposure now, given the challenging combination of higher CPI [inflation], higher yields, lower GBP and weaker growth going forward."

'We believe that the rotation out of growth and into value will have legs this time'Instead, put your money into eurozone equities, says JPM. They've "lagged significantly year-to-date, had big outflows and the region has de-rated. We think eurozone is an attractive hedge against a potential rise in bond yields and in inflation".

It's why the broker is still 'overweight' the banks. "Their correlation to both remains strong," it says of a sector trading at depressed PE's not far from 2009 and 2011 lows.

"We believe that the rotation out of growth and into value will have legs this time. Value style is attractively priced and it benefits from rising yields."

While JPM has concerns about the cyclical nature of the DAX, a forward price/earnings ratio of 15 makes the less-cyclical French market "attractively priced". It likes the energy sector, too, as it "looks cheap, earnings are bottoming out and demand supply balance is improving".

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.