Why stocks are not the only game in town

14th November 2016 11:17

by Lance Roberts from ii contributor

Share on

Why I am buying bonds (for a trade)

Over the last three weeks, I have been selectively buying bonds into portfolios as opportunities have presented themselves. Importantly, I am buying actual bonds, not bond funds or exchange-traded funds (ETFs), so the rise in rates over the last week is not important to my holding period return or my return of principal.

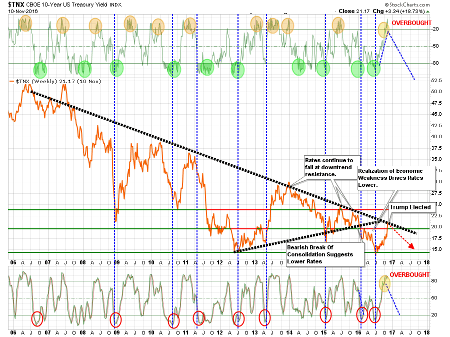

However, the spike in rates this past week now has me buying bond ETFs for a trading opportunity. As shown below, interest rates are now pushing overbought conditions only seen near absolute peaks in interest rates movements (orange circles on the chart below).

What is interesting is that stock buyers are told to buy stocks after big corrections, yet it works exactly the same way with bonds. When interest rates spike, bonds become very oversold and operate on exactly the same premises as stocks.

So, bonds are now extremely oversold and this is as good of an opportunity as one will get to buy bonds.

Higher rates negatively impact economic growth, but the outcome for bonds is excellentDoes this mean rates will plunge on Monday? No. Rates could go a bit higher from here, but it will likely not be much. As Jeff Gundlach stated last week:

"I do think this rate rise is about 80% through. If yields rise beyond 'critical resistance' levels, including 2.35% on the 10-year note, then things are in really big trouble."

He is right, higher rates negatively impact economic growth. But in both cases, the outcome for bonds is excellent.

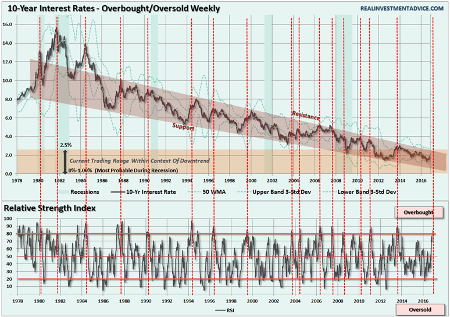

The chart below shows the long-term trend of the 10-year Treasury going back to 1978 as compared to its RSI index.

Whenever the RSI on rates has exceeded 80% - 'red dashed' lines - it has preceded a subsequent decline in rates. In other words, overbought rates are a signal to buy oversold bonds for a potential reversion trade.

As I have repeatedly written in the past:

While the punditry continues to push a narrative that 'stocks are the only game in town,' this will likely turn out to be poor advice. But such is the nature of a media-driven analysis with a lack of historical experience or perspective.

From many perspectives, the real risk of the heavy equity exposure in portfolios is outweighed by the potential for further reward. The realization of 'risk', when it occurs, will lead to a rapid unwinding of the markets, pushing volatility higher and bond yields lower.

This is why I continue to acquire bonds on rallies in the markets, which suppresses bond prices, to increase portfolio income and hedge against a future market dislocation.

In other words, I get paid to hedge risk, lower portfolio volatility and protect capital. Bonds aren't dead, in fact, they are likely going to be your best investment in the not too distant future.

In the short-term, the market could surely rise. This is a point I will not argue as investors are historically prone to chase returns until the very end. But over the intermediate to longer-term time frame, the consequences are entirely negative.

As my mom used to say: 'It's all fun and games until someone gets their eye put out.'

So, yes, from a trading perspective, one of the "most unloved" asset classes to own currently - bonds.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In.