Why high-flying portfolio is buying this emerging market

16th November 2016 10:57

by Douglas Chadwick from interactive investor

Share on

At the start of this article I must come clean and own up to liking the cheerful, hard-working people of the Far East, and in particular Vietnam.

I travelled there 55 years ago when in the Merchant Navy, and now my youngest brother is a doctor in Ho Chi Min City. His experiences, and my recent visit there, confirmed my opinions of this country.

Also, as an intrepid adventurer upon the high seas of investment in early 2003, one of my first investments was into the Far Eastern emerging markets and in particular the .

In the next three years these investments only just failed to double my money before I exited into mainly cash in 2006, shortly before the world markets collapsed in 2007/08.

Further to go for emerging markets

Bearing this in mind, it should not be surprising that I have a soft spot for this part of the world and I have been waiting for the Saltydog numbers to suggest it is worth visiting this area again.

It would appear that, after many years of lying relatively dormant, falling or at best lacking a finite direction, the Asian and emerging markets are making their presence felt again.

A recent publication by one prominent broker stated: "When our work highlights assets at unequivocally cheap prices, in an area we feel offers superb long-term potential, and when we can find exceptional fund managers, we get particularly excited.

"After a period in the doldrums, Asian and emerging markets reached this point in November 2015. Stockmarkets have bounced strongly, but we believe there is much further to go."

This statement is definitely confirmed by our numbers at Saltydog.

IA sector | Four-week return (%) | 12-week return (%) | 26-week return (%) |

Global Emerging Markets | 7 | 12 | 34 |

Asia Pacific | 6 | 11 | 34 |

Please be aware that our numbers are created by only looking at the top-performing 50% of funds that are in any Investment Association (IA) sector.

We do not want our decisions to be influenced and degraded by the performance of non-performing fund managers.

Investing in Vietnam

I have chosen to write about and concentrate on Vietnam as a potential area for investment for the reasons I gave at the start and for the three that follow:

1) Vietnam is a politically stable, socialist-oriented market economy, which is managed using a mixture of direct and indirect five-year plans. It has recently been achieving steady growth of around 6.5% a year.

2) Vietnam is fortunate in being a leading agricultural exporter of rice, cashew nuts, coffee, tea, fishery products and rubber. It is also the largest oil producer in the region.

3) Vietnam has been receiving investment from multinational businesses, not just into the mature textile industries but also into new IT and engineering industries, as they take advantage of the abundant well-educated workforce, presently the cheapest in Asia.

It's possible to find unit trust/OEIC funds in the IA sectors tabled above which have a small percentage of its funds invested in Vietnam, but to get 100% investment it appears necessary to invest into an exchange-traded fund (ETF) or an investment trust.

I have only managed to find the following two:

Fund | Ticker | Four-week returns (%) | 12-week returns (%) | 26-week returns (%) |

db X-tracker FTSE Vietnam ETF | XFVT | 3 | 13 | 25 |

Vina Capital Vietnam Opportunities Trust | VOF | 4 | 14 | 30 |

I hold both of these funds personally. They feature in the Saltydog analysis, but not in the portfolios which focus on unit trusts and OEICs.

It now remains to be seen how the result of the American elections impinges on the progress of this region and, of course, the rest of the world's markets.

Portfolio holdings

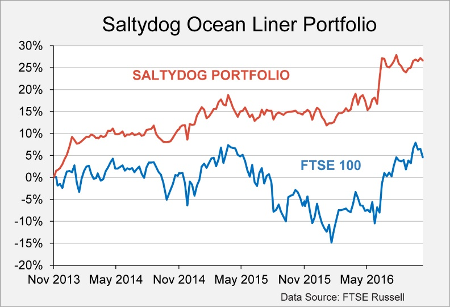

Our Ocean Liner portfolio is currently holding a significant amount of cash, and an investment into one of the funds from the global emerging markets or Asia Pacific sectors would fit in with its overall risk profile - we just need to see how they perform over the next couple of weeks.

Here's a list showing the current holdings in the portfolio.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.