Why Royal Mail shares just dived 7%

17th November 2016 12:56

by Harriet Mann from interactive investor

Share on

As enters the final stage of its three-year cost-cutting programme, the country's favourite postie has increased its savings target by £100 million. Interim results are as expected: revenue inched higher and profits fell, but as the group recruits its red army for the manic Christmas season, a more opaque UK economic outlook makes the market nervous. It's why the shares have plunged 7% to a seven-month low.

Initially targeting £500 million of savings in the three years to 2017-18, Royal Mail now reckons it can cut costs by £600 million - £225 million of which will come from the UK Parcels, International & Letters (UKPIL) business in 2016-17.

While that's good news for investors, the Brexit vote creates uncertainty and UBS predicts UK economic growth, to which Royal Mail's letter volumes are sensitive, will halve in 2017 to 1%.

'Bulls will be hoping for some bargain-hunting to deliver a bounce'"We are monitoring developments in the UK economy closely as we have already seen some impact of the softer economic conditions on our marketing mail revenue," warned chief executive Moya Greene.

"Growth in ecommerce is the key driver for B2C parcel volumes but the parcels market remains highly competitive, particularly in the international space."

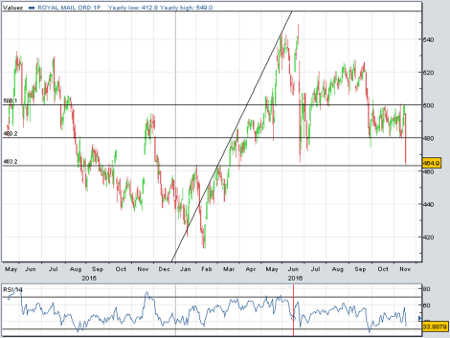

A plunge Thursday takes Royal Mail shares below recent support at around 480p. With a 'neutral' rating on the stock, UBS analyst Dominic Edridge thinks the shares are only worth 488p, implying just 5% upside from here.

"Bulls will be hoping for some bargain-hunting to deliver a bounce," says Accendo Markets analyst Mike van Dulken. "Bears will hope the recent envelope trading range was merely a pause before another 50p leg south to test two-year rising lows at 440p."

It's no secret that fewer letters are sent today, and that it's parcel delivery that now drives Royal Mail's earnings. First-quarter trends continued throughout the half, with total letter volumes down 2% as Brexit uncertainty reduced marketing activity in the UK. UK parcel volumes increased 2% as collections, processing and delivery productivity rose 2.2%.

It was 9% growth in revenue at the continental European parcels business GLS to £942 million that nudged group six-month sales up 1% to £4.58 billion, offsetting a 1% slip at UKPIL to £3.64 billion.

As expected, adjusted operating profit slipped 5% to £320 million before restructuring costs, despite a £12 million tailwind from the weaker pound. Include transformation costs and operating profit actually increased 6% to £262 million.

On a reported basis, pre-tax profit slipped from £116 million to £110 million, giving earnings per share of 8.6p. At least the dividend rises 6% to 7.4p.

Optimising the network

Royal Mail has spent a lot of cash optimising the efficiency of its enormous network, transforming its IT infrastructure and improving order handling and billing procedures for customers.

Better shipping solutions should also improve accessibility to its international services. The 2016/17 restructuring budget is set at £130-£160 million. There haven't been any London property disposals, which may be down to Brexit. Net debt has now swollen to £452 million.

Over 19,000 staff will be employed over Christmas to work in nine temporary sorting centresViewing European GLS as the key to unlock group-wide growth, Royal Mail has just bought Spain's ASM and Californian parcels firm Golden State Overnight.

After years of big spending following chronic underinvestment, Royal Mail is past its investment peak.

Management now plan no more than £500 million of capital expenditure each year, compared with £615 million over the past three.

And, as ever, Christmas will be the clincher. Planning started back in the spring and over 19,000 staff will be employed over the period to work in nine temporary sorting centres.

There is no mention of the upcoming Ofcom report on how Royal Mail is regulated, but this has been promised by the end of this financial year.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.