Three infrastructure trusts for income seekers

17th November 2016 16:35

by Fiona Hamilton from interactive investor

Share on

Infrastructure funds have gained a strong following since the first of the six social infrastructure funds made its debut in 2006, followed since March 2013 by six renewable infrastructure funds.

Their popularity with institutions, individuals and even sovereign wealth funds has allowed them to return regularly to the market to raise more capital, with the result that they now have around £12 billion under management.

Their attraction is the relatively high and steadily rising yields, paid quarterly or half-yearly. Their distributions are reliable because revenues are largely government-backed and their net asset values (NAVs) per share are based on discounted cash flows. That means they should be relatively unaffected by gyrations in the equity market.

The catch is that their high distribution policies mean their NAVs have limited capital growth prospects.

Social infrastructure funds

Also, the "assets" in their portfolios have finite lives, usually with less than 25 years to run, at the end of which they may have no residual value. Investing in them is a bit like buying an index-linked, time-limited tradeable annuity.

To date, the social infrastructure funds excluding (which has a different business model) have invested almost entirely in PPP/PFI-like (Public-Private Partnership/Private Finance Initiative) concessions to run facilities such as schools, hospitals, prisons, court houses, and motorways.

The concessions typically start with lives of 20 to 25 years and the managers are usually paid on an availability basis - which means it does not matter how much the facilities are used. The payments funds receive are usually fully government-backed, and partially linked to the retail prices index (RPI).

The managers can improve returns by controlling costs or supplying supplementary services. However, hot competition for good-quality infrastructure concessions has pushed up the costs of acquiring them, and lowered the potential returns.

Some funds now include concessions which are not availability-based, e.g. toll roadsThis makes it hard for the funds to extend their lives by adding new concessions without diluting their yields.

This situation could ease given the government's announcement of a £250 billion infrastructure plan, with two thirds to be funded by private finance, but in the meantime funds have been looking for similar opportunities in overseas markets, which can involve added risks.

More of a concern is that some funds have started to include concessions which are not availability-based, such as toll roads and student accommodation.

Priced on yield

Shares in the social infrastructure funds are priced largely on yield. , and trade on different premiums but this results in almost identical yields to shareholders.

3i Infrastructure has a lower yield because it invests directly in companies related to infrastructure so has better long-term growth prospects.

However, its equity exposure makes it more vulnerable to a bear market.

has the highest yield, but the least impressive record, and around 7% of its portfolio is invested in projects with demand-based revenues, with some backed by corporate rather than government-based covenants.

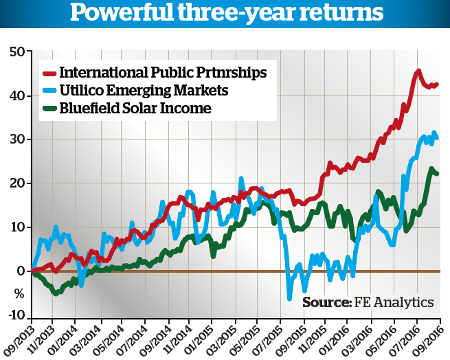

Of these five funds we prefer International Public Partnerships. Its revenue has the highest inflation linkage of the PPP/PFI-style social infrastructure funds, at around 75%, and the average remaining life of its portfolio concessions is the longest in the peer group at 28 years.

INPP has grown its dividends by 2.5% per annum since launchIts exposure to projects under construction, which has been value-enhancing in the past, is 10%.

Its portfolio currently comprises 122 infrastructure projects with government-backed revenues. The UK accounts for 70%, with the balance in Europe, Australia and North America. Energy accounts for 29%, with 22% in education and 20% in transport.

Its substantial involvement in offshore energy transmission and the TTT project demonstrate investment adviser Amber Infrastructure's success in finding opportunities in new sectors.

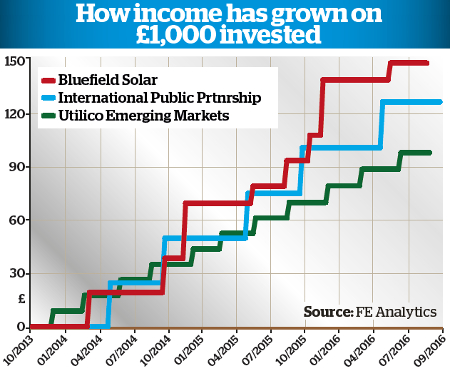

INPP has grown its dividends by 2.5% per annum since launch, and expects to pay out totals of at least 6.65p and 6.82p for 2016 and 2017 respectively.

Renewables

The renewable infrastructure sector includes one wind specialist, three solar specialists, plus , which includes both, and , which also includes some PPP-type investments in water and waste management. Currently only the first-named has any overseas exposure.

So far all the renewable trusts have fulfilled their commitment to raise dividends in line with inflation from an initial 6p to 7p. Their yields are higher than on the social infrastructure funds, partly because their shares trade on lower premiums.

However, the near halving of forward electricity prices in the three years to March 2016 means they have struggled to achieve their target NAV total returns of around 7 to 9%.

Electricity prices rose in the summer and the funds would benefit if they continue to climbAs a result dividends have been barely covered, leaving little for the reinvestment needed to bolster capital growth. As a result their NAVs have made little or no progress.

Their big drawback, relative to social infrastructure funds, is that revenue is less certain because it depends on the amount of power they generate and what they get paid for it. Output can be affected by meteorological conditions or problems with their equipment.

Revenue is unpredictable in that most derive 60% or less of their revenues from 20- to 25-year government-backed RPI-linked subsidies, such as FITs (Feed-in Tariffs) and ROCs (Renewables Obligation Certificates), with the balance dependent on prices negotiated with electricity distributors.

Comfortingly, forward electricity prices rose over the summer and the funds would benefit if they continue to climb, as they could if more polluting generators continue to be decommissioned before newer, cleaner plant comes on stream.

Solar choice

On the other hand, electricity prices could be undermined if economic growth is badly affected by Brexit, or shale oil extraction dramatically reduces the cost of gas - which is a key driver of UK electricity prices.

Continued rapid expansion of renewable generation - which already accounts for a quarter of the UK electricity market - could also undermine returns.

We are opting for a solar fund, because solar generation depends on UV, which fluctuates less than wind speeds, and because solar panels have fewer moving parts than wind turbines.

That means they are less likely to run into costly maintenance problems or to be obsolescent when the leases on their sites expire.

BSIF launched with a distribution target of 7p, paid half-yearly and rising annually by RPIThis suggests they have more chance of achieving extended lives, as some of their forerunners in Europe have done, though the expiration of their subsidies may leave them dependent on open market prices.

Our choice is , which trades at a below-average premium for the subsector, offers an above-average yield, and recently enhanced its attractions by replacing almost all of its short-term borrowings with lower cost long-term debt.

With 73 operational photovoltaic solar plants on greenfield, industrial and commercial sites across England and Wales, it has the most diversified portfolio of the solar funds.

BSIF was launched with an above-average distribution target of 7p, paid half yearly and rising annually by RPI.

Its managers, Bluefield, receive a performance fee if distributions exceed that target, as they have in 2015 and 2016, but the fund's competitive base fee is reduced if the target is missed, so their interests are aligned with income-seekers.

Emerging markets

has a totally different way of tapping into the ever-expanding infrastructure sector, as it invests for total returns in the shares of profitable companies providing infrastructure-type facilities in emerging economies.

It therefore has much greater long-term growth prospects, but is more vulnerable to stockmarket gyrations, as demonstrated by the 14% fall in its share price in summer 2015.

Companies involved with the provision of electricity, gas, ports and airports together account for over 60% of UEM's portfolio, and its largest country weightings are China, Brazil and Malaysia.

Brokers fear those premiums are more likely to contract than to expand from current levelsThe yield on UEM's shares is lower than on any of the infrastructure funds at 3.1%, paid quarterly, but its average growth over the past five years has been faster at 3.4% per annum.

So has the growth in its NAV per share and, as a result, the trust's five-year NAV total return is up with the best of the infrastructure funds.

Its five-year share price total returns lag those of HICL and 3i Infrastructure, both of which have seen the premiums on their shares climb into the high teens over that period.

But many brokers fear those premiums are more likely to contract than to expand from their current levels, whereas UEM's current discount of 9% should have more scope to narrow, as the trust uses buybacks to try to keep it in single figures.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.