These two economic factors, not politics, will upend markets

18th November 2016 11:16

by Ceri Jones from interactive investor

Share on

This month's tactical asset allocator valuation was conducted with one working day left to the presidential elections, just as volatility, as measured by the Vix, soared over 40% in a few days to 69%, and the S&P 500 tumbled for the ninth straight session - something that hasn't happened since 1980.

For months we had been glued to what must be the most vicious and bizarre election in American history, and the polls suggested (correctly) it was going to be a close-run thing.

But who becomes president will not in reality have much impact on the trajectory of the markets.

The more significant consideration is the Federal Reserve's ability to stimulate the economy, which is fading fast.

US rate rise

Engineering the right balance is a challenge for Janet Yellen, as she needs to hike rates but does not want to slow down the economic engine prematurely.

A rate rise in December is still the most likely outcome, but many corporations have taken advantage of the low-rate environment to borrow money via the bond markets and will be squeezed.

This, in turn, will drive the dollar - already at its highest level in nearly nine months - to surge further as we approach December.

If the dollar index, which compares the US dollar against a basket of other currencies, moves much above the 100 threshold, it will damage US stocks because it makes US goods more expensive overseas.

Banks are stymied by negative rates on cash used as collateral in their derivatives tradesThe stability of the big investment banks is another major concern. Firms such as have been warning their wealth clients that a banking-led crisis is a real possibility.

Putting aside the burden of toxic loans and even Deutsche Bank's particular woes, investment banks face major structural issues, because as well as complying with new and onerous capital adequacy regulations, their business models can no longer deliver profits in an era of low growth and negative interest rates.

Take, as just one example, the banks' derivatives businesses, which from 2002 to 2007 were a huge and growing source of revenues, burgeoning at an annual compound rate of around 30%, according to analysts at Berenberg investment.

UK real wages have just kept pace with inflation, but are still about 7% lower than before 2007Economic volatility even continued to boost demand for Delta 1 derivatives (where price movements of the underlying asset are mirrored by identical moves in the price of the derivative) and synthetic finance during 2015, lifting the contribution derivatives made to investment banks' equity revenues to over 16%.

Now, however, they are stymied by the negative rates on the cash used as collateral in their derivatives trades, although some are passing on this cost to their largest institutional clients.

Closer to home

Back at home, the High Court's ruling that prime minister Theresa May does not have power to trigger Article 50 without parliamentary approval has put her under pressure to call a snap general election next year to ensure she has enough support to push her vision of Brexit through the Commons.

As in the US, behind the political headlines economic demons are at play, with both prices and unemployment rising inexorably.

The crunch comes when prices of goods rise faster than wages, squeezing living standardsAlthough the weak pound has been a short-term boost to large exporters, it has wrought havoc on inflation, driving up the consumer prices index from 0.6% to 1% according to the latest Office for National Statistics (ONS) release, and the general expectation is that inflation will rise steadily to at least 3-4% by the end of next year.

Gilt yields have been rising in response, which is eroding the premium yield offered by the , damaging a key support for the stockmarket.

Real wages have just about kept pace with inflation, but are still about 7% lower than before 2007, as companies continue to cut costs where they can in order to boost earnings.

The data on unemployment is particularly worrying. If you separate out the monthly figures that the ONS unhelpfully clumps together, unemployment could have risen by as much as 144,000 from August to September.

The crunch will come when the price of goods begins to rise faster than wages, which will squeeze living standards that are already difficult for many groups in society. In particular, the pound's impact on import prices will ramp up food prices.

Brexit-vulnerable sectors are becoming more cautious about investment spendingIt can't therefore be much of a surprise that UK retail sales are flat, and stocks in other domestically focused sectors, such as financials, construction and travel, have tumbled.

A lot of the discussion focuses on whether those financials firms able to navigate a changing regulatory landscape, and harness new technology to win customers, have been oversold and are worth backing.

A good test of how well the economy is holding up is the amount being ploughed into corporate expansion, and the evidence suggests that Brexit-vulnerable sectors such as financial services and manufacturing are becoming more cautious about investment spending.

PwC forecasts that GDP growth will remain at around 1% for next year, about half its recent rate, pushing the UK below the US, Canada, Germany and France in the growth rankings.

It is fairly safe to say that longer out, as soon as the Fed acts, bonds will be hitThe slump in bond yields across the summer months helped to sustain UK equity prices at valuations of around 18 times 2016 earnings, but bond yields have begun to recover in recent weeks, helping to stoke a buyer's strike in risk assets on both sides of the Atlantic.

It is fairly safe to say that longer out, as soon as the Fed acts, bonds will be hit.

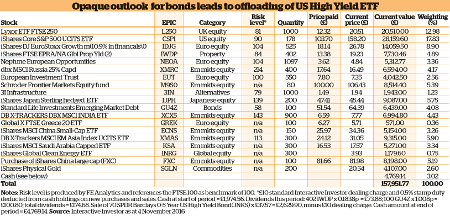

Our portfolio is already exceptionally underweight bonds, and it is hard to make a case for them, so this month we are taking profits from one of our two bond holdings, the , and parking the proceeds in cash until the outlook is less opaque.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.