Sickly Mitie deteriorates further

21st November 2016 13:26

by Harriet Mann from interactive investor

Share on

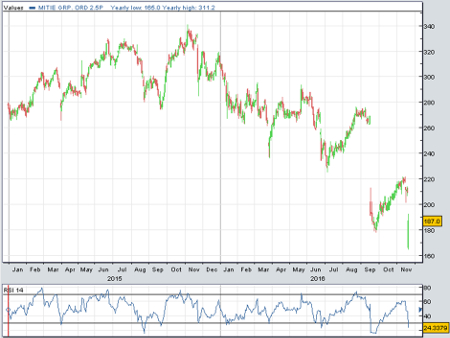

Crashing by a fifth to prices not seen since 2008, second profit warning in three months reflects a company in crisis. And, in the chief executive's final update after a decade at the helm, the support services group has placed its healthcare business under immediate review, with plans to exit the market.

But this won't be a magic fix, and the remaining few months of its financial year will be a hard slog. What money a third profits warning?

It's no surprise the market is struggling to adjust to rising labour costs and economic uncertainty; Mitie first warned that profits were going to suffer back in September. And, with lower levels of more profitable project work and reduced spending from facilities management clients, no wonder life is tough.

Mitie's long-term view on the healthcare market has changed too. It's written off the value of its healthcare operations and put the business under review. Not only are homecare charge rates weak, but the volume of care being commissioned is lower, which is why the FTSE 250 firm's Healthcare business is haemorrhaging cash.

"Given the further deterioration of the financial performance of the healthcare business and following a review by the directors, we have concluded that a sustainable long term plan for the group's domiciliary healthcare business cannot be delivered under Mitie's operating model," it said Monday.

A £117 million write-down at the healthcare business plus £6 million of restructuring costs plunged Mitie to a first-half loss of £100 million. A year ago it made £45 million. Options will include selling Healthcare, although finding a buyer might be tough.

Amid sluggish outsourcing markets, half-year revenue slipped 2.6% to £1 billion in the six months to 30 September. Excluding these "exceptional" costs, operating profit still plummeted 39% to £35.4 million, due to the changing mix of less profitable operations. The interim dividend falls by a quarter to 4p.

As is common following a profits warning, Mitie shares sank as much as 20% in early deals. However, they did claw back some ground, recovering to an 11% fall to 186p by late morning.

Not all bad news

It wasn't all bad news. A healthy sales pipeline grew to £9.3 billion, while the order book fell 9% lower to £7.7 billion. Improving visibility in difficult times, 94% of the 2016/17 budgeted revenue has been secured, with nearly two-thirds of 2017/18 sales already in the bag. Cash conversion has also increased by 16.5 percentage points to 107.9%.

"Currently we are in the middle of one of the periods where there is a lot of change happening," said Mitie. "Growth in the UK economy is low and wages are rising because of increases to the minimum wage, pension costs and apprentice levies. This, and the resulting differentials in pay, will cause labour to be more expensive in the UK over the coming years.

The search for new CEO Phil Bentley, who takes over next month, took the firm over a year"Together with an anticipated increase in the costs of imported goods and services we are likely to see price rises in a range of markets in the future. This period of transition in the UK economy will create pressures for our clients but our evolving outsourcing model will generate more opportunities."

The company also secured new contracts with some big companies during the period, including Manchester Airports Group, Network Rail and the Scottish Fire Rescue Service. It also won its largest security contract with , which should be worth £115 million over three years.

After a search lasting well over a year, Ruby McGregor-Smith will make way for new boss Phil Bentley next month. She leaves at a difficult time with financial performance well below expectations, but it hasn't been an awful decade of tenure.

And Bentley has been busy doing his homework before taking charge. Thankfully, the former chief executive of Cable & Wireless Communications has experience of running large service-based companies, having been managing director of British Gas and held various roles at .

Unfortunately, better revenue visibility and momentum behind project level won't be enough to bring full-year profits back in line with previous expectations. Even with a £10 million boost from restructuring plans.

When new bosses take the reins of new companies during difficult times, a traditional "kitchen sinking" mentality dictates the tone of debut corporate results - be warned.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.