Goldman Sachs outlook for 2017

30th November 2016 09:00

by Lee Wild from interactive investor

Share on

It's that time of year when analysts and strategists both on Wall Street and in the Square Mile begin making predictions for the next 12 months. I'm sure they hate it, but it does at least give the investing public a steer as to what the big bitters think we should be looking out for in 2017. This time it's Goldman Sachs' turn.

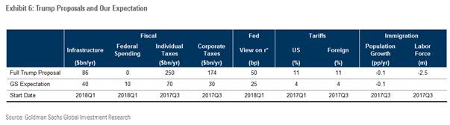

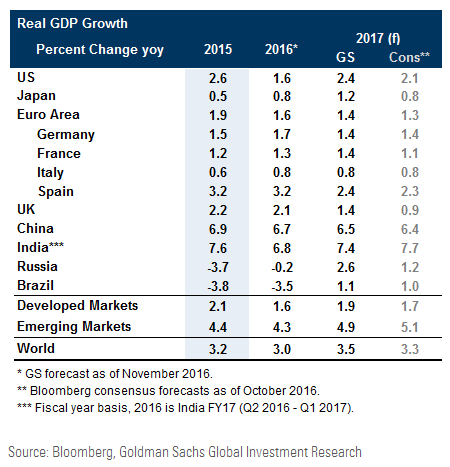

Assuming Donald Trump makes it to the White House in January, a fiscal stimulus package passed by a Republican-led Congress could trigger a further temporary growth boost starting in mid-2017, argues Goldman.

However, aggressive implementation of trade and immigration policies would be negative for growth. "The near-term effects are positive because the fiscal stimulus package boosts US demand and this has positive spillover effects to other economies.

The Trump agenda is likely to result in higher US interest rates and thus a stronger dollar"However, the longer-term effects on US growth are negative because the fiscal boost peters out and the other policies-higher tariffs, reduced immigration, and tighter Fed policy-weigh on growth.

"This has negative spillover effects on other economies, especially in [emerging market] economies with partially fixed exchange rates or dollarized economies. The reason for the greater impact there is that the Trump agenda is likely to result in higher US interest rates and therefore a stronger dollar."

And, given both output and employment are now close to potential, Trump policies will likely reinforce the gradual upward move in inflation, already underway.

"We remain sceptical that the equilibrium interest rate has fallen as much as widely believed," adds Goldman. "We therefore still expect the Federal Reserve to raise the funds rate substantially more than implied by market pricing."

It expects an additional 75 basis points of rate increases in 2017. That's higher than the Fed's own estimate of 50bp, largely because the broker's forecasts for inflation and growth are more aggressive.

To insulate itself from the subsequent upward pressure on global long-term rates, and with real GDP still way below potential and core inflation stubbornly low, the European Central Bank (ECB) will extend its asset purchase program beyond March 2017, according to Goldman.

The Japanese central bank, meanwhile, will focus on its yield control policy, adopted in September, while "greater interest rate divergence should put continued upward pressure on the dollar".

Europe could re-emerge as a source of political risk, with France's election atop the list of concerns"The risks to our baseline forecast are skewed to the downside," warns Goldman.

"First, much remains unclear about the economic policies of the incoming Trump administration, and the positive initial market reaction could reverse if the policy mix looks more unfavorable than now widely assumed.

"Second, Europe could re-emerge as a source of political risk, with the French election at the top of the list of concerns. Third, a stronger dollar could lead to renewed pressure on emerging markets, especially China.

"The recent renewed upward pressure on the dollar versus EM currencies bears close watching."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.