What triggered Daily Mail's 10% surge?

1st December 2016 13:33

by Harriet Mann from interactive investor

Share on

has split the City this year. Its post-referendum rally of over 50% is certainly eye-catching and the company has just reported full-year results ahead of expectations.

But the numbers do show how bleak the last year has been - cemented by a recent downgrade by Barclays. Nobody believes the backdrop will change any time soon, either, but one analyst still predicts big upside for the shares.

After Daily Mail's detailed pre-close trading update in September, the revenue breakdown holds no surprises. Print advertising is especially hard right now, and underlying revenue was flat at £1.9 billion, aided by organic growth in its business to business (B2B) and consumer digital operations. With 40% of operating profit from North America, the stronger dollar helped boost reported revenue 4%.

Split in two main divisions, Daily Mail is shifting focus increasingly towards B2B, which now generates more-than three-quarters of operating profit from its risk management service, information group, event operations and Euromoney businesses. Squeezed by the bleak outlook for print ads, media revenue fell 2%, while B2B climbed 1%.

Digital investment

But Daily Mail's media operation isn't sitting idly by: it ramped up its digital media investment drive, which paid off with growth in digital ads and subscriptions. Still, the heavy cost comes at a time when revenue from print ads and Euromoney has suffered, which helps explain why operating profit fell 11% to £277 million.

Include £17 million of income lost following the sale of its stake in Local World a year ago, and adjusted pre-tax profit slipped 7% to £260 million, giving adjusted earnings per share (EPS) of 56p.

DMGT says heavy acquisitions will help unlock the potential of its refreshed portfolioEarly-stage acquisitions, organic investment and lower profits within DMG media pulled operating margin down two percentage points to 14%.

At least management is committed to its policy of "real dividend growth": the pay-out rises 3% to 22p.

A heavy acquisition and disposal programme has positioned the group well to unlock the potential of its refreshed portfolio, says the company. It spent £42 million on acquisitions throughout the year, while making £128 million from disposals.

The October 2015 acquisition of UK-based conveyancing search provider ETSOS completes its European property information operation.

New boss Paul Zwillenberg has identified three key priorities following a strategic review: improving operational execution; increasing portfolio focus; and enhancing financial flexibility.

Industry challenges remain, but management thinks it can deliver underlying revenue growth in the B2B sector this year. Cost-cutting should go some way to offset the difficult print advertising environment, although how much margin stability this provides is uncertain.

Reported results will also be hit by the absence of the 53rd week, which contributed £12 million sales and £6 million cash profit last year.

Potential upside

Coming in slightly ahead of forecasts, broker Numis Securities sees potential upside for the shares, but is holding fire on material upgrades for now. Analyst Gareth Davies pencils in £1.99 billion revenue, £266 million pre-tax profit and earnings per share of 56.1p in 2017.

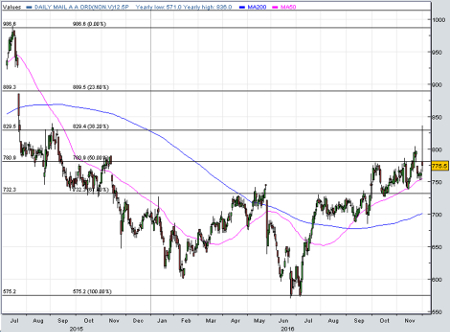

Daily Mail shares soared 10% Thursday morning to a 15-month high. However, after briefly breaking above 50% Fibonacci retracement of the decline from mid-2015 levels, a wave of profit taking wiped out most of the gains by lunchtime.

The shares currently trade on 14 times forward earnings and with a 2.9% yield and Davies reckons they're worth 25% more.

"DMGT has reported a good set of 2016 results that have come in ahead of our estimates," explains Davies.

"Divisional profitability is ahead in each division, with RMS most notable. DMGT shares represent very good value at current levels, we reiterate our 'buy' and 970p target."

But Daily Mail has clearly split the City. Just last week, Barclays warned that Brexit risks to advertising, softer margins and hefty restructuring costs would make 2017 a battleground. The investment bank slashed its target price by 10p to 705p, taking a thick red pen to forecasts.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser