Why we have a problem with Tesla

6th December 2016 09:56

by Alistair Strang from Trends and Targets

Share on

is a bit of an oddball but has appeared in our mail recently, the predominant question being "where's the bottom?" As the chart shows, there has been a reasonable uptrend this year which, unfortunately, has broken in recent days.

There's another detail worthy of consideration, if opting to suspect (as we do) the price is due to engage reverse gear any time soon. The immediate price cycle had a pretty conclusive bottom of $180 which was supposed to generate a bounce.

Unfortunately, the price has broken $180 a few times and the situation now is of weakness below $178 leading to somewhere around $170 and the uptrend since 2013.

We've a problem here as, while $170 will almost certainly generate a bounce, the share price will move into a region where weakness to $155, with secondary $138, becomes probable. Or, in other words, our suspicion is that any bounce shall be short-lived.

Ultimate bottom against this share calculates at $75, though we'd assume they'd need to run over the Duracell Bunny to achieve such a point. We cannot calculate anything sane below $75.

Having spread sufficient Christmas misery, what does the share need to assure us any bounce from the immediate uptrend is viable?

It needs better than 'blue' on the chart, $201.1 at time of writing, as this gives sufficient charge for growth to an initial $212.07 with secondary, if bettered, a rather more reasonable $230.3.

In fact, if we're honest, the price would enter a zone allowing positive news to engage warp speed to $250.

In summary, safe above $201, dodgy below $178. And currently it's in the middle...

'Big picture' updates

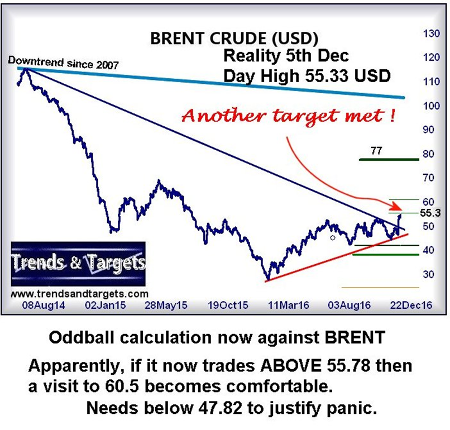

We've also a couple of "big picture" updates against GBP/EUR and Brent crude:

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.