How Ashtead snubbed generous Trump

6th December 2016 13:54

by Harriet Mann from interactive investor

Share on

Despite the whopping £1.5 billion it's added to market value over the past month, there was not so much as a whisper about Donald Trump's presidential election win in the equipment rental firm's interim results. Some might call it ungrateful.

But it's quite deliberate. Boosted by the weak pound and bolt-on acquisitions, the £8 billion company, a star constituent of Interactive Investor's new Aggressive Winter Portfolio, confirmed Tuesday it will beat expectations this year, even without Trump.

"Our end markets remain strong, the structural drivers are still in place and we have a strong balance sheet which allows us to execute our plans responsibly," read its outlook statement. "As a consequence, the board continues to look to the medium term with confidence."

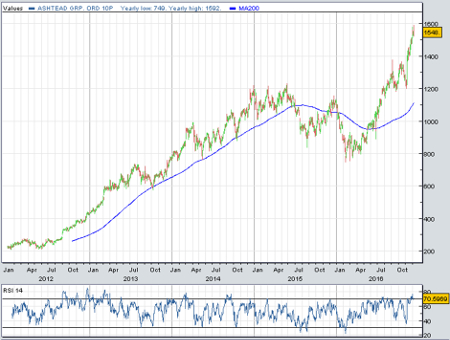

However, despite impressive organic growth, Ashtead has a lot to thank Trump for, certainly in terms of recent share price performance, up by a quarter since the US election. Even with a lot of good news priced in already, the shares hit a record high at the opening bell Tuesday and have only succumbed to mild profit-taking since.

The strength of the business is clear to see in results for the six months to 31 OctoberThat's because Ashtead is tipped to be a major beneficiary of Trump's election to the White House. A promise to spend up to $1 trillion on American infrastructure could be hugely lucrative for the British company, but it doesn't rely on it.

The strength of the business is clear to see in results for the six months to 31 October, despite the obvious benefit of sterling weakness post the EU referendum. With both its US Sunbelt and UK A-plant divisions performing well, management thinks it will beat expectations this year.

That's triggered City upgrades, including a 100p-a-share price target boost from Jefferies to 1,800p, implying a further 17% upside.

The broker also upgrades forecasts for the year to April 2017 by 4%, now pencilling in £3.07 billion of revenue, pre-tax profit of £778 million and earnings per share (EPS) of 102.8p.

Estimates for 2018 grow by 6% to turnover of £3.36 billion, profit of £885 million and EPS 116.9p, then to £3.5 billion, £931 million and 123.1p in 2019.

This puts Ashtead shares on only 15 times earnings estimates for the current year and an undemanding 13 times 2018 forecasts. That looks cheap, especially if Ashtead benefits from just a fraction of what Trump has promised.

Momentum during the second quarter helped half-year pre-tax profit jump 9% to £426 million at constant currency, on double-digit rental revenue growth to £1.4 billion. EPS rose 9% to 56p. Strip out the impact of interest, tax, depreciation and amortisation and cash profit rose 13% to £592 million, reflecting a record margin of 49%.

Ashtead's Sunbelt division is the key catalyst behind last month's share price rally. And revenue from the North American business rose 8% to $1.8 billion (£1.4 billion), and two-thirds of that growth dropped through to cash profit, up 13% to $924 million, and operating profit, up 9% at $596 million.

Management says this reflects the successful roll-out of its long-term growth strategy as it launches into its US plan for 2021. Forty-two new branches were added in the half, and the firm is on track to reach its target of 70.

Ashtead has just increased its capital expenditure budget to £1-1.2 billion for the yearAn increased rental fleet underpinned A-plant's rental-only revenue growth of 16% to £152 million, and total sales jump of 12% to £199 million.

With a margin of 48% compared to Sunbelt's 51%, 41% of UK turnover dropped through to cash profit.

The group spent £142 million on 11 bolt-on acquisitions in the first half. Add in £683 million gross spend on investment in the business and net debt increased from £1.98 billion to £2.69 billion. Strong earnings momentum meant the net debt:cash profit ratio actually dropped from 1.9 times last year to 1.8 times at constant currency.

After heavy investment in its fleet, Ashtead has just increased its capital expenditure budget to £1-1.2 billion for the year to make the most of opportunities to drive profit growth. The budget was previously £875-1,250 million.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.