Should you keep buying commodities in 2017?

7th December 2016 13:31

by Harriet Mann from interactive investor

Share on

Things looked pretty dire for the miners at the beginning of this year, but little has gone to script in 2016. Indeed, the metals and mining sector has rallied hard on the back of Chinese stimulus, disciplined global production and Donald Trump's election to the White House. But after doubling in value inside 12 months, is it too late to buy?

UBS doesn't think so. Analysts there have just upgraded their sector rating from 'market weight' to 'overweight', and have made some big changes to their outperforming model portfolio.

"We believe investors should be 'overweight' the miners going into 2017," writes UBS analyst Jo Battershill. "In our view, the upcoming financial reporting season is likely to provide some pleasant surprises in terms of free cash flow, balance sheet strength and shareholder returns."

Left with a metals supply glut after the commodities super-cycle, physical prices and mining shares plummeted on nerves that Chinese growth was slowing.

But, against the odds, fresh Chinese stimulus underpinned commodity demand, as a large liquidity injection increased infrastructure investment and improved housing affordability, lifting sales and prices.

Trump's election to the White House triggered a mass trade on reflation hopesTough stimulus, like the 276-day annual operating limit for coal mines, also had a delayed but positive impact on reducing production.

It's not all down to China though. Producers elsewhere showed production discipline, and prices responded to cuts in output.

There have been no further increases in US interest rates (although a second hike in 10 years is pencilled in for next week), and both the eurozone and Japan launched additional quantitative easing programmes.

Finally, Donald Trump's election to the White House triggered a mass trade on reflation hopes following the president-elect's promise of huge infrastructure spending.

Exceeding expectations

That's why metal prices have overshot expectations. The FTSE 350 Mining index has rocketed by 160% since its February low, recovering all the ground lost in 2015.

Now in a major earnings upgrade cycle, companies should enjoy strong free cash flow, healthy balance sheets and meatier returns.

Not only does China's construction pipeline underpin solid demand throughout the entire first quarter, but supply cuts and producer discipline, and accommodative fiscal policy reinforce industry fundamentals.

Zinc prices have already rallied 58% year-to-date, but inventories should keep fallingObvious risks include Fed rate increases, government transitions in the US, China and Europe, and the shape of future stimulus, but Battershill reckons commodity demand will be underpinned by an acceleration in Chinese infrastructure and property investment as supply tightens.

The copper, zinc and nickel markets are already benefiting from China's buoyant property market, with US economic growth providing further fuel.

So UBS has increased its 2017 copper price forecasts by 36% to $3 per pound (/lb), well above consensus of $2.21, as the market focus shifts from the 2015/16 surplus to the 2017 supply deficit.

Zinc prices have already rallied 58% year-to-date, but inventories should continue to decline into the new year, and prices are tipped to hit $1.50/lb.

With nickel demand on the rise, but a tenth of supply set to vanish, prices are expected to rise from around $5.20/lb to $5.60 in 2017 and then $6.25 in 2018.

Much better position

We are certainly entering 2017 in a much better position than last year. Global growth has increased for the first time in seven years, from 3.1% to 3.5%, driven by better-than expected US expansion, the beginning of an oil recovery, some emerging countries exiting from recession, and the dollar peak against G-10 countries.

With significant US fiscal spending expected, reflation will be a key theme of 2017.

"Over the last five-years, the direction of the metals and mining sector has been highly dependent on the strength of the Chinese economy," says Battershill.

"While we expect this will still remain the case in 2017, the prospect of a global fiscal policy response and a subsequent lift in infrastructure investment could remove some of the dependency on China, and in a best case scenario, actually lead to additional volume demand at the margin."

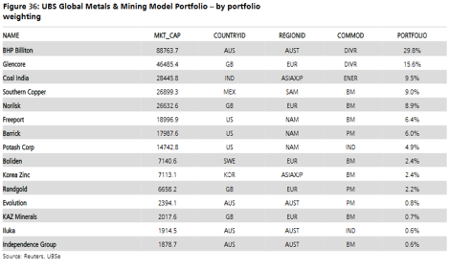

The analyst has made some big changes to UBS's successful Metals and Mining portfolio, up 51% since inception in April versus a 39% increase for its benchmark MSCI Metals and Mining index.

It's pulled to avoid operational risk, to favour major gold producers, and is taking some profit on outperforming .

Taking their places are copper miner , gold producer and Australian mineral sands miner Iluka on the back of strong Chinese property sales.

makes up the lion's share of the portfolio at almost 30%, followed by at 15.6%, at 9.5% and at 9%. The portfolio is less exposed to diversified miners in favour of base and precious metals and offers a 3% dividend yield.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.