Insider: These bosses have skin in the game

9th December 2016 12:15

by Lee Wild from interactive investor

Share on

Devro's a silly sausage

has had a shocking four weeks, although, to be fair, the sausage skin maker's share price has underperformed for the past 18 months.

On 10 November, the company warned that underlying operating profit for 2017 will be lower than previous expectations. It blamed plant upgrades for a drop in sales volumes in Latin America, and said group volumes would be down 10% next year.

Numis Securities analyst Charles Pick was unimpressed. He called it a "massive blow to sentiment and will have serious operational gearing issues," adding "it has been assumed the dividend is held but any fresh issues could leave it vulnerable".

Devro is throwing £3 million at the problem in the fourth quarter of 2016, but there'll be more over the next few years.

"Our price target has been cut to 209p (from 293p) based on a subjective 12x for calendar-year 2018 when [operating profit] should rebound but cannot be assured of so doing," says Pick. "Sentiment has been pole-axed and it will be March 2017 before the 2016 finals with a full run-down on the issues."

Devro shares collapsed from 226p to a low of 140p in less than three weeks. Directors, including chairman Gerard Hoetmer, chief executive Peter Page and finance boss Rutger Helbing, have been keen buyers of the shares on the way down.

This week, Hoetmer has bought again, this time at prices between 147p and 157p. In all, he spent over £153,000 on three trades, and is currently up £4,100 before costs.

He'll know he's in for the long haul here, though. First prize will be filling the gap between current prices and pre-warning levels at around 230p. It's a recognised pattern following a big gap-down on a profits warning.

Management must demonstrate to investors it can repair the business first, however, and recovery if often not straightforward. At least bosses have skin in the game!

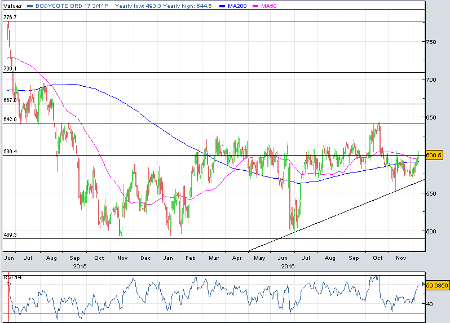

Bodycote

is a creature of habit. It's why the heat treatment engineer made it into the Interactive Investor Consistent Winter Portfolio for 2016/17. It's risen between 1 November and 31 March in nine of the past 10 years, and by an average of 22%.

Its shares are currently up 1.1% since the end of October, better than the benchmark FTSE 350 index, down 1.8%.

A trading update three weeks ago showed clearly how much Bodycote - which earns a huge slug of money overseas - has benefitted from the weak pound. Typically, across most of the divisions, revenue was up strongly, but down if you strip out foreign exchange benefits.

Still, a forward PE ratio of less than 16 is fair, and management has access to funds if the right opportunities come up - net debt at the £1.1 billion company is just £12 million.

And Dominique Yates, who'll take over as finance director on 2 January, has been keen to build a stake in the business. We heard in October that Alexandra Laforie, a "person closely associated" with Yates, had bought 50,000 Bodycote shares at 640p, costing £320,000.

This week, Laforie tripled her holding with the £591,000 purchase of 100,000 shares at just over 591p. That takes total spend so far well over £900,000.

SDL

A day after he'd wrapped up a successful capital markets presentation to analysts and investors, non-executive director Christopher Humphrey spent £65,000 on 15,000 shares in the content management and language translation software firm at 432.5p each.

It's Humphrey's first share purchase since he joined the board in June. The shares have been as high as 485p since then, but there's been renewed interest following the latest presentation when SDL outlined its medium to long-term goals.

SDL wants to generate 10% annual organic revenue growth and mid-to-high teens percentage profit margin. Current estimates suggest rapid earnings growth over the next few years and an undemanding forward price/earnings (PE) ratio of 16-18.

Ophir Energy

It's also great to see directors at backing the business. The shares are up sharply following OPEC's landmark decision to cut oil production from January, and management are already "in the money".

Chief operating officer Dr Bill Higgs and finance director Tony Rouse over 259,000 between them at a cost of around £225,000. Ophir currently trades north of 90p.

To find out more, click here.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.