Insider: Big money backs this exciting pair

22nd December 2016 11:30

by Lee Wild from interactive investor

Share on

Ashtead's road to Riches

Six months after being appointed non-executive director of Ashtead, Lucinda Riches has spent almost £78,000 on 5,000 shares in the rental equipment company at 1,559p each.

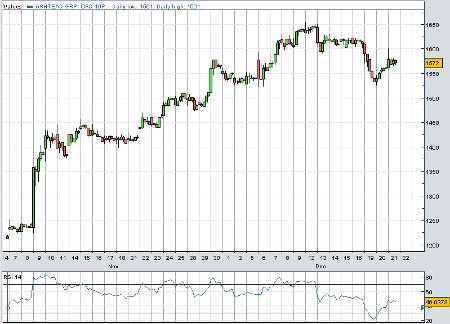

That's a brave move given the price has risen from less than 30p in 2008, and 750p in February this year to a record 1,654p this month.

Of course, this long-term rally may have further to run. Indeed, after decent half-year results a few weeks ago, analysts tipped shares in Ashtead - a constituent in this year's Interactive Investor Aggressive Winter Portfolio - up to £18.

They'd already resumed their rally following Donald Trump's shock win in the US presidential election. His promise of $1 trillion of infrastructure spend got investors excited about Ashtead's huge American division - Sunbelt - which serves the US construction and industrial equipment rental sector.

However, doubts made public by broker UBS earlier this week lopped more than 5% off the share price.

"Sell", screamed UBS analyst Rory McKenzie, arguing that the $1 trillion of infrastructure projects over 10 years may not even exist. He points out that it would take only $161 billion to repair all the bridges in America, and that few projects were expected before the second half of 2018.

"A >60% uplift in public infrastructure spending would only be equivalent to a c7% increase in Ashtead's total market," writes McKenzie, adding that the current valuation of 15 times forward earnings prices in 10% compound annual growth rate (CAGR) over five years. "We are less optimistic."

"We increase estimates to reflect a more optimistic market growth outlook, increase our price target to 1,400p, but downgrade to ‘sell' – risks from here are well-skewed to the downside after a large re-rating."

Chief backs Photo-Me with millions

Shares in Photo-Me, the photo booths and digital printing kiosks firm, have traded a tight range for the past three years. Apart from the odd departure, they've rarely traded lower than 130p or higher than 167p.

However, recent half-year results got the City excited, not least the team at broker finnCap, where both profit forecasts and the price target were given a healthy leg-up.

Despite being flattered by a weak pound, a 19% increase in revenue and 20% jump in pre-tax profit was impressive. Strip out the FX benefit and you're still left with top-line growth of 4% and a similar uptick in profit.

"Strong cash generation underpins internally financed machine rollout as well as the attractive 20% increase in ordinary dividend forecast for both FY17 and FY18," wrote analyst Roger Tejwani.

He upgrades profit estimates by 14% both for the year ending April 2017 and April 2018 to £48 million and £50.4 million respectively. That gives adjusted earnings per share of 9.2p and 9.6p, putting the shares on a forward price/earnings (PE) ratio of 16.

The price target also increases from 185p to 215p, implying potential upside of 30%.

Chief executive and deputy chairman Serge Crasnianski is certainly enthusiastic about prospects. Following last week's £3 million splurge on Photo-Me shares at 155.75p, he's added another 2.89 million at 158p, worth almost £4.6 million.

The French entrepreneur's stake in the business he was forced out of for 20 months until his return in summer 2009, is now 84.6 million shares. That's 22.5% of the company, currently worth £140 million.

Canny Crasnianski has already made a paper profit of well over £300,000 on his latest purchases.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.