How stockmarket extremes have become the norm

16th January 2017 10:23

by Lance Roberts from ii contributor

Share on

There has been a litany of articles written recently discussing how the stockmarket is set for a continued bull rally. While Trump was initially expected to be extremely bad for the market, post-election he somehow became extremely good for it.

These are some primary points in common among each of these articles, which are as follows:

1) Interest rates are low.

2) Corporate profitability is improving.

3) Oil prices are rising.

4) Trump's fiscal policies will supplant the Fed's monetary policies.

While the promise of a continued bull market is very enticing, it is important to remember that, as investors, we have only one job: "buy low, sell high".

It is a simple rule that is, more often than not, forgotten as "greed" replaces "logic". It is also the simple emotion of greed which fosters exuberance and extremes, which ultimately revert into devastating losses.

Therefore if your portfolio, and ultimately your retirement, is dependent upon the thesis of a continued bull market, you should at least consider the following charts, which are a collection of current "extremes" in the market.

Extreme Valuations

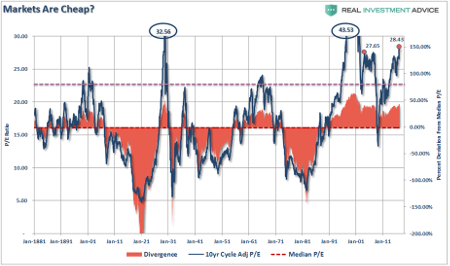

It is often stated that valuations are still cheap. The chart below shows Dr. Robert Shiller's cyclically adjusted price/earnings (PE) ratio. The shaded area is the current deviation of PEs above or below their long-term median PE.

Currently, valuations are pushing levels only witnessed in 1928-1929 and 2000. However, it is often suggested the current valuations are nowhere near the "dot.com" level so obviously stocks are just mildly overpriced. The problem is current valuations only appear cheap when compared to the peak in 2000.

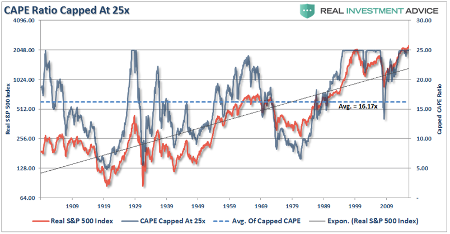

In order to put valuations into perspective, I have capped PEs at 25x trailing earnings as this has been the level where secular bull markets have previously ended. I have noted the peak valuations in periods that have exceeded that level.

With valuations at levels that have historically been coincident with the end, rather than the beginning, of bull markets, the expectation of future returns should be adjusted lower. This expectation is supported in the chart below, which compares valuations to forward 10-year market returns.

The function of math is pretty simple - the more you pay, the less you get.

To read the rest of Lance's article, click here.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In.