How to pick the right Absolute Return fund for you

16th January 2017 16:41

by Rob Griffin from interactive investor

Share on

It's no surprise that the Investment Association's (IA's) Targeted Absolute Return fund sector has become so popular with investors. With the global economy so unpredictable, it's natural to be drawn to funds that aim to deliver positive returns in any market condition.

More than £5 billion has been ploughed into this sector over the past year, according to an analysis of data compiled by the IA, which represents the fund management industry.

As a result, it has been the best-selling sector in the past four quarters and eight of the past 12 months.

Justin Modray, founder of Candid Financial Advice, attributes the increased enthusiasm for the sector to volatile stock market conditions over the past year, but warns that they don't provide a guaranteed route to riches.

Although these funds aim to make money in any market conditions, returns are not actually guaranteed"It's not surprising investors have flocked to the perceived safety of the IA Targeted Return sector - but, given the patchy track record of funds in this sector, it remains to be seen whether this is a wise move," he says.

A key problem is that although funds in this area all aim to make money in any market conditions, these returns are not actually guaranteed - and the success they've had in hitting this target has varied enormously.

"Picking funds in this sector is incredibly tough because none can be relied upon to consistently deliver what's on the tin," says Mr Modray.

"Some funds are so cautious they struggle to deliver better than cash returns, while others are very aggressive and far more volatile than you would expect for this sector."

Assets and strategies

Targeted absolute return funds embrace a variety of assets and investment strategies.

The strategies used range from fairly straightforward long/short approaches, where managers take 'long' positions in shares that are expected to appreciate and 'short' positions in those predicted to decline, to more complex investment strategies.

The differences mean it's virtually impossible to carry out a detailed like-for-like analysis of funds due to widespread confusion over their aims and approaches, especially as they all have different names, risk parameters, and investment time horizons.

It is a point acknowledged by the Investment Association (IA) - its sector guidelines insist funds state the timeframe over which they aim to meet their objectives, although this period must not be longer than three years.

Examine funds' targets, benchmarks and timescales to see which match your objectivesIn addition, the IA provides a monthly breakdown that shows how many times each fund has failed to deliver returns greater than zero after charges for rolling 12-month periods - and in some cases this makes for alarming reading.

The most recent statistics show the worst performers have failed to achieve this goal a staggering 22 times out of the past 24 periods. In fact, only three out of the 78 funds that can be analysed over the maximum timeframe have always hit this target.

Of course, not all of these funds are looking to achieve positive returns over one year, so prospective investors need to examine the targets, benchmarks and timescales for funds to see which best match their objectives.

They must also understand a particular fund's goal, the assets in which it invests, and the charges that are applied. It is also important to establish whether they will have to pay performance fees for returns above a certain level.

Research required

Adrian Lowcock, investment director at Architas, suggests some funds in this sector can appeal to less adventurous investors, pointing out that capital preservation and diversification are among their strongest attributes.

"They are very useful for investors looking to protect capital from volatile markets as they effectively offset some potential gain by taking a more cautious defensive approach," he says. However, the mixed nature of the sector makes it difficult for investors to draw any meaningful conclusions.

This is illustrated by Morningstar data that reveals that the best performing portfolios over the year to 15 December 2016 returned an impressive 25%, while the worst were actually down by a similar amount.

Look for consistent funds that do particularly well when equity markets are fallingThere is a similar disparity over longer timeframes. Over the three years to 15 December 2016, the stand-out performers enjoyed double digit returns - the highest being 36% - while a significant number lost money over the same period.

However, Mr Lowcock advises against basing a decision on performance figures alone. Just because a portfolio has had a stellar period is no guarantee that it will be automatically repeated, so a degree of research is required.

"Some funds will have very specific strategies, which means they might win big one year, but not do so again for a while," he explains. "Look for funds that have consistent performance and do particularly well when equity markets are falling."

Mr Modray agrees. "All you can do is look for a manager who takes a common sense approach, has reasonable charges and appears to have weathered storms better than most in the past, but even this is no guarantee of future success," he adds.

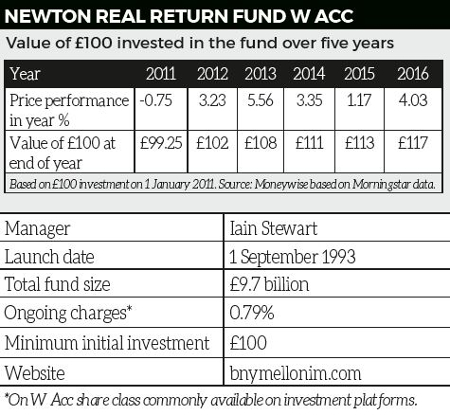

Fund to watch: Newton Real Return

The aims to deliver a minimum return of what you would get from holding the money in cash plus an additional 4% over five years, before fees, from a portfolio of mainly UK and international securities.

For the cash benchmark, it uses the one-month sterling LIBOR rate, the interest rate at which a panel of selected banks borrow funds from one another in sterling with a maturity of one month. It also aims to achieve a positive return on a rolling three-year basis.

Iain Stewart, its experienced manager, adopts an absolute-return style, while also looking to preserve capital through security selection, diversification and hedging strategies.

The fund, which takes a global multi-asset approach, has the flexibility to invest in conventional and alternative assets.

Stewart's fund focuses on a stable core of predominantly traditional return-seeking assets with a capacity to generate capital and income, alongside an insulating layer of stabilising assets that are used to hedge risks and dampen volatility.

Return-seeking assets include 44% in equities - with the highest exposure to health care, consumer services and utilities - plus investments in corporate bonds, infrastructure funds and renewable energy.

The stabilising side accounts for 49% of assets under management, with around 28% in government bonds and 12% in precious metals, plus cash and index-linked positions.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.