After the Trump rally, all the risk is on the downside

19th January 2017 10:57

by Ceri Jones from interactive investor

Share on

It's a shame to be pessimistic so early in the New Year, but the many headwinds to growth that existed in the US, and indeed the rest of the world, before the presidential election last November remain in place.

For months now, investors have been all too happy to go with the flow and ignore doubts about the health of the US economy.

The market seems to believe that the president-elect's plans to stimulate the economy by reducing corporate taxation and rolling back regulation will lead to higher growth; but corporate profits, employment and bank lending are all mired in late-cycle conditions which, together with record debt-to-GDP ratios, will cut short the honeymoon.

Not the Reagan economy

The Dow Jones Industrial Average index has been pushing up against the 20,000 milestone, yet by almost every metric the market is expensive - price/earnings (PE) multiples are only just shy of 2000 and 1929 levels.

You could argue that a market does not necessarily require real earnings growth to keep rising, and that it is defying gravity because companies are retaining capital to pay for dividends and share buybacks, and that there is a dearth of attractive investment options.

Trump's tenure requires optimism that the Fed will tighten monetary supply only graduallyBut even if we ignore these astronomical valuations, the best we can hope for is that Trump's quest for growth will push him into a U-turn on the protectionist measures promised during his campaign.

It's certainly hard to imagine anything happening in the first few weeks of the new administration that could help lift the markets further - all the risk is on the downside.

Unfortunately, the many comparisons that have been made of the Trump and Reagan administrations do not stack up either. The economy under Reagan enjoyed low debt, high inflation and a supportive Fed that cut rates by 1,000 basis points between 1981 and 1983.

Trump's tenure is pointed in the opposite direction, and requires optimism that the Federal Reserve will continue to tighten monetary supply only gradually.

On an EV/EBITDA basis, the US market has only been this expensive during the tech bubbleIf you reference Japan, for example, any attempt to stimulate the economy through large-scale deficits looks doomed to failure.

Many commentators have been recommending investors switch into US high yield, but the reality is that corporate indebtedness has been rising.

If you look at a company's enterprise value, which includes both its net debt and its market capitalisation, and compare it to its earnings using earnings before interest, tax, depreciation and amortisation (EV/EBITDA), the US stock market has only been this expensive during the tech bubble.

Murky waters

Brave investors might try the relatively new (exchange traded fund) which tracks the top 100 stocks based on average projected free cash flows and earnings over two years, holding quality companies such as , and .

If the US market is difficult to predict, the UK picture is positively murky. Markets have shrugged off Brexit, but that's because so far nothing much has changed - a situation that cannot last.

EM look ripe, but investors must be selective thanks to Trump's protectionist promisesMeanwhile unsecured consumer credit in the UK has grown to £192.2 billion, just short of 2008's pre-crisis levels, and retailers such as have reported dire Christmas trading.

Europe is also braced, with all eyes on the French election on 23 April. A surprise victory for Marine Le Pen, leader of the far-right National Front, could herald the collapse of the EU, although she recently recognised the risks of withdrawing from the single currency even if Frexit takes place.

Some of the best opportunities must surely be emerging economies, which have bucked the trend in showing real growth in recent months.

Investors will have to be highly selective, however, as Trump has promised increased protectionism, which will impact global capital flows, and his diplomatic policy toward China is a concern.

A strong dollar also makes it harder for developing countries and companies to service hard currency debts, and weakens prices for commodity exports.

Protection against higher inflation

One step investors can take is to protect their portfolios against surging inflation, as for example in the US the labour market is strengthening and in Britain the effects of the weak pound are feeding through.

As well as holding gold or other commodities, there are inflation-linked bond ETFs such as Lyxor FTSE Actuaries UK Inflation-linked Gilts ETF, with a total expense ratio (TER) of 0.07%.

For protection against US inflation there is the , which provides exposure to US Treasury Inflation-Protected Securities (TIPs), with a TER of 0.09%. It is available to trade in US dollars and sterling.

You can also hedge against inflation by buying wind and solar opportunities, which benefit from rising power prices. Investment trusts are best suited to infrastructure, for example , which focuses on operational assets and has a proven management team.

Ant Gilham, fund manager for Old Mutual Global Investors, suggests buying Australian bonds, which offer an extra 40 basis points over US bonds, and also provide some hedging against a Chinese slowdown on the basis that Australian bond prices will rise if Chinese demand for Australian iron ore slumps.

Pundits are predicting that gold has already peaked, but not, of course, if a crash occursChina, Gilham says, is still a command-controlled economy targeting a level of growth - although that target has come down a long way, to 6% from 15%.

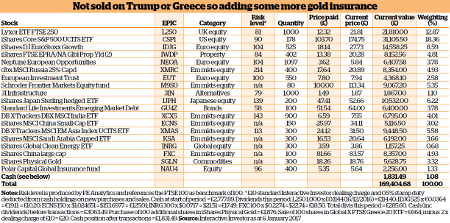

Our portfolio is already 'underweight' US and UK equities, at 18% and 13% respectively, so we are not taking action on those fronts.

Moreover, the FTSE 250, which we track for our UK exposure, is not really a mid-cap play but invests heavily in UK investment trusts that are focused on global equities.

We will, however, liquidate the , as the Greek crisis could return. The proceeds will be used to bolster our gold holding. Pundits have been predicting that gold has already peaked, but not, of course, should a crash occur.

This article was originally published in our sister magazine Money Observer. Click here to subscribe.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.