Insider: Heavy trading by AIM chiefs

20th January 2017 12:57

by Lee Wild from interactive investor

Share on

Bosses show love of Nature

AIM-listed has given investors little to get excited about in recent years. Its shares, worth 100p less than six years ago, had meandered lower to less than 4p last year.

However, shares in the £11 million company, which treats waste at shipping ports and offshore, almost tripled in value just before Christmas after it won a five-year contract with an oil major worth "at least" £5 million.

"Having broadened our sales focus from rig owners to include IOCs [international oil companies], we are very pleased to be awarded this contract by one of the major operators in the North Sea," said chief executive Jan Vesseur.

Less than a month later, Vesseur and his management team bought over 2.3 million shares worth not far off £300,000 in total. For all but Vesseur, who bought 626,400 shares at 12.5p, these were maiden purchases.

Finance chief Maarten Smits and head of the oil & gas business Gert-Jan Davidzon each bought 696,000 shares at 12.5p. Chairman Berend van Straten bought a total of 274,000 in two tranches at 11.75p and 12.5p, while head of maritime Rene van der Wolf spent some pocket money on 41,760 shares.

Numis founder rolling in it

Broker and corporate advisor reported a strong 12 months back in December. It grew revenue by 15% to a record £112 million, driving pre-tax profit up by a quarter to £32.5 million. Shareholders will receive a record dividend, too, giving a prospective yield of nudging 5%.

Obviously, a significant uptick in trading volumes after Brexit helped, but Oliver Hemsley, founder and chief executive of the AIM-listed firm until August last year, can take a lot of credit. He's stayed on to develop client relationships and identify business opportunities.

However, after rallying 16% since late November to a 13-month high, Hemsley has decided to offload a stake in the number-one-ranked UK small- and mid-cap brokerage firm.

On Tuesday, Hemsley sold 2.36 million Numis shares, or 2.1% of the business, at 244p. That netted the son of a Rutland pig farmer almost £5.8 million. After the sale, he still owned 7 million shares with a current market value of £18 million.

However, as luck would have it, two days later he received 16,706 shares worth £43,000 after one of the broker's bonus schemes vested. Well, they say "money comes to money".

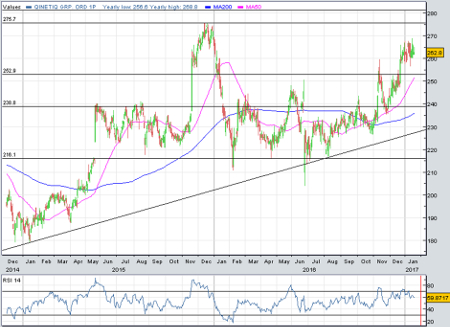

Qinetiq man stockpiles shares

Two months ago, high-tech defence contractor reported slightly better than expected half-year results, and was confident enough to repeat guidance for the full-year. A couple of weeks later it won a £1 billion contract amendment from the UK Ministry of Defence, then paid £57.5 million for unmanned aerial, naval and land-based target systems business.

Now, Qinetiq shares are trading at a 12-month high, and ahead of new finance director David Smith's first day in the office on 1 March, non-executive director Paul Murray is still snapping up stock.

On Monday, Murray spent almost £50,000 on 18,865 Qinetiq shares at an average price of 263.6p. They haven't been this high since the start of 2016.

And Murray, on the Qinetiq board for over six years and a non-exec at since September 2013, might be onto something. Analysts at Berenberg certainly this so.

Earlier this month, the broker upgraded the shares from 'sell' to 'hold' with price target of 275p. True, the implied upside is modest, but chief executive Steve Wadey's growth strategy is having some success and concerns about margin contraction in its core markets may have been overdone.

It has a strong balance sheet, too, despite the recent acquisition, although it does trade on almost 17 times forward earnings, a 10-15% premium to peers.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.