Royal Bank of Scotland price target upgrade

24th January 2017 17:14

by Lee Wild from interactive investor

Share on

In one month’s time, publishes full-year results, which should be accompanied by a new strategic plan, predicts UBS analyst Jason Napier. But while he admits he can see why volume of investor enquires on this stock has increased recently - and he has pumped up his price target - a ratings upgrade, it seems, will have to wait.

“Bulls expect an expanded restructuring programme to improve efficiency in a lower-for-longer environment, leading to significant [earnings per share] upgrades,” said Napier Tuesday. “Bears worry about the restructuring cost capital drags of subjecting RBS to another round of reengineering.

“They also, rightly, point to the bank's already-high PE ratios: is a new plan already in the price?”

Well, EPS estimates rise by 15% for 2016 and 2017 to 19.8p and 18.7p respectively. They’re hiked by 16% for 2018 to 17.1p before taking off to 20p a year a later. Upgrades are driven by higher assumed revenue at the corporate and institutional banking (CIB) business, plus loan losses which will take longer to normalise given continued strength in the UK economy.

Napier talks of clear “upside risk” to management's £1.4 billion CIB revenue target if fourth-quarter numbers from US peers are anything to go by.

For February’s fourth-quarter results, UBS forecasts adjusted income of £3.08 billion, up 7% year-on-year, a 5% increase in adjusted pre-tax profit to £724 million, and Common Equity Tier 1 (CET1) ratio of 15.1%.

But RBS’s new plan must include a new income outlook, detail on cost cutting and on further non-core run-off (winding down of non-core assets over time).

“We think recently higher UK swap rates reduce the income pressure from hedge decay,” adds UBS. “We expect an enlarged restructuring budget to bring the bank closer to its existing long run 50% cost/income ambition. And we await more colour on run-off assets in commercial banking. Meanwhile, [Deutsche Bank's] and [Credit Suisse’s] RMBS settlements with the DoJ bring RBS closer to the front of the queue.”

However, there’s little pattern in the US authority’s treatment of the sub-prime mortgage miscreants, and Napier is not confident that the £4.6 billion of excess capital RBS had in the third quarter will be sufficient to settle its potential bill.

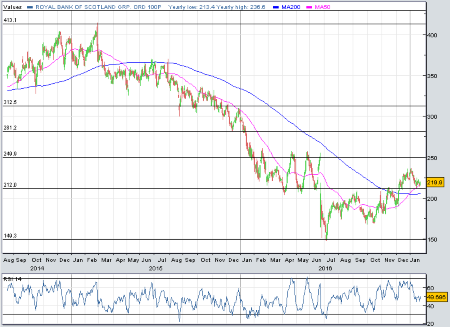

Factoring in a better UK macro outlook in 2017, higher CIB revenue, a delayed sale of Williams & Glyn, and higher litigation costs, there’s no reason for UBS to improve on its current share rating, although its price target ticks up 20p to 230p on those EPS upgrades.

“With limited capital upside, no near-term dividend, a significant share overhang and uncertainty around excess capital, we remain ‘neutral’,” concludes Napier.

That said, he adds that if CIB generates £1.4 billion in revenue and £750 million in costs, while legacy settlement costs are £2 billion lower than forecast, RBS shares could be worth as much as 260p, one day.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.