Dogs of the Footsie jumps 43%

28th February 2017 10:17

by Heather Connon from interactive investor

Share on

Our Dogs mined a rich seam in 2016, as a stellar performance from resources companies helped them achieve one of the best results in the portfolio's history.

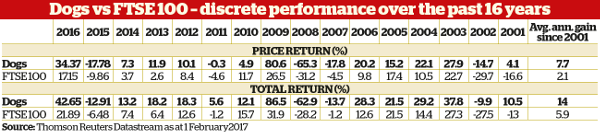

Our Dogs of the Footsie portfolio produced a return of 34.37% based on share price performance alone, and 42.65% when dividends are included - around twice that achieved by the FTSE 100 index.

That means our Dogs have also regained their dominance over the index over the medium and longer term; they are ahead over three, five and 10 years, as well as over the 16 years that our sister publication Money Observer has been compiling the portfolio.

We will introduce the 10 companies that comprise the Dogs of the Footsie 2017 later this week.

How the Dogs of the Footsie works

Anyone who has followed our Dogs strategy for the past 10 years would have more than doubled their money when dividends are included, and made a 50% return even if all the income had been spent.

That is comfortably ahead of the FTSE 100, which has returned 20% in share price terms over the period and almost 60% on a total return basis.

The Dogs have beaten the index in 12 of the 16 years the portfolio has been running - a 75% success rate - and in one of the other four years it was also ahead in total return terms.

The average annual return including dividends over the period has been a healthy 14%, compared with 5.9% for the index.

The Dogs in question are the unloved companies in the FTSE 100 index, as measured by their dividend yield. Each year, we assemble a portfolio of the 10 blue chips with the highest yield and hold them for a year.

The theory behind the portfolio is straightforward: a high yield indicates a depressed share price, which in turn often means that the sector or the company - or both - are out of favour with investors.

That can push shares down to significantly undervalued levels, and the bounce when sentiment turns may bring very healthy returns. That was certainly the case for the two mining companies in the 2016 portfolio: and .

This time last year, the economic slowdown across the globe, and in China in particular, had combined with over-capacity in many basic materials to push prices sharply lower, slashing the profits of resources companies and putting their balance sheets and dividends under pressure - indeed, both of these companies did cut their dividends last year.

A year on, and the outlook is far less gloomy.

The prices of oil and other basic materials are stable at worst; the new US president is promising an infrastructure spending boom, which should boost demand for these companies' products; and they have cut costs and restructured their businesses.

Recovering share prices

Investors have rediscovered their attractions and their shares have recovered sharply - these two companies were by far the best performers in the portfolio, more than doubling investors' money over the year as measured by both share price and total return.

That demonstrates a key feature of the Dogs portfolio: a high yield can indicate the market's expectation that the dividend will be cut - as was the case with , and as well as the two mining groups.

But, as the performance of the two miners demonstrates, a dividend cut need not be a disaster for the share price: indeed, investors often welcome the fact that the management has faced up to reality, and will mark the shares up, not down, on a reduced dividend.

By choosing 10 companies we aim to give the Dogs portfolio the comfort of diversification. That worked last year: the performance of the companies in the portfolio varied sharply, as is often the case, but the overall result was positive.

While all but Pearson, the media and education group - which shocked the market with a profits warning in January - managed to gain ground over the year, only half of them did better than the index.

But the exceptional performances of the five that beat the FTSE 100 more than compensated for the laggards.

The Dogs also have the benefit of size: while a high yield on a small company may indicate imminent financial collapse, it is extremely rare for a FTSE 100 company to collapse quite that dramatically.

Although they can go very wrong - as the dismal record of the banks in the wake of the financial crisis shows - the company will generally endure, even if its dividend payment does not.

One of the key attractions of the Dogs strategy is that it is easy to follow. There is no need to calculate complicated ratios or conduct complex analysis of the company's prospects, balance sheet or cash flow.

The only thing that is needed is a rank of the FTSE 100 members by dividend yield - something which you can do using the screening or ranking tools available on Interactive Investor.

Exclude dividend cutters

Any companies that have formally announced that their dividends will be cut should be excluded from the list; but if a cut is simply predicted by analysts, the company can still be included in the portfolio.

For the 2017 portfolio, we excluded Pearson as it has announced a dividend cut, and after much deliberation , as it employs a formula of distributing half its earnings as dividends; given that these will be lower this year due to factors such as exchange rates and terrorism, its dividend will also be reduced.

You must buy all 10 companies and should not exclude a company because you dislike its business or are worried about its prospects - quite apart from the fact that you may well be wrong in your estimation of the company, the strategy is necessarily formulaic rather than judgemental.

The Dogs strategy originated in the US where for years it was highly popular - and profitable. In recent years, however, its record there has been more mixed.

That may be because the Dow is a narrow index, with just 30 companies that rarely change, while our own Footsie has 100 companies with quarterly changes based purely on market value.

In most Dog portfolio years, the outlook for dividends has been uncertain, and this coming year is no exception. The unexpected dividend cut from Pearson was a clear warning that income is never guaranteed.

Dividend cover is an important metric for investors. This measure compares a company's earnings per share with its dividend: a ratio of 2 and above (meaning the dividend is covered twice by earnings) is deemed relatively safe; anything below 1.5 could mean there is a risk of a cut.

Many of our 2017 Dog components do have relatively thin dividend cover, including the oil majors and and utility . But the same has been true of Dog constituents in the past, yet the strategy has still done well.

It is, of course, not without its risks, but our dogs have proved their pedigree over the last 16 years and we hope 2017 will be no exception.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.