Brainjuicer shares have tripled, and could keep going

3rd March 2017 10:21

by Richard Beddard from interactive investor

Share on

Rather than dwell on results for the year to December 2016, which included a return to double-digit revenue and profit, strong cash flows as usual, and record returns on capital, my attention is on what's driving profitability and growth, and what might get in the way.

That's because BrainJuicer's share price has grown even faster than the company in the last year. Its enterprise value now stands at £90 million, about 17 times adjusted profit in 2017. The earnings yield is 6%.

These are not bargain levels, and unless BrainJuicer continues growing and the return on an investment at the current price improves over time, there are probably better investments out there.

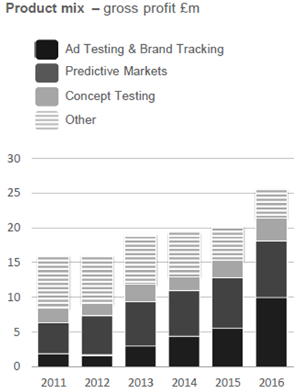

This chart from a presentation on BrainJuicer's website shows how the market researcher has changed over the last five years:

Next is Predictive Markets, BrainJuicer's single biggest product, which grew by 12% and brought in 32% of revenue in 2016, and Concept Testing.

Perched on top is the rapidly shrinking 'other' category, once the largest, which encompasses more traditional market research services. Until 2016, this contraction was masking the rapid growth in BrainJuicer's products, but it's shrunk so much now, the rest of the business can shine.

While Predictive Markets remain BrainJuicer's biggest product, Ad Testing and Brand Tracking are growing much faster. New products and new concepts only need testing when there are new products and concepts to test, and companies typically test them using a number of techniques from a variety of agencies.

Once a brand has decided on an agency to test its advertisements on the other hand, it usually gives a mandate for a year, and more often than not renews it subsequently. The business is less ad-hoc, which perhaps explains the emphasis BrainJuicer puts on its fastest growing segment.

Butterflies

It's tempting to talk of butterflies emerging from chrysalises at this point, and to an extent, I think that's what's happened.

BrainJuicer pioneered the use of behavioural science in market research for more than a decade. The central idea is that humans are primarily emotional, not rational decision makers. Hitherto, market research had tested whether an advertisement, say, persuades us a product would be a wise purchase.

Evidence that it works comes not just from BrainJuicer's profitable growth, it comes from advertisements like John Lewis' at Christmas. These ads, the most recent of which featured a trampolining boxer dog, a kindly old man on the moon, and a penguin that became almost as famous as the brand it represented, tell us nothing about the benefits of shopping at the department store. They just make us feel good.

There's a pretty compelling case for investing in BrainJuicer in its ability to spawn better predictions

For the last five years, BrainJuicer has been doing John Lewis' ad testing, helping the company decide which adverts to go with.

The Predictive Markets product is based on another insight from behavioural science, that we are better at predicting other people's behaviour than our own.

Instead of asking market research panel members what they think of a product or concept, BrainJuicer asks them whether they would buy shares in it, the idea being that the value of those shares would ultimately be determined by what all the buyers and sellers in the market think.

FaceTrace, the method BrainJuicer uses to test advertisements, gets people to reveal which of seven universal emotions they feel as they watch an advertisement. The emotions are happiness, sadness, contempt, surprise, anger, disgust, fear and neutrality. Panelists, the subjects of the market research, choose the emotion they feel by picking from a menu of faces with expressions of varying severity, allowing BrainJuicer to plot their feelings as an advertisement progresses.

As well as recording how people's emotions change during the advertisement, BrainJuicer also asks panelists the overall emotion they remember after the advertisement finishes.

The results are compared with thousands of results from previous tests to predict how the product, concept, advertisement or brand will fare in the market. BrainJuicer's advantage lies, not just in its proprietary methods, but also the sheer volume of tests it has already done. For Predictive Markets, it claims to have performed 40,000 tests over 11 years.

Even though the big market research agencies are piling on the behavioural science with varying degrees of commitment and skill, I think there's a pretty compelling case for investing in BrainJuicer right there in the ability of its database to spawn better predictions.

Haunting

One thing has been haunting me over the last six months, though: Affectiva, or at least what Affectiva stands for.

Advertisements for Affectiva have been haunting me quite literally, ever since I started following BrainJuicer on Twitter (I've stopped now!). Affectiva automates the kind of facial recognition used in FaceTrace by using cameras to record people's expressions and computers to recognise them. Could BrainJuicer, the disrupter, be disrupted by technology?

Affectiva is one of a number of companies including Microsoft using automated facial coding for market research, which is a small part of a broader technological onslaught on market research.

Judging by a webinar produced by BrainJuicer, it's not at all clear that automated facial coding will ever be better. For a start, it's actually more difficult. It requires more kit, often in laboratory conditions. Secondly it isn't doing the same thing.

Instead of asking people what they feel, it's reading those feelings from their expressions. While computers can effectively read a smiling face, accurately recording the most useful emotion, happiness, they're less reliable at interpreting negative expressions and hopeless at detecting contempt, apparently the most common negative emotion in response to marketing.

BrainJuicer is still incubating caterpillars that could one day turn into butterflies

And, while it's possible to model the enduring emotions people remember from the transitory emotions they feel as they watch an advertisement, it's not as predictive as asking them outright. For a small sample of advertisements BrainJuicer's techniques come out on top, although the machines beat traditional market research techniques.

While a marketing webinar is not the most unbiased of information sources, it seems quite plausible to me that the best way to find out how people feel about something, is to ask them*.

The good news is BrainJuicer is still innovating, and the company is still a disruptor. The company's new loss-making System1 agency is putting ad. testing at the heart of the creative process. It farms out creative briefs to a minimum of three freelancers whose advertisements are tested by BrainJuicer to ensure they meet a minimum quality standard before they reach the client. Kearon says it should be a low cost alternative to the traditional creative process.

As an industry outsider, I don't know whether the System1 agency will work or fade quietly into the night, but it shows BrainJuicer is still incubating caterpillars that could one day turn into butterflies.**

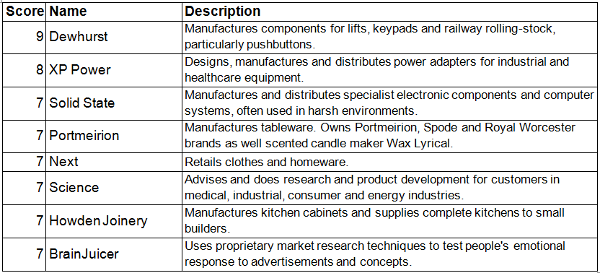

Despite reservations about the valuation and the sheer pace of change in market research, BrainJuicer scores 7/10 according to my Decision Engine algorithm***, which is just about enough to recommend it.

The accounting is clear, and I believe I understand how BrainJuicer makes money. Its record of profitability and cashflow is excellent. The current board has largely been responsible for BrainJuicer's success to date, and John Kearon, the company's entrepreneurial founder and chief executive, still owns 27% of the shares. He has a good incentive to continue to grow the business for the long-term although I am uneasy about a proposed new incentive plan.

My verdict does not mean the share price will go up (or won't go down) in the immediate future. It means BrainJuicer is well set to meet the challenges ahead, of which there will be many. It's (still) the kind of company I like to invest in for the long-term.

---

*Scientists are using brain scans to detect emotions too, but the cost of Magnetic Resonance Imaging, prohibits its use on an industrial scale.

**Oh no! I promised myself I wouldn't push that analogy to its limits.

***I'm rebuilding the Decision Engine. Here are the eight companies that currently score seven or more:

---

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.