Where we are investing our ISA allowances

14th March 2017 08:57

by Faith Glasgow from interactive investor

Share on

It's always interesting to know what journalists who write about investing plan to do with their own cash, so we asked a cross-section of colleagues and freelancers at our sister publication Money Observer how they intend to allocate this year's ISA allowance.

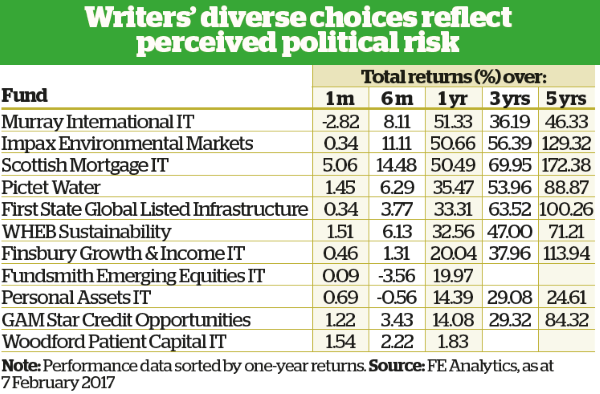

There's plenty of food for thought in the responses we've rounded up: our contributors' choices are remarkably diverse, underlining the difficulties even well-informed investors face in the current climate.

Sleuth eats his own cooking

My long-term investments are in my self-invested personal pension (SIPP) rather than an ISA. Hypothetically speaking though, I'd make the same decisions in either tax-efficient wrapper.

Since I eat my own cooking, this year I've bought shares in , and , as I have in the Share Sleuth portfolio. I like these strong, well-managed businesses currently trading at attractive valuations. I also favour , and .

I focus on UK-quoted companies, so I outsource the management of part of my SIPP to fund managers whose expertise extends to markets I cannot reach. If had spare cash, I'd consider adding to holdings in and .

Both have languished since their relatively recent launches, which allows investors to buy the skills of good fund managers with long-term approaches in exotic markets at close to net asset value (NAV).

Richard Beddard

High-conviction global pick

It's a challenging time for investors, given the uncertainties over the UK's divorce negotiations with the EU and whether or not the campaign trail version of Donald Trump will change his tune in the presidential hot seat.

I had been tempted to take advantage of some of the wide discounts on offer, but given the backdrop I have decided to boost my exposure to , a global growth trust.

The trust, managed by James Anderson, takes a high-conviction approach, but the portfolio is well enough diversified to perform well in the choppier market conditions I anticipate in the second half of 2017.

I picked up shares on a small discount last year, and I will look to take advantage of market corrections between now and the tax year end to top up my exposure.

Kyle Caldwell

Sold on sustainability

I am thinking of using my ISA allowance to invest in two funds that focus on sustainable investing: which has a strong focus on companies involved in health and resource efficiency, and , with a bias to water management and sustainable energy.

I generally believe in taking a global view on investing, and most sustainability funds are fairly international in outlook. After all, many innovations in the renewables space are driven by companies in North America and Asia.

In times of resurgent populism, investors in sustainable businesses are able to balance various national risks against each other, while trying to mitigate the global risks that concern us all by investing in companies that help us progress towards resource- and energy-efficient economies.

Wheb Sustainability returned 31% over one year, and Impax Environmental Markets returned a meaty 52%.

Marina Gerner

Sound choice for drip-feeding

After far too long, I have finally got around to setting up a regular contribution into my ISA account, so I am perhaps less concerned than lump-sum investors about the murky geopolitical backdrop to this year's ISA season.

Bearing in mind the predominantly global trusts I already own, I've split my allocation between a core UK equity income trust, , and an attractive thematic niche investment, .

The Finsbury trust, run by Nick Train, comprises a concentrated portfolio of around 30 high-quality, mainly UK companies; value may be the investment style du jour, but I'm quite happy to have a quality bias, given the Brexit uncertainties ahead.

Pictet Water is a broad-based fund that focuses on companies worldwide involved in improving, controlling or monitoring water supplies. It has had a bumper 12 months, and in light of the pressing need to improve global water management, I expect it to continue to produce long-term rewards.

Faith Glasgow

Stout stronghold looks solid

I am opting for an investment trust with a global remit, as that gives its manager maximum scope to adjust regional and sectoral weightings in response to what could prove a rapidly changing scenario in 2017.

gets the nod, because it has achieved outstanding 10-year returns under manager Bruce Stout and offers a 4.1% yield, paid quarterly.

The trust's high-conviction equity portfolio is defensively positioned, while its borrowings are invested in overseas bonds.

The UK and US account for just 13 and 17% respectively of Murray's portfolio, because Stout finds better value and long-term growth prospects in the Far East ex Japan, Latin America and emerging markets, which together account for 50%.

This bias undermined returns in 2015, but the trust came good in 2016. Continental Europe and Japan account for 14 and 5% respectively. Share buybacks and new issuance are tactically deployed to keep the share price close to NAV.

Fiona Hamilton

Banking on bond yields

I normally prefer individual stocks to funds, as predicting fund manager performance is even more at the mercy of unknowable factors than is examining the rationale and numbers behind a business.

But I fear the risks in UK and US equities are currently all on the downside, mostly because valuations imply unrealistic earnings expectations, but also because the political outlook is very uncertain.

I therefore quite like , steered by the experienced manager Anthony Smouha, which invests for income in the bonds of high-quality companies, but typically in 'junior' or 'subordinate' debt where it may be possible to achieve higher yield but with the same risk level as senior debt. The fund affords some useful protection against rising inflation.

GAM's relatively small presence, as bond managers go, should allow it to pick up issues too small to be purchased by its competitors.

Having said that, three of its four biggest holdings are in , l and - solid insurance companies that have not been caught up in the financial bubble and whose stocks I am quite comfortable owning.

Ceri Jones

Tackling the Brexit blues

I generally like to open my ISA as early as possible in the tax year to get the maximum benefit. However, when the current tax year started, we were in the run up to the EU referendum and things were looking uncertain, so I decided to hold fire until after the vote.

I opened my ISA a few days later. I was, and still am, pessimistic about the impact of Brexit on the UK economy, so I decided to opt for a global equity fund.

Feeling depressed, I decided also I wanted something relatively conservative, so I put my money in the reasonably safe hands of Terry Smith, choosing his global blue chip equity fund, .

However, for next tax year's ISA I have already decided I want something more exciting. I am planning to invest in , an investment trust that invests in private equity funds. It has a strong track record and is on a good discount to NAV.

Helen Pridham

Global pharma contrarian play

The UK markets have fixated on Brexit for the past seven months. In the US, Donald Trump's victory has provided a similar focus of attention. This makes it more difficult than usual to judge what the principal investment themes will be this year.

Global pharma was one of the worst-performing sectors last year. This year, on the downside, Trump has promised to negotiate aggressively on the prices pharma firms charge, while in the UK there are large downside risks for pharma companies from the potential fallout from a hard Brexit.

There are, nevertheless, attractive upside considerations, not least the many and varied scientific leaps forward taking place in the global pharma sector that could usher in a golden age of medicine.

Given last year's poor performance and what appears to be more fear than greed being displayed by the investment community, this year I will target my investment strategy on the global pharma sector. It could be one of the more significant non-consensus winners in 2017.

Rebecca O'Keeffe, Interactive Investor investment director

Sturdy defence, strong keeper

As an investor I'd like to think I'm optimistic about the long term. Otherwise, why would I invest at all?

But given the unpredictable global and domestic political situations, I'm feeling quite pessimistic about the immediate future, so I want to reduce the risk in my portfolio. I am therefore going to split my allowance between two defensive funds.

The first is a niche fund that could help me weather 2017's potentially stormy markets, . Infrastructure is perceived by many to be a defensive sector, where mature businesses offer steady and reliable income that often has inflationary pricing linked in.

The second choice is a strong 'goalkeeper', in the form of Sebastian Lyon's . This trust aims to protect and increase shareholders' funds over the long term by investing in equities, fixed-income securities, cash and cash equivalents (which may include gold).

Moira O'Neill, Moneywise editor

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.