Investment trusts: The basics and 10 trusts to buy and hold

23rd March 2017 08:56

by Rob Griffin from interactive investor

Share on

Investment trusts have been around for almost 150 years, but they still divide opinion among investors. While those in favour point to an impressive track record of delivering returns, others argue they're not always the cheapest fund options and can be volatile.

However, most agree they possess unique qualities that make them worth considering by anyone investing over the longer term.

What are investment trusts?

They are actually companies that are listed and traded on the London Stock Exchange in the same way as normal shares. In fact, they're also commonly referred to as "investment companies", because their business is investing assets on behalf of their shareholders.

Run by dedicated managers, investors' cash is pooled and put to work across a wide range of areas, including other companies and alternative asset classes.

Their ability to get access to more specialist areas of the market, borrow money to invest and smooth out returns, sets them apart from other investment products.

According to Gavin Haynes, managing director at Whitechurch Securities, their structure means they are easy to understand. "They operate in the same way as an ordinary share," he says. "They also employ an independent board so that shareholders' interests are represented."

The directors on these boards meet several times a year and constantly monitor the investment trust's performance. If it is not up to scratch they can replace the fund manager.

How do they work?

Investment trusts are known as "closed-ended" because there will only ever be a set number of shares available to buy – irrespective of the demand.

Unlike open-ended funds, they can't automatically create and cancel units in response to the amounts being invested. This means the demand for a trust will influence its share price.

When a lot of investors want shares, the share price will exceed the valuation of the underlying assets. This is known as trading at a premium. Conversely, when demand is low the share price will fall below the valuation of the underlying assets. At this point, the trust will be trading at a discount.

For Adrian Lowcock, investment director at Architas, this can be a blessing or a curse. "You run the risk of overpaying but there's also the opportunity of buying them cheaply."

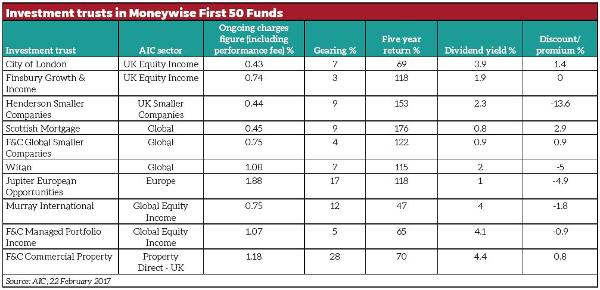

As part of its First 50 Funds for beginners, our sister website Moneywise has selected 10 investment trusts investors could consider buying and stashing away for the long term (see table below, click to enlarge).

What do trusts invest in?

They can put their money into a wide variety of areas and their "closed-ended" structure enables them to invest in more specialist areas. These include less liquid asset classes such as private equity, commercial property and infrastructure that are not easily accessible to other fund types.

This liquidity issue is important. For example, if someone wants their money back from an investment trust they simply sell the shares.

If they are in an open-ended fund, such as a unit trust, the manager may have to sell some of the underlying holdings to redeem units. In areas such as commercial property, this can take some time.

Not having to worry about dealing with lots of redemptions in troubled times enables managers of trusts to take a longer-term view on potential investments.

Other qualities

An interesting feature of trusts is the fact they can engage in gearing, points out Patrick Connolly, a certified financial planner with Chase de Vere.

"They can borrow extra money [gearing] to invest and this gives an added boost to returns if the underlying investments perform well," he explains.

"This is why investment trusts usually outperform similar open-ended investment funds over the long term."

However, the gearing facility isn't a guaranteed route to success. "If the underlying investments perform badly, then investors will have more money exposed to this bad performance and have to pay interest on the money borrowed," he adds.

Another benefit is that trusts can hold back up to 15% of the dividends from the underlying portfolio, says Gavin Haynes, managing director at wealth manager Whitechurch Securities. "This means they can supplement future dividend payments, which can smooth out returns for investors over time," he says.

Popularity of investment trusts

Investment trusts have been around a long time. The first was the that launched back in 1868 – and it's still going strong today. It now boasts £3.5 billion of assets under management and invests in more than 500 companies across 35 countries.

Today there are more than 400 trusts across sectors as diverse as emerging markets and Japanese smaller companies, to infrastructure, financials and environmental.

They're also increasingly available on investment platforms, says Martin Bamford, managing director of financial planners Informed Choice. "Since commission on investment products was abolished at the end of 2012, investment trusts, which don't typically pay fees to advisers, have operated on a more level playing field with unit trusts and open-ended investment companies," he says.

The whole investment trust area is thriving at the moment, agrees Annabel Brodie-Smith, communications director for the Association of Investment Companies. "Assets under management were at an all-time high of £159 billion at the end of January," she says.

Who are they suitable for?

An investment trust is worth considering by anyone wanting to invest over the longer term – and by that we mean at least five to 10 years.

The sheer number of trusts available, each with their own aims and objectives, means there is a good chance of finding at least one to meet your needs.

For example, younger investors seeking to maximise growth may be drawn to a trust that focuses its attention on the emerging markets, which are riskier economies with higher growth potential. Others may want exposure to specialist areas, such as commercial property, as a part of their broader portfolio, while those approaching retirement need a reliable trust that can deliver income.

Bamford suggests investment trusts tend to favour the long-term investor who is looking for exposure to a specific sector or theme. "They often appeal to more experienced investors who take an active interest in the management of the trust and its approach," he says. "Investors should be comfortable with the closed-ended pricing features and any use of gearing within the trust. Like all investments, a trust can fall in value, so investors need to have sufficient capacity for losses before making an investment."

How have they performed?

As with all types of investment, there have been winners and losers. Success depends on a variety of factors, including the skill of the management team at the helm and whether the area in which they invest is in favour.

A look at the performance figures over the past decade illustrates the point with the best performers enjoying double-digit annualised returns – and the worst losing money.

, which aims to grow investors' capital by investing in the worldwide biotechnology industry, has been the standout name over the past 10 years. During this period it generated a cumulative return of 554.6%, according to Morningstar data compiled to 20 February 2017. It means a £100 investment a decade ago would now be worth £654.66.

However, trusts at the other end of the performance tables tell a different story. , which invests in emerging market properties, for example, has made an annualised loss of 10.73% over this period. It means £100 invested a decade ago would have shrunk to £32.14 today.

How much do they cost?

People can buy shares directly from the investment trust company, or from a DIY investment platform or stock broker. If you need advice choosing investments, you should use the help of a professional independent financial adviser.

Costs will be a vital part of the decision making process. In its simplest form, the higher the charges levied, the better your investment needs to perform in order to make you money.

The costs you might incur will depend on how you choose to buy your investment companies – and which one is most suitable will depend on your choice. For example, if you opt to go via a platform or stock broker the charges for their services will vary.

If you hold shares through an individual savings account wrapper there may be fees attached.

Costs have changed in recent years and this is a consideration for potential investors, points out Justin Modray, founder of Candid Financial Advice.

"Investment trusts used to benefit from generally lower charges than unit trusts, but with the abolition of sales commissions prompting cheaper unit trust versions they are broadly similar these days," he says. "In fact, unit trusts are typically cheaper if anything."

Haynes says that although many trusts provide a low-cost route to active management, this isn't always the case. "Some of the more specialist equity trusts can be relatively expensive," he says. "The actively managed trusts have to justify their selection versus cheaper passive or tracker funds if we are to use them in a portfolio."

Making your choice

Deciding which is suitable for you will depend on your aims and objectives, as well as your attitude to risk – but whatever you choose you'll need to do your homework, points out Bamford.

"Investors should look at the history of the investment trust to understand its performance and trading history, including whether current levels of discounts or premiums are typical or unusual," he says.

Brodie-Smith believes there is something for everyone. "We have everything from traditional global investment trusts to more exotic asset classes," she says. "You just need to make sure you're happy with the risk being taken."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.