Why Barclays is worth keeping an eye on

23rd March 2017 09:29

by Alistair Strang from Trends and Targets

Share on

Barclays Bank

We always tend to hold in slightly less contempt than the other two retail banks, simply due to the strength with which it recovered from the shambles back in 2009.

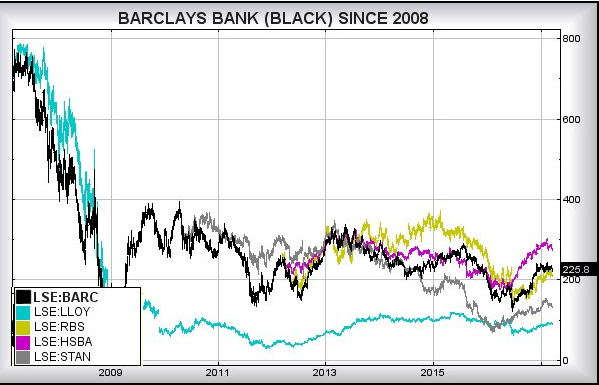

Alas, as history shows, "how little did we know..." For a giggle, we've given two charts below, one showing Barclays in recent times, another with a bunch of overlays featuring other banks' comparative performance since 2009.

One 'amusing' aspect of this exercise comes from (gold line on the chart), as since the market did its 1/10th trick with the share price, movements are proving volatile and useful, whereas - shown in teal - are as boring as heck.

One funny aspect comes from , a share which has more than doubled in price during the last year from its low of 378p. Barclays has almost doubled, RBS gained 70% and Lloyds has gone up a bit.

We've been fascinated with STAN for some time, due to it outperforming other sector members. For now, it has fallen back into line, but next time the share betters 800p we'd suspect it'll be worth close attention.

And so, Barclays remains tarred with the same brush as RBS & Lloyds, though it consistently outperforms each. The magic number for the share to now better is at 254p, something we've written about repeatedly and something the share has failed to attain.

It's fairly critical, as should Barclays manage to close above 254p, it joins STAN in the outperforming club and enters a phase where 323p becomes the next major point of interest in the longer term.

The immediate drop cycle is calculated with a bounce point around 220.75p, this being a fairly key point. The danger with any excuse to move below 220p is of coming weakness in 20p dollops.

The important 'however' is the 'red' uptrend since the Brexit vote manipulation, as this is currently at 219.414p and just a few days from coinciding with our bounce point potential.

As a result, Barclays is probably worth keeping an eye on as usually, when a software projection matches a 'red' line, a bounce is indeed justified.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.