Judges Scientific: A miniaturised Berkshire Hathaway

30th March 2017 17:18

by Richard Beddard from interactive investor

Share on

Today, I'm talking myself into investing in . It would mean investing in another investor, a prospect I don't usually relish.

What does it do?

It doesn't matter.

What do you mean it doesn't matter? You never say that. It always matters!

OK, it doesn't matter much in the usual sense of the question, I'm not as interested in what makes the individual products and services special because that's Judges' job. It buys small businesses that make specialised scientific instruments and then doesn't do very much with them. The idea is to harvest the profit, initially to pay off the debt used to fund the acquisitions.

On the stockmarket, investors are prepared to pay more for the profits and assets of these businesses as part of a larger group than private buyers like Judges are for the individual companies, so the mere act of buying them creates value for Judges' shareholders.

You're thinking of buying shares in a company that's advantage is it might be good at buying other companies? Isn't that incredibly risky?

Acquisitions are often risky, particularly if they are large. Acquirers get over-excited about the prospects of the combined entity and pay too much, overestimating the benefits of the acquisition and underestimating the hassles of combining businesses.

Firms can perform well for a few years, attracting the attention of acquirers, who later learn profits are less enduring than they hoped. Judges, though, focuses on small companies with, it says, sustainable profits and cash flows. Generally, it doesn't integrate them. It remains a gaggle of 13 businesses, a bit like a miniaturised, and very focused, Berkshire Hathaway.

Berkshire Hathaway? You're invoking Warren Buffett? That's a cop-out. No need for further analysis, it's a Buffett stock...

I know. I know. The less said about Buffett the better. I'm just pointing out that he who should not be named, reputedly the world's greatest investor, he doesn't meddle much in the businesses his company acquires. He just lets them get on with it. No doubt there are many differences between Berkshire Hathaway and Judges, though, not least their size and the way they are financed. Another is Judges' circle of competence.

Circle of competence? Another Buffettism. You've been captured in his aura.

I'm going to stop the Buffettisms, I promise. They can mislead not so great investors into getting above themselves. The similarities between me and Buffett start and end with the first letter of our surnames. I know that.

Anyway, circle of competence: Buffett advises investors to stick to their knitting. It's common sense, but Berkshire Hathaway is a diversified conglomerate that has slowly broadened its circle of competence. Judges, though, has a very definite circle of competence, and that may be a good thing... Diversification could be a sign the rich hunting ground of the past is exhausted.

Rich hunting ground? Now you've got my attention...

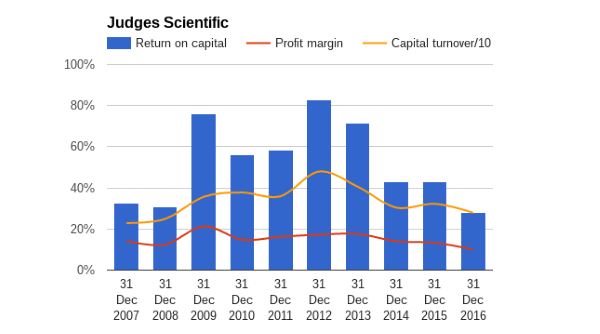

Take a look at this:

I'll be the first to admit, the shape of the curves in the chart are a little disquieting. In its most recent financial year, Judges was less profitable (in terms of return on operating capital) than in any other year in the last decade.

Also, there's a caveat: Return, profit, excludes exceptional items. The major exceptional item, amortisation of intangible assets, would often wipe out most of the profit if I included it, but I'm ok with that. The intangible assets are accounting figments representing customer relationships, products in development and other valuable things Judges acquires. After Judges acquires a firm, it treats new customers, new products in development, and any new intangible assets it creates as expenses. This means that it is simultaneously expensing (writing off or amortising) past investment and expensing current investment.

While that's correct in accounting terms, the practice presents an unduly pessimistic view of profitability because it charges current profits twice.

On average, cash flow is much closer to the adjusted profit figure than it is to the unadjusted one, which gives me confidence.

But, but, but... profitability is highly variable, and falling. That can't be a good sign?

You're right, if the falls are sustained. But look how profitable Judges is. In 2016, its worst year, return on operating capital was 28%. Even if we allow for some benign accounting it looks as though Judges has built a profitable mini-conglomerate.

So you think profitability will start rising again?

Ah, the $64,000 question.

Whether we like it or not, and I don't, when we invest we make judgements about the future. Judges has been capable of higher levels of profitability, so it could well be more profitable in the future. Mostly, it sells instruments to universities around the world, which are largely government funded and therefore scrabbling for cash in austere times. The business climate is erratic too, but Judges believes a global expansion in higher education underwrites its future prospects.

I have my doubts about whether this expansion is sustainable, but my view is parochial and ill-informed. As science and industry strives for greater precision and efficiency, machines that make scientific measurements should remain in demand. Britain has a well-deserved scientific reputation, which probably helps Judges' businesses in their export markets.

Judges earned 85% of its revenue abroad in 2016, and 61% outside of the EU, so perhaps that illustrates my point. In the short term at least it should benefit from the weaker pound, and it reports a strengthening order book.

It would be imprudent to assume profitability will return to the highest levels Judges has achieved in the past. However, I guess profitability is more likely to improve than deteriorate further.

I see where this is going. You're going to add the Shares to the Share Sleuth portfolio* aren't you?

Maybe, my Decision Engine scores Judges 8/10, but that's partly based on the assumption that profitability is at the low-end of what we can expect in future.

I'm sorry to go all Buffett on you again, but if Judges joins the portfolio I'd be venturing outside my circle of competence. My judgements about the future are airy-fairy, and conglomerates make me uncomfortable. They suck me into trying to understand each individual subsidiary, and that's difficult because there are lots, and the parent companies don't usually say much about them.

I want to avoid that, so the investment case must stand or fall on whether Judges is good at identifying small scientific instrument companies and buying them cheaply without actually studying any of those companies in depth!

Well go on then, is Judges a good investor?

It's acquired a very profitable group of businesses, but that doesn't mean it paid a good price for them.

I don't usually include the cost of acquisitions, goodwill and acquired intangible assets, in the return on capital calculation as they're historical costs and I'm interested in whether ongoing operations are profitable. But, since Judges' business model requires it to acquire more companies, it makes sense to check it's earning a good enough return on all the capital it has invested, not just the capital it uses to make machines. In other words, whether it is a good investor.

Reassuringly, Judges calculates this figure. I have checked it, and it is good enough. Before tax, the return on total invested capital was 15% in 2016 and 24% in 2015.

Apart from the numbers, Judges explains its investment strategy well. Once it's agreed initial terms it tries to stick with them rather than bargaining business owners down, which, it says, is enhancing its reputation among potential sellers, of which there are plenty.

Judges estimates there are approximately 2,000 UK precision scientific instrument manufacturers, the vast majority earning revenues under £5 million, and it's open minded about foreign acquisitions.,

Owning businesses is an advantage when it comes to identifying and evaluating candidates for acquisition. Last year, Judges bought CoolLED, a company that makes illumination systems for fluorescence microscopy, partly on the nod of Scientifica, a major customer and another of Judges' subsidiaries.

Judges has been in the game for over a decade now, and its founder and chief executive David Cicurel has skin in it. He owns 15% of the shares. One of my guiding principles, when relying on other investors, is that they eat their own cooking. I'm sure it sharpens the mind.

*See our sister publication Money Observer's Share Sleuth page for more on the portfolio.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.