Turbocharge your ISA with these smaller company investment trusts

30th March 2017 17:57

by Fiona Hamilton from interactive investor

Share on

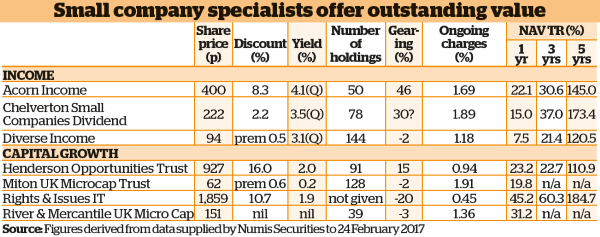

Double-digit discounts in the UK smaller company investment trust sector reflect investors' fears about greater volatility at the less liquid end of the stockmarket, compounded by worries that smaller companies tend to be more domestically oriented than their larger counterparts and will, therefore, be more affected if the UK economy flags as Brexit negotiations progress.

However, statistics from the Association of Investment Companies indicate that smaller company trusts have on average outperformed larger company trusts by a substantial margin over the past five and 10 years in Europe, Asia and the UK.

This is far from a 21st-century phenomenon. Over the past 50 years, the Numis Smaller Companies index, which covers the bottom 10% by market capitalisation of companies quoted on the London Stock Exchange, has outperformed the FTSE All-Share index by a steadily increasing margin, while the Numis 1000 index, which covers the smallest 2%, has pulled even further ahead.

Smaller companies is a vibrant sector

Gervais Williams, managing director at Miton Group, has long been a flag waver for smaller companies.

He attributes their long-term outperformance to "their extra vibrancy", which he expects to be more important than ever now that the credit boom is petering out and, in his opinion, growth prospects are withering, even in the US.

"World growth is a bit stagnant," he says. "There is real anxiety about the lack of capital expenditure, productivity is not improving, there is a lot of political uncertainty and many larger companies seem to be swimming in treacle.

"But smaller companies don't have to worry so much about international problems, and the good ones have been investing hard to improve productivity, which should help them buck the softer economic trend."

Adding to their attractions, Williams says, is the fact that many smaller companies have better dividend cover than more mainstream stocks and have been growing their dividends at a faster pace.

Also the share prices of many of them have yet to fully recover from their post-Brexit setback, so "some outstanding small firms are still on exceptional valuations".

He contends that this is reawakening interest among institutional and private investors, who have ignored smaller companies while there has been easy money to be made in ETFs and index funds focusing on larger, more liquid shares. He believes this 'marks a multi-decade turning point' for the sector.

Rewarding investors

Since 2011 Diverse Income Trust has been the main way to gain exposure to Williams' smaller company expertise. Although it has a multi-cap remit, Diverse Income has had a persistently high weighting in smaller companies.

More than two-thirds of its portfolio is currently in companies listed on the FTSE Small Cap index, Fledgling index or Aim, and this approach has proved rewarding: Diverse Income tops the UK equity income sector in terms of five-year NAV total returns.

Reflecting Williams' belief that the returns on smaller companies tend to be inversely proportional to their scale, around 40% of Diverse Income's holdings have a market capitalisation of less than £100 million.

However, since April 2015, those wanting undiluted exposure to the smallest companies have been able to opt for Miton UK Microcap Trust, which focuses on companies with market capitalisations of less than £150 million at the time of investment.

Like Diverse Income, Miton is managed by Williams, has well more than 100 holdings - to reduce stock-specific risk - and does not normally gear.

Williams says both trusts focus on "regular everyday businesses" that are often steadily expanding leaders in their markets, rather than blue-sky opportunities.

But whereas Diverse Income concentrates on firms generating sufficient cash flows to fund attractive and growing dividends, Miton's focus on less mature companies means distributions may be some years off. It is therefore capital growth oriented.

River & Mercantile UK Micro Cap trust is Miton's closest peer. Launched four months earlier, it too concentrates on capital growth, and it has a lot of Aim-listed holdings.

However, it focuses on even smaller companies: it only holds those with a free market float of less than £100 million. The trust has a more concentrated portfolio of around 40 stocks.

It is managed by Philip Rodrigs, who produced award-winning results for Investec UK Smaller Companies fund before joining River & Mercantile in 2014.

He looks for companies with 'an unrivalled market position, perhaps supported by patented technology', that should enable them to grow "whatever the weather".

Rich pickings

He says: "Fortunately, there are rich pickings in the diverse micro-cap universe for those seeking to invest in unique companies."

The trust's returns over its first two years were almost twice those of the NSCI index. Its focus on companies involved in digitisation and big data helped it pull well ahead of Miton in 2016.

Rodrigs is optimistic about the outlook, not least because his portfolio includes a lot of technologically advanced companies that are steadily building their global presences, as well as some UK domestic cyclicals valued on massive discounts to the wider market.

However, River & Mercantile takes care to remind investors that micro caps are likely to be more volatile than larger companies.

Both Miton and River & Mercantile have generated sufficient interest for their shares to trade at close to NAV. However, other trusts with substantial small company exposure trade at much wider discounts.

Henderson Opportunities Trust is in the UK all companies sector, and its manager, James Henderson, likes to hold sufficient larger companies to more than offset the trust's gearing, which is currently around 15%.

However, more than two-thirds of the trust's holdings are listed on the FTSE Small Cap, Fledgling or Aim indices, and these have powered its exceptionally strong five-year NAV total returns.

Henderson says the trust underperformed the All-Share index for the first time in five years last year, because weaker sterling disproportionately favoured larger companies.

However companies in the FTSE 100 are "typically low-growth, mature businesses", and with the valuations of many smaller companies still to recover from their post-Brexit travails, he expects that underperformance to reverse.

He and his colleague Colin Hughes have a long history of finding value among genuinely small companies. They look for those good enough to control their own destinies and in many cases compete on the world stage.

The trust targets a progressive yield as well as capital growth, and its ongoing charges are below those of Miton and River & Mercantile.

Rights & Issues Investment Trust also invests mainly in very small companies and holds them as they grow into much larger ones.

Small company specialists

Having merged its two share classes in June 2016, the trust now features in the UK smaller companies sector, where it has by far the best five-year NAV total returns.

The trust has been managed since launch in January 1989 by the Knott family, which owns more than 15% of the trust's shares. Investment director SJB Knott keeps his cards close to his chest, but that might need to change if the board is genuinely committed to lowering the discount.

Rights & Issues has a very concentrated portfolio, with the top 10 holdings accounting for more than 90%.

Around half of the portfolio is invested in 'general industrials', with holdings in Colefax Group, Chamberlin and Macfarlane Group together accounting for 45% of the portfolio.

Investors wanting a smaller company specialist that pays an attractive quarterly yield might consider the Acorn Income or Chelverton Small Companies Dividend trusts.

Both are substantially geared by zero-dividend preference shares, which enhances their dividends but is liable to make their capital returns quite volatile.

Around 80% of Acorn's assets are invested in UK equities. The rest is in fixed interest, cash and other higher yielders.

The equities are managed by Fraser Mackersie and Simon Moon at Unicorn Asset Management, who say their focus is on "profitable, cash-generative, well-financed, dividend-paying stocks at the lower end of the market cap scale".

Over the past year or so they have increased the portfolio's small company bias. Around half of it is now in companies capitalised at less than £250 million.

Nearly two-thirds of Chelverton's portfolio is in companies capitalised at less than £250 million, and more than half of that is in companies capitalised at less than £100 million.

Long-standing manager David Horner likes companies "that generate cash on a sensible and sustainable basis, which is then used to grow the business and reward shareholders". He only initiates a holding if a company yields at least 4% on a 12-month view.

Horner expects market volatility to remain high, but he hopes "resilient domestic economic growth will lead to a more stable and stronger sterling, which should highlight the valuation attractions of our domestic earners".

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.