US funds: How to find an active fund worth its salt

7th April 2017 08:44

by Holly Black from interactive investor

Share on

For years investors have been told the best way to invest in the US is to buy tracker funds.The market, it is claimed, is impossible to beat.

But a euphoric president Donald Trump-inspired rally has sent the US stockmarket to record highs, so some experts are saying that now could be the time for active US fund managers to shine.

Tom Becket, chief investment officer at Psigma Investment Management, says: "There are still opportunities in the US, but you can't just rely on a passive approach anymore. Investors need to be selective."

For years investors have favoured the stocks of defensive blue-chip firms such as Amazon and Google, but Trump's policies look to benefit smaller, domestically focused businesses.

Boost for smaller firms

No one yet knows exactly which promises Trump will be able to carry through, but if he delivers on his plan to impose higher taxes on imports, this could be a boon for domestic manufacturers, which have typically struggled to compete against low-cost Chinese suppliers.

If Trump also carries out his plan to invest in infrastructure, this would boost housebuilders, construction firms and their suppliers.

Furthermore, he has spoken of turning away from renewable energy sources back towards oil and gas, which is welcome news for a sector that has seen its profits hit by lower commodity prices in recent years.

As a result, the performance of smaller companies and cyclical sectors has been driven up out of sheer optimism since the election.

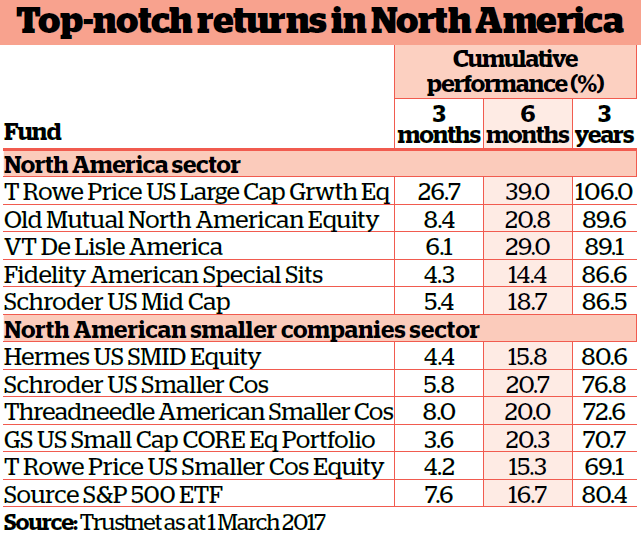

That can be seen clearly enough in the performance of US smaller company funds, where the average return over the past year (to 24 February) is an incredible 51.3%

That compares with an average return of 38.5% from North America funds generally.

It is among these smaller companies that experts say the opportunities lie.

Darius McDermott, managing director at Chelsea Financial Services, says: "Actively managed funds that invest in smaller or medium-sized companies definitely look better bets at the moment. These are the companies most likely to benefit from any tax reductions under Trump."

The Legg Mason Royce US Small Cap Opportunity fund, for example, has returned an eye-popping 71.5% over the past year. Royce co-chief investment officer Francis Gannon is looking at IT and industrial firms, where he believes earnings could deliver double-digit growth.

Rally has further to go

James Thomson, manager of Rathbone Global Opportunities, has around 60% of his £947 million fund in US firms.

He is concerned that recovery stocks in finance, infrastructure and commodities could disappoint as 'Trump mania' wears off, so he is focusing on steady stocks offering predictable growth.

Ian Heslop, manager of the multi-cap Old Mutual North American Equity fund, thinks the US rally has further to go.

Company earnings are strong and growing, and the economy looks good, he says. However, he adds: "We have a guy in the White House who is very difficult to understand."

Heslop has been selling quality, defensive sectors such as healthcare, which have become expensive, and buying cheaper, cyclical stocks such as financial firms and energy businesses.

"For the first time in a long time, the idea of value investing is not abhorrent," he says.

But he warns that the US market tends to swing severely and that a concentrated portfolio can make investors vulnerable to such volatility.

That's why he holds more than 200 companies, the largest of which include Bank of America and Walmart. The fund has returned 45% over the past year.

The US stock market has climbed by 16% and finished at a new record high for nine consecutive days since November's election. It set a new record high of 20837 on 27 February.

But investors needn't take all their profits just yet; they may just have to find managers able to work a little harder to find the next opportunity.

Becket says: "Trackers have been a great way to invest in the US in the past, but if fund managers can't beat the stock market now, they never will."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.