Portmeirion in three-way scrap for place on this 'buy list'

21st April 2017 16:14

by Richard Beddard from interactive investor

Share on

There's plenty to encourage long-term investors to hold Portmeirion shares through thick and thin, but will companies analyst Richard Beddard add them to his portfolio?

Richard, I need to talk to you about Portmeirion.

You were dancing around Portmeirion towards the end of last year. What stopped you swooping in with a clinch?

I might well have done, but I was distracted by other companies, then Christmas got in the way and the share price was on a roll. I wasn't in a great hurry to add to the portfolio* anyway. The company had experienced a dramatic fall in sales in South Korea and India, surprisingly significant markets, perhaps, for a manufacturer of British tableware, so I didn't feel as confident as I might. Then there are the winds of change...

Winds of change, very poetic. Tell me more...

It's probably nothing, but last year Portmeirion acquired Wax Lyrical, which makes scented candles and reed diffusers, those pots of perfume with sticks poking out. Portmeirion has acquired companies before, Spode and Royal Worcester in 2009, for example, but they were, in some ways, less ambitious acquisitions, venerable British pottery brands bought cheaply out of administration. Though I suppose candles and reed diffusers qualify as tableware, as well as, perhaps, sideboardware and toiletcisternware, I supposed Wax Lyrical might be a diworseification.

You've mashed up a few words there. What's a diworseification?

An acquisition that boosts profit in the short-term, but undermines profitability in the long run, usually because the acquirer paid too much. As I will explain, I don't think Wax Lyrical is a diworseification, it was more of a stray thought that allowed me to procrastinate.

I didn't make the word up, by the way, Peter Lynch, a US fund manager introduced me to it in his book "One Up on Wall Street."

You're not going to ask me about toiletcisternware are you?

No, I think we should move on...

Good. There was another stray thought that subliminally nudged me into inaction. Again, it's probably nothing, but Brett Phillips has been finance director since 1988, the year the company floated, and he's retiring this year. I don't blame him, he's served 30 years, but it's making me wonder about Lawrence Bryan, the CEO. He's been around forever too, and the pair have guided Portmeirion through trickier times than these for potters. Winds of change, you see. They're unsettling. When they go, will the culture they helped shape survive? I would expect so, after all it must be pretty ingrained.

You kicked the can down the road?

Yes. I mean no. I waited until the company published its annual report, which it did last week.

OK, short of haranguing the executives, you are in possession of all the facts. What do you think?

Well, I like what I see:

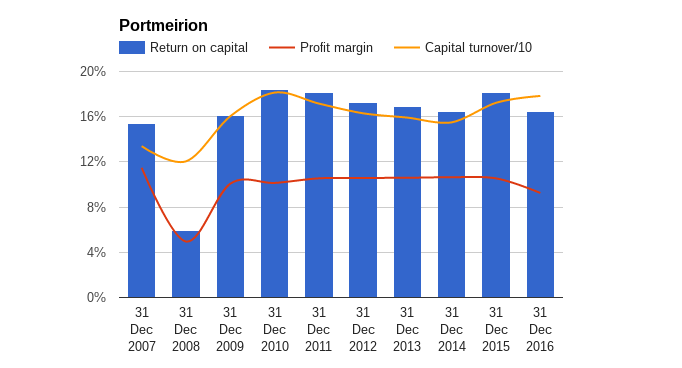

The dramatic decline in profitability during the Credit Crunch in 2008 serves as a reminder that buying tableware isn't compulsory and if we sew up our pockets, Portmeirion suffers. Generally, though, it's highly profitable in accounting and cash terms (for a growing manufacturing business). At the end of most years the company has a debt free balance sheet, but in 2016 it dipped slightly into the red after shelling out for Wax Lyrical. Over the last decade revenue has increased 170%, and profit has increased 180%.

There is a small caveat. I do not include the cost of goodwill and acquired intangible assets in my calculation of profitability. My main concern is to decide how profitable Portmeirion is likely to be in future and goodwill and intangible assets have more to do with the past.

They're horrible bits of jargon, figments created to balance the accounts when Portmeirion acquired Wax Lyrical, Spode, Royal Worcester and before them, Pimpernel, which sells trays and placemats. Although the company paid for the intangible assets identified at acquisition, brands and customer lists for example, they will not necessarily wear out or require replacing. Indeed, if the company continues nurturing them as it has done they will grow in value rather than be a cost.

If we assume, therefore, that Wax Lyrical is money well spent, and there is nothing terminally wrong in South Korea and India, I predict Portmeirion will be capable of earning similar returns to its 10-year average return on capital of 16%, as it did in the year to December 2016.

You know what they say about assumptions; they make an ass out of u and me. How confident are u?

Ah, now we get to the nub...

Start with Wax Lyrical...

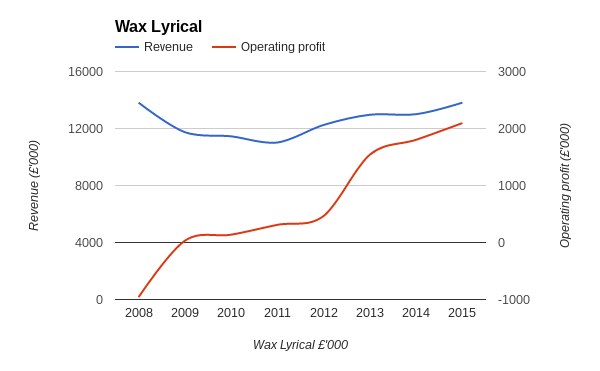

It's a substantial acquisition, Portmeirion paid £17 million, more than twice Portmeirion's annual profit, for Wax Lyrical, which earned £2 million pre-tax profit in the previous financial year. If we deduct tax at the standard rate, our waxy friend doesn't look especially cheap on a multiple of just over 10 times earnings, but Portmeirion believes that by selling home fragrances to Portmeirion customers at home and abroad, and through its own retail outlets and websites, sometimes as part of its ceramic ranges, it should be able to grow the business "significantly".

Wax Lyrical was experiencing a bit of a growth spurt before the acquisition:

But its unprofitable past is a potential worry. If history should repeat itself, it could well be a diworseification. I don't think that's likely, though. If Wax Lyrical's depiction of past events is to be trusted, it was the victim of mismanagement unlikely to be repeated by an accomplished manager of brands like Portmeirion.

Since 2012, Wax Lyrical has sustained high profit margins of 12 to 15% on rising revenues, but before that, its record was less distinguished. The company lost focus in the 2000's when its American owner expanded the product range to include imported textiles, floral accessories and Christmas decorations. Loss making, and facing receivership in 2006, Wax Lyrical was rescued by businessman Mike Armstead, who stopped the imports and re-focused the company on manufacturing in its Lake District home and product development.

South Korea then?

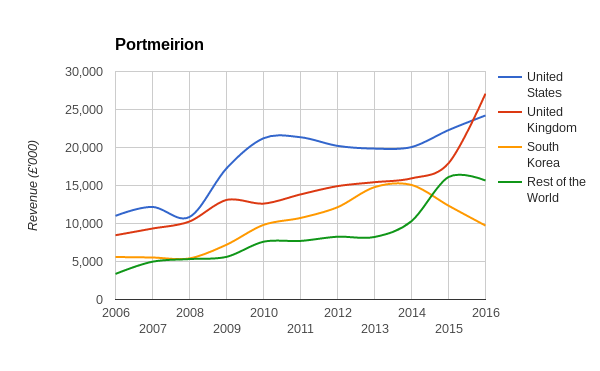

£1.5 million in pre-tax profit earned by Wax Lyrical between May and December masks most of the fall in profit in the pre-existing business for the year, principally, the company says, resulting from sharp declines in revenue from South Korea and India. You can see the switcheroo in this chart:

Revenue has fallen 36% over two years in South Korea. After years of steady growth, it's back at levels Portmeirion achieved in 2010. UK revenues, which otherwise rose marginally, soared thanks to the acquisition of Wax Lyrical, and since India is in the Rest of the World bucket, a plunge in revenue from nearly £6 million to just over £1 million have been masked by progress elsewhere. The rise in US revenue was entirely due to the fall in the value of the pound, otherwise US revenue would have fallen marginally.

Portmeirion blames the economy in South Korea and its distributor in India. Developed economies tend to fix themselves and the company is using new distributors in India so these issues may well be temporary. However, I can't help wondering whether Portmeirion's brands, which have enduring appeal in the UK and the USA, are more faddish in Asia. A decade of prior growth in South Korea would suggest otherwise.

The scale of the declines is alarming, though. Partly it's because South Korea and India buy a lot of British-made earthenware, which is more profitable than bone china, porcelain, and other products sourced by Portmeirion from China. But I also wonder if Portmeirion's reliance on single distributors in South Korea and India made things worse. If the distributors miscalculated by overstocking, it would exaggerate fluctuations in demand and provide an oddly reassuring explanation if demand from consumers is perhaps more stable than the figures show.

Sounds a bit iffy...

Only if you're a neurotic investor like me. There's lots to encourage long-term investors to hold Portmeirion shares through thick and thin.

The company has a deserved reputation for stability and probity, having never cut or withheld the dividend in nearly 30 years as a listed company. The brands, particularly Portmeirion Botanic Garden, launched in 1972 and still generating a third of revenue, and Spode Christmas Tree, the dominant US Christmas tableware pattern, have enduring appeal and are sold through diverse retailers and websites around the world, including the company's own shops and sites. A new more efficient kiln came on line in the factory at Stoke on Trent last year, and it has spare capacity should demand for British earthenware recover in South Korea and India.

I'm thinking Portmeirion's troubles are temporary growing pains in less mature markets and it remains a good business. It's jostling with Judges Scientific and Howden Joinery to join the portfolio. A share price of 950p values the enterprise at nearly £120 million, or about 17 times adjusted profit in what could be a relatively bad year.

*The Share Sleuth portfolio

Contact Richard Beddard by email or on Twitter.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.