Four investment trusts to play the Trump 'reflation trade'

28th April 2017 16:20

by Cherry Reynard from interactive investor

Share on

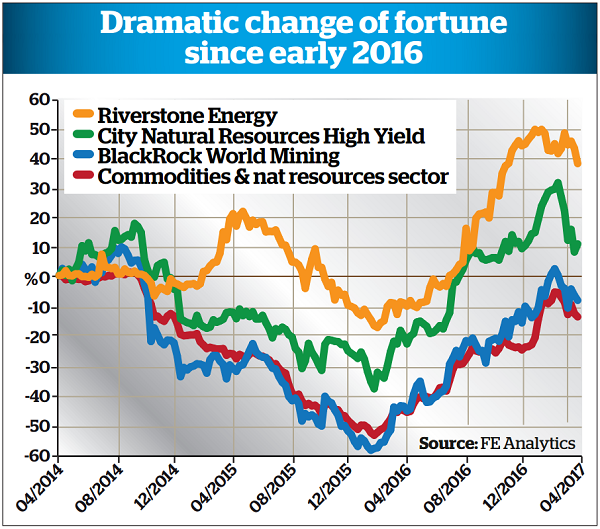

Until the start of last year, commodities had become a byword for a terrible investment. After the wheels came off the 'commodities supercycle', commodities - and the trusts that invest in them - saw spectacularly poor performance: trusts in the sector fell by an average of 33%, 22% and 39% in 2013, 2014 and 2015* respectively.

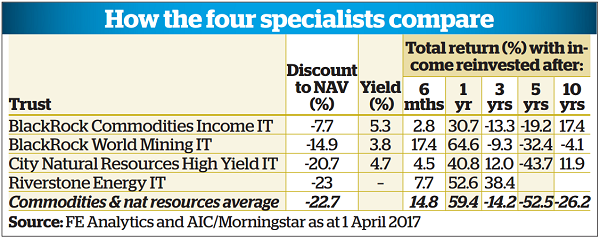

That all changed last year. Commodities have been among the strongest beneficiaries of the 'reflation trade'. As inflation expectations re-ignited and asset prices readjusted, commodity prices rose, swiftly followed by the share prices of associated companies. As a result, while five-year performance still looks weak (down 53%), one-year performance is spectacular, with the average trust up 59 %. This is good news for those who timed it well, but less so for those who held on grimly through the lean years.

A good hedge

After such a strong run, investors would be forgiven for thinking they had missed the boat. However, when inflationary pressures are emerging, commodities have long been seen as a good hedge. The latest UK inflation report from the Office for National Statistics (February) showed consumer prices index inflation at 2.3%, outpacing the Bank of England's target maximum of 2%.

The British Chamber of Commerce is now predicting inflation will be 2.4% in 2017, rising to 2.9% in 2018. There is a similar picture globally, with higher wage growth in the US and even traditional laggards Europe and Japan showing signs of rising prices.

Commodities specialists are still enthusiastic about the sector. Simon Elliott, head of investment trust research at Winterflood Securities, says: "Managers tell us that having had operational issues for a number of years, mining companies are now seeing demand pick up, but supply is not coming back on. Companies are avoiding the mistakes they made in the last cycle."

Certainly, valuations of mining companies look relatively undemanding in spite of the rally. , for example, is up more than 70% over 12 months, but remains on a price-to-earnings ratio (p/e) of 16.85 times and pays a dividend of 3.9%.

This is a notable contrast with some of the consumer staples groups: Reckitt Benckiser is up 12% over the same period, but still trades on a p/e ratio of 29 times with a dividend of just 2.1%. It is a similar picture at , which has a p/e ratio of 25.85 times and a dividend of 2.7%. Commodity companies are catching up, but they have a long way to go.

However, wealth managers urge a note of caution. Noel O'Halloran, chief investment officer at KBI Global Investors, says: "In theory, we should be increasing our exposure to commodities, as they are an inflation hedge in a reflationary world, but they are zero-yielding, they are difficult to price and they are very volatile. They are also exposed to a potential trade war between the US and other countries, and to China. I find better risk/reward elsewhere."

Simon Moore, senior investment manager at 7IM, believes that the real answer lies with China. "Investors need to take a view on China. Certainly, its rate of growth is slowing - from 7.5 to 6.5%, but with 1.5 billion people, this still represents a lot of growth. Is this now in commodities prices? Are inventories full? The countries that produce commodities tend to be less developed nations, which brings some volatility. Commodities were oversold and have bounced back. The question of whether they are now overbought is a difficult one."

The £627 million , run since May 2009 by Evy Hambro and his team, has been the flagship trust for the sector. This has been a blessing and a curse. It was the poster-child for the commodities boom, but has subsequently become the highest-profile victim of the sector's weakness.

Investors have focused in on some problematic investments. The trust took a hit from London Mining, which went into administration in October 2014. It owned the Marampa Mine in Sierra Leone and was hit hard by the Ebola outbreak. However, other unquoted investments in the portfolio have proved more successful. Avanco Resources, for example, has provided a sizeable boost to the trust's income stream.

Return doubles

The trust has put those worries firmly behind it over the past 12 months, rising 100 % and topping the sector. Elliott says: "The trust has come back very strongly. With its option-writing and focus on quality assets, it could have lagged a recovering market, but it has kept pace with its benchmark. Its dividend has fallen slightly, but not as much as expected, and the manager is still very bullish on the sector's prospects."

The dividend yield is currently 3.6 %. The managers write options on some of the companies to support the yield. This means that they will forgo some of the upside on selected stocks in exchange for a fixed payment. This may limit the capital growth of the trust, but it has not been a notable problem in 2016.

Income seekers may also want to look at the sister trust to World Mining, the . The trust currently has a yield of 5.6%, but this has come at the expense of capital growth. The trust's share price is up 32.8% over one year, well behind the sector. That said, it proved steadier in the downturn.

The BlackRock team style themselves as stockpickers first and foremost, rather than trying to call macroeconomic trends. They favour quality companies with strong balance sheets, avoiding those companies with lower quality reserves and higher debt. However, they aim to have a higher weighting to those areas with favourable pricing - they have had high weighting to copper, nickel and iron ore miners over the past 12 months, for example.

After a painful 2013, steered a steadier course over the difficult years of 2014 and 2015, losing just 12.1 and 14.6% respectively. To their credit, the managers recognised the severity of the changing circumstances and moved the portfolio to a more defensive positioning.

This has not prevented the trust participating in the recovery of the past 12 months. It is up 60.9% over the past 12 months, which puts it middle of the sector. The trust currently has a dividend yield of 4.47% and is top of the sector over three years.

City Natural Resources is managed by specialist group New City Investment Managers, which also manages a further four funds, all based on energy and commodity investment. The portfolio itself is an eclectic mix. Elliott says the trust's managers tend to allocate to smaller companies and will take strong views on which commodities offer the best value at any given point in the cycle.

Fixed income

The trust is also unusual in including some fixed income holdings. The portfolio includes preference shares, loan stocks and corporate bonds, which helps boost the yield and contributes to stability of performance.

Elliott believes the trust's weighting in smaller companies should give it greater upside in the current environment: "When the commodity cycle turns, you would expect the large cap companies to do well at first, but then smaller companies should pick up after that, which should help City Natural Resources."

The discount also makes it interesting - it trades on a 20 % discount to net asset value. This is little changed on a year ago. is the £1.6 billion investment trust spin-off from the giant Riverstone energy and power-focused private investment firm, which now runs around $34 billion (£27 billion) of specialist capital.

The trust unashamedly calls on its private equity heritage. There is no Rio Tinto or among its holdings, but it focuses on exploration, production and midstream companies, seeking to back managements with proven track records, often investing alongside teams that the wider Riverstone group has backed successfully in the past.

It came to market in October 2013, which proved skilled - or lucky - timing. The trust sat on cash for some time and managed to buy assets at depressed prices as the commodity rout took hold. It saw only minimal falls in 2014 and 2015, and rose 70% in 2016.

Stockbroker Numis says of the trust: "Riverstone's build-up strategy, whereby capital is deployed gradually over time, has allowed portfolio companies to benefit from industry distress, and this is being reflected in the portfolio valuation as markets recover… We regard Riverstone's management highly and (the trust) has a unique mandate among London-listed funds."

The discount is in line with the sector average at around 20%. Nevertheless, investors may be deterred by the chunky 20% performance fee.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.