Seasonal timing of the market - does it ever work?

5th May 2017 10:29

by Jennifer Hill from interactive investor

Share on

Ask any investment expert for their view on the old adage that investors should sell out of the stockmarket in May and hold cash over the summer, and you are likely to be met with the view that it is time in the market rather than timing the market that counts.

However, although it is notoriously difficult to consistently predict market movements, and true that missing the market's best days can erode value, an analysis of long-term stockmarket returns shows that seasonality does exist.

"It can be argued that there are times when the market has greater cyclicality than others - dividend flows tend to be greater in the first half of the year, for example, and housebuilders are typically thought to underperform at the end of the year," says Julian Chillingworth, chief investment officer at Rathbones.

"Investors can never afford to be too complacent. There have been times in recent years when a "black swan" [unpredicted, highly improbable and catastrophic] event around holiday periods has disturbed this complacency, when volumes are usually low, and investors have been caught out." These include the Soviet coup in August 1991, the Asian currency crisis in July 1997 and China's 'Black Monday' in August 2015.

Agricultural calendar

The saying 'Sell in May and go away; don't come back until St Leger's day' was originally driven by the agricultural calendar, with landowners committing capital before the harvest and then receiving funds when they sold their produce in the autumn.

During this summer period, trading volumes were therefore thinner and markets more prone to volatility. "Historically then, a precedent was set and the whole thing became self-perpetuating," says Chillingworth.

More recently, it stems from stockbrokers leaving their desks during the summer months to attend social events such as Royal Ascot, Wimbledon, the Henley Royal Regatta and Cowes Week, culminating in the last of Britain's five classic horse races, the St Leger stakes in Doncaster on the second Saturday of September.

The idea that stockmarkets perform better during the winter months than in the summer is not confined to the UK. In the US, the 'Halloween indicator' advocates selling on 1 May and buying back on 31 October for similar reasons.

An academic paper by Sven Bouman and Ben Jacobsen, published in 2002 by the American Economic Association, found these effects had occurred in 36 out of 37 countries studied. It was shown to be "particularly strong and highly significant" in European countries, dating back as far as 1694 in the UK stockmarket.

Monthly seasonality of global stockmarkets

April and December are the best months to be a UK equity investor; during these months, the FTSE 100 recorded the highest average monthly returns between 1980 and 2016, according to Stephen Eckett, author of The Harriman House Stockmarket Almanac 2017. Since 2000, October has overtaken December as the second best-performing month.

The months with the lowest - in fact, negative - returns are May, June and September. Since 2000, January has equalled September in having the worst average returns.

Meanwhile, in a 2013-published analysis, US academic Vichet Sum found that monthly returns from stockmarkets in 70 countries are significantly higher in January, February, April, July and December relative to the other months of the year. September is again the worst month to be invested.

Seasonal behaviour

Traders no longer abandon the City for the summer, but an analysis of returns over the past 30 years shows that UK shares typically fall between May and September. Since 1986 the FTSE 100 index, excluding dividends and charges, has ended down more than half of the time between 1 May and 30 September, figures from Architas, the multi-manager, show.

Taking the period as a whole, the index has lost 29.7% over the five summer months - an average of 0.99% per year - but has made 194.3% during the seven winter months. The FTSE All-Share index reflects a similar picture: it fell 31.8%, an annual average loss of 1.1%, during the summer, but rose 211.4% during the winter.

"Even though stockmarkets are meant to be efficient, this sort of seasonal behaviour still exists," says Adrian Lowcock, investment director at Architas.

The stockmarket seems to be following trend this year, having performed well over the winter months. "This suggests that markets might take a breather over the summer, as they have been pricing in a more optimistic outlook," adds Lowcock. "It is useful to remind investors that corrections of 10% or so are not uncommon."

Highly unpredictable

Summer sell-offs are not unusual. Over the past 10 years, the has fallen sharply between May and September three times - in 2015 (-13.2%), 2011 (-15.5%) and 2008 (-19.5%). However, the summer has also produced some stellar returns, notably in 2016 and 2009, when markets rose 10.5% and 21% respectively.

"Sometimes the summer is weak, sometimes it's strong, though it can typically be more volatile due to lower volumes," says Rob Morgan, an investment analyst at Charles Stanley. "The lesson to be learnt is that market movements over a short timeframe are highly unpredictable."

Importantly, however, missing the best days to be invested can have a significant drag on returns. Being out of the market on the 50 best days over the last 15 years would have led to an annualised loss of 8.1% (excluding transaction costs). Had you remained fully invested, you would have made an annualised 5.9% gain, data from JP Morgan Asset Management shows.

"Many of the best days often come just a few days after the very worst days," says global market strategist Alex Dryden. "Therefore, investors need to be mindful that trying to time the market using this old adage will most likely dent their long-term returns."

So what's the verdict? Private investors should adopt a minimum three-year view, so short-term fluctuations shouldn't really enter their thinking, according to Morgan. Ben Yearsley, investment director of Shore Financial Planning, agrees: "Do your research, put a decent portfolio together and stick with it for the long term."

Investors, can, however, use the 'sell in May' adage to their advantage by ensuring their portfolio is prepared for any summer volatility.

Winning winter portfolios

It's a fact: some stocks consistently perform better during the winter than the summer. That is according to Lee Wild, editor of our sister website Interactive Investor, which runs two highly successful winter portfolios.

"Two decades of data supplied by The UK Stockmarket Almanac showed that buying certain shares on 1 November and selling on 30 April would have generated significantly more profit than if they had been held all year round," he says. "This statistical anomaly got us thinking about the best way investors could benefit from such a reliable trend."

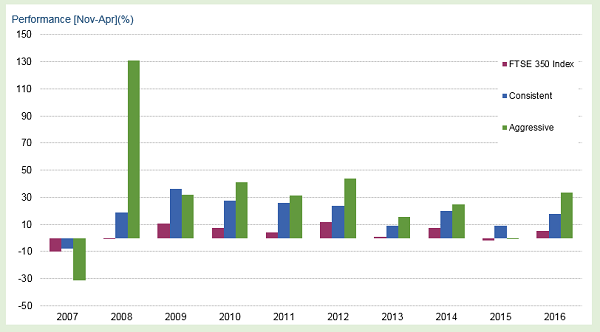

Interactive Investor's Consistent Winter Portfolio comprises the five FTSE 350 companies with the best record of gains over the past 10 winters. Its higher-risk Aggressive Winter Portfolio comprises the top outperformers in at least seven of the past 10 winters.

Both portfolios beat the benchmark in their first two years, and are well ahead in 2016/17. "With less than two weeks to go, as at 19 April the Aggressive is up an incredible 29%, and the Consistent portfolio has gained 4.9%; the FTSE 350 is up 3%," says Wild.

Four tips to weather seasonal volatility

1) Shore up defences

Defensive assets, such as targeted absolute return funds, can help to protect investors from market weakness. Darius McDermott, managing director of FundCalibre, likes Brooks MacDonald Defensive Capital and Smith & Williamson Enterprise.

2) Drip-feed

Bank profits after a period of strong performance, and drip-feed money into markets when redeploying capital. "The historically high market levels will undoubtedly worry people this year, given the continued global economic and political uncertainty," says Gavin Haynes, managing director of Whitechurch Securities. "Valuations on many measures don't look stretched, but investors concerned about current levels as an entry point could drip-feed cash in."

3) Keep some cash

Keep a little cash aside ready to invest in the event of a sell-off. "Famous investors like Warren Buffett always keep money aside ready to take advantage of opportunities," says Lowcock.

4) Reinvest dividends

Dividends ploughed back into the market destroy the 'sell in May' adage: with dividends reinvested, the FTSE 100 has returned a total of 20.6% between May and September over the past 30 years, according to Architas. Unless you need the investment income, elect to have it automatically reinvested.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.