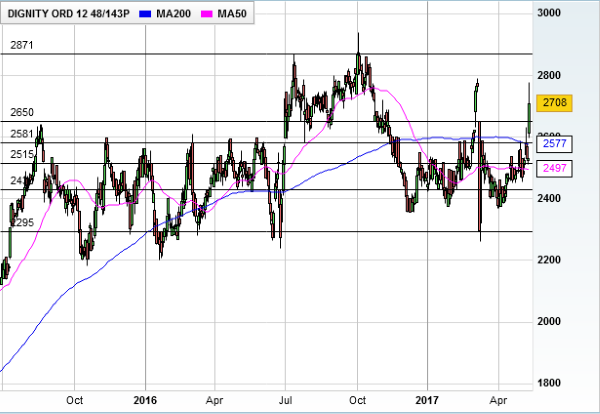

Is Dignity about to hit all-time high?

15th May 2017 13:47

by David Brenchley from interactive investor

Share on

It's probably not the most upbeat industry to be in, but funeral services provider first-quarter trading update certainly got investors excited Monday.

Everyone knows the old adage about death and taxes being the only certainties in life, but it's a truism that has seen the firm's shares rocket since IPO back in April 2004.

It's also why the stockmarket "over-reaction" to the company's 2016 full-year results in early March was surprising. In just 48 hours, the stock fell 19% from a five-month high the day prior to results, ending up at a nine-month low of 2,261p.

Clearly, Dignity's services will always be in demand – this is not a cyclical industry, despite relying on the death rate. And therein lay the problem in those results a couple of months ago.

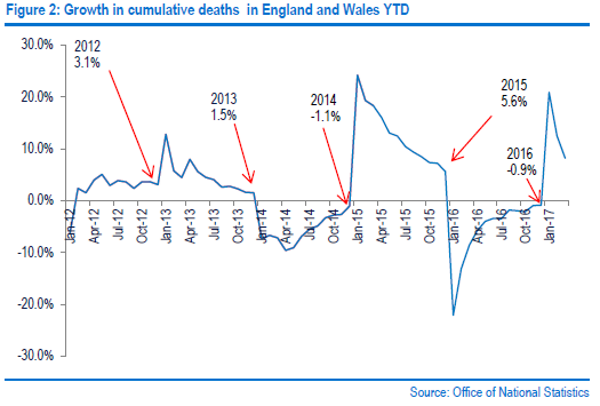

While not stellar, the 2016 numbers were comparable to 2015. But there was a significant increase in the number of deaths in those two years – 2015 was the strongest year for deaths since 1968 – and the firm warned that "historical data would suggest that deaths in 2017 could be significantly lower" in its outlook statement.

It's been a rocky road since, with bargain hunters swooping swiftly before the stock sold back down again in early April. However, Dignity shares rallied around 10% Monday to a high of 2,777p on news of an excellent start to the year.

Revenue in the first quarter to 31 March 2017 jumped 15% year-on-year to £93.3 million, with underlying operating profit up a fifth to £167,000. Operating profit margin was up 180 basis points at 40.1%. In contrast to predictions of a weaker death rate, the number leaving this mortal coil was actually 7% higher year-on-year at 167,000.

Compared with the first quarter of 2015 - the company's strongest quarter in 10 years - broker Investec Securities says the latest results "are more impressive".

Three-month revenue was 9% higher than in 2015, with operating profit up 4%, this despite the death rate being 5% lower. It's prompted Investec analyst Cora McCallum to upgrade her recommendation to 'buy' from 'hold, though she kept her target price of 2,940p.

In a note to clients, and with Dignity shares at 2,530p, McCallum said: "Whilst the shares have recovered since the FY16 results, which lowered longer-term earnings per share (EPS) growth guidance from 10% to 8%, our 2,940p target implies c.17% total return".

That target implies a still-substantial 7% upside and a new record high.

Elsewhere, the highly acquisitive company, which has grown over the years by buying up smaller, family-owned funeral homes countrywide, says it's still finding opportunities, shelling out £20 million on 12 funeral parlours and one small crematorium in the period. Expect further acquisitions.

Despite the increase in deaths in the quarter, Dignity points out that data indicates large variances in the number of deaths at the end of the first quarter tend to normalise by the end of the year (see chart below from Investec). That's why it still expects the death rate in 2017 to be lower than last year and reaffirmed expectations for the full year.

Panmure Gordon was one of the bargain hunters back in March, raising its recommendation then to 'buy'. Today, it keeps that unchanged, alongside its target price of 2,750p.

"The shares trade more than 10% higher than their March 2017 level, at which time we argued that it was wrong, though easy, to dismiss them as an 'expensive defensive'," analyst Michael Donnelly said. The shares currently trade on 21 times forward earnings.

He added that whilst the 8% compound annual growth rate in EPS is lower than previous guidance, it still remains "exceptionally attractive", being driven from a solid base of demographic trends and Office for National Statistics forecasts.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.