Three AIM shares in recovery territory

31st May 2017 10:38

by Alistair Strang from Trends and Targets

Share on

Red Rock, Coal of Africa, and Condor Gold (LSE:RRR, LSE:CZA, LSE:CNR)

One of these stupid philosophy questions - "if a tree falls in the forest, does it make a sound if no-one hears it?" - sprung to mind when walking the dogs.

With a sound of two shotgun blasts, a large pine tree snapped when assaulted by a very slight breeze. My two Golden Retrievers discovered warp speed despite me being rooted in place at the sudden spectacle - 100 yards away.

The only thing faster than the speed of this tree fall is an AIM share dropping in price - whereas expecting growth at similar speed is usually an exercise in futility.

We've chosen three shares to decorate our headline section, simply due to all of them now giving recovery potentials. Of course, we've also been getting emailed too.

is looking slightly interesting at present. At risk of slipping into "teacher" mode, the dashed blue line on the chart below is perhaps the real trend despite the solid blue line presenting itself as the trend.

Bringing us to this point of view are the share price movements since breaking the dashed blue line as it has gone up - and down; but critically shown some respect for this historical line.

The situation now appears to be of growth bettering 68p taking the price into a region where 106p makes an initial ambition. Secondary, if bettered, is a longer term 136p. Of course, there's only one caveat - "You'd be daft taking the foregoing at face value!"

The pink barbed wire line on the chart at 75p is probably quite important. Closure above this point will visually prove crucial in confirming the share has commenced some proper recovery.

Ideally, if we threw timeframe logic at it, closure above 75p shall occur sometime in the next few months as it will also better the blue downtrend. Only then does the 106p/136p thing become serious.

is a bit of a weird share, one which we hear nothing about for a year or so - then suddenly a bunch of folk remember it exists.

Certainly something seems to be happening, and now above 3.25p points at 3.625p next and a probable bonk against the downtrend since 2015. However, above 3.625p opens a new field for play as it's easy to extrapolate a longer-term surge to 5.5p.

Currently at 3.25p, the price would need to break 1.925p to give us an excuse to panic - really panic - as 1.25p becomes a best guess bottom!

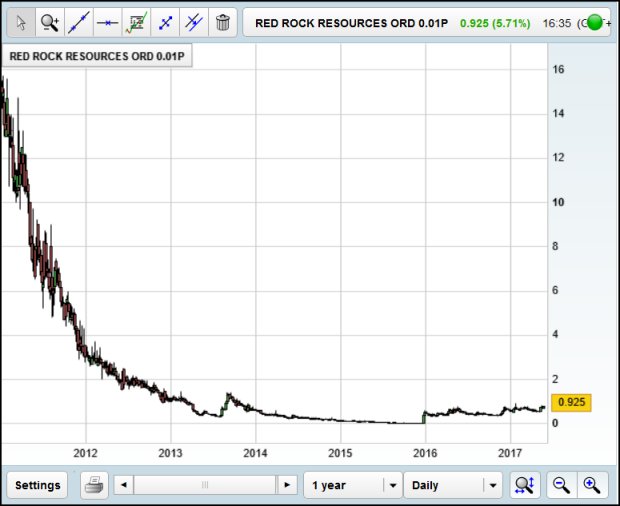

is one of these shares which spring to mind when discussing how absolutely rotten the AIM market can be. Certainly, the collapse in price since 2010 has become the stuff of infamy, but moves in the last week justify a raised eyebrow, in a nice way...

The immediate situation suggests anything now above 0.9675p should bring growth to an initial 1.64p with secondary a rather more useful 2.98p.

Currently trading at 0.925p, the price would need break 0.42p to justify hysterics. In the event of it making 1.64p, we'll issue a more in-depth report.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, Shareprice, or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.