FTSE 100: How a 100-point rise is possible

2nd June 2017 10:01

by Alistair Strang from Trends and Targets

Share on

FTSE for Friday and the AIM (FTSE:UKX and FTSE:AXX)

Thursdays are usually pretty grotty, but the start of June managed to be a slightly interesting day. Not brilliant, just not as bad as usual.

The session closed with the promise of movement now bettering 7,551 points continuing to 7,584, effectively matching the highest ever on the index. Certainly FTSE futures appear to have gotten into the mood by blossoming to 7,577 in the evening session.

Of course, this creates the situation where the risks being opened up and spending the rest of Friday paying for such temerity unless the opening minute high is actually bettered within the first 90 minutes.

This is one of our rules of thumb - designed to permit a short at the opening high with a super tight stop, as there's often a good chance of the market reversing to the previous day's closing price. In the case of the FTSE, this implies a reversal toward 7,543 would make sense before clenching buttocks and switching to a long.

In summary, the situation now exists of the FTSE trading above 7,551 and reaching 7,584 initially. Secondary, if such a point is bettered, comes in at 7,650 or so.

Folk who read our diatribe at the start of the week may remember we were a bit vague about 7,650 as it could easily be 7,630 due to some stupid FTSE moves. If triggered, the tightest stop looks like it is 7,510 points, fairly reasonable given we just mooted a 100-point rise potential.

Of course, what happens if 7,510 breaks? It appears weakness toward an initial 7,460 makes sense with secondary, if breached, at 7,365. We'd suspect some really foul news will be needed to provoke such dramatics within a single day. If triggered, stops need be at 7,560 points.

AIM

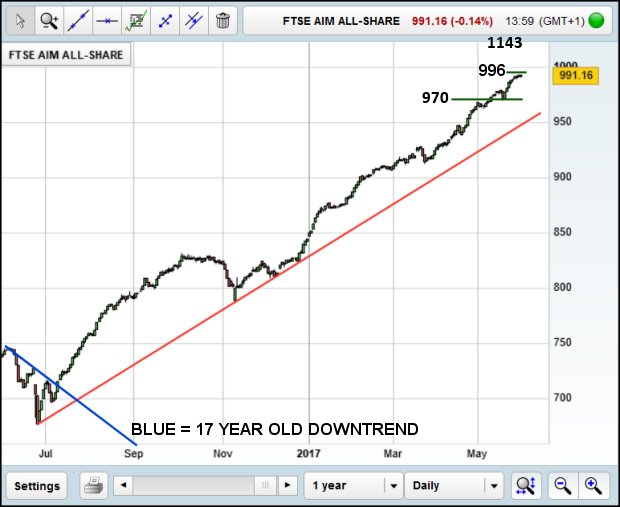

We last glanced at , back in March, and it has finally reached our stated target.

Actually, despite showing a truly intimidating growth curve following the Brexit vote, the index isn't quite at the target yet and has used the last four sessions to dance teasingly just below our 996 ambition.

However, we're perhaps being killjoys; last time we wrote on the subject, we'd mentioned a logic which demanded this index actually close above 970 to permit some proper long-term ambitions.

It's interesting to note, the index didn't actually ignore our 970 ambition - quite the contrary. Instead, as shown, the market bettered our 970 before reversing with (it felt) the intention of proving it wasn't a mistake by again bouncing up from 970 and this time, to our 996 calculation.

Except it hasn't quite achieved 996 yet and while 994 is probably sufficiently close for a "target met", experience teaches us our targets absolutely must be bettered to provide optimism for the future. This is why our 970 thing proved quite a big deal with the market showing it was a real expectation.

Of course, perhaps we're making a drama out of the (usually) dramatic for no reason, as just about every calculation now signals 1,143 and above for the future.

For any slowdown to be considered real, the market needs to drop below 927 before we'd raise an eyebrow. Or below 712 to provoke rushing out and buying running shoes.

The funny thing is, the AIM appears to be behaving exactly as it should, given the index bettered a 17-year-old chart in 2016.

Essentially, it's supposed to be going up and the big picture influence is coming from a currently ridiculous sounding 1,555 points. Of course, what all this means for members of the AIM whose share price has been ruthlessly tossed around since 2009 is that hope remains for the future.

Unless, of course, you're holding a share which broke below its logical bottom as members of this fraternity appear to be the LibDems of the AIM - they exist but are best ignored as they tend to disappoint.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, Shareprice, or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.